January 2021 Newsletter

Table of Contents

Investment Management – 4Q 2020 Investment Letter

Education Planning – “529 College Savings Plans Are Best in Class”

Disclaimer

Investment Management

4Q 2020 Investment Letter

Glass Lake Clients and Prospects:

The calendar finally turned to 2021. Before we look forward to better days ahead, let us look back at what ended up being a solid year for the stock market despite an economy ravaged by Covid-19. The S&P 500 finished the year up 16.3% after tacking on 11.1% in the fourth quarter. The technology-heavy Nasdaq Composite crushed it with a 43.6% return in 2020, while the small capitalization Russell 2000 rallied strongly in the closing months to finish up 18.4%. The Federal Reserve’s highly accommodative policies, a more robust Covid-19 vaccine rollout, and a likely benign political environment should provide lasting market support, though future gains should temper.

Fed

As discussed in prior newsletters, the ongoing dichotomy between Main Street and Wall Street is largely due to the Federal Reserve’s ultra-low interest rate policies that are likely to persist for some time. In September, 13 of 17 officials who participated in the Fed’s two-day meeting projected the federal-funds rate target to remain at 0%-0.25% through at least 2023. It also introduced a policy framework that will “maintain an accommodative stance of monetary policy” until inflation is moderately above 2% “for some time” and until labor markets reach maximum employment. The latest economic data indicated a 6.7% unemployment rate in November, versus 3.5% last February, and 1.6% core CPI inflation in October, so the Fed need not feel compelled to tighten anytime soon.

As shown below, the 10-year treasury yield rallied a bit in the fourth quarter but remains at historically low levels. Low yields have not only buoyed equities, but also most other asset class, including cryptocurrencies (bitcoin quadrupled in 2020), home prices, bonds, and commodities. It has also allowed froth to percolate in some areas of the stock market, most notably fast-growing, unprofitable companies, many of which recently came public through a record-setting year for money raised through IPOs and special purpose acquisition company offerings.

Figure 1: 10-Year Treasury Yields Remain Very Low

Source: U.S. Department of Treasury

My Prediction: Inflation accelerates in the coming months, exerting some upward pressure on 10-year treasury yields, but Fed policies keep the 10-year below 1.5% through at the least the first half of 2021.

Covid-19 vaccines

Optimism surrounding Covid-19 vaccines is the second key pillar to the stock market strength. Phase 3 data from two leading vaccine candidates were much more efficacious than expected – one from Pfizer (PFE) and partner BioNTech (BNTX) released on November 9, and the other from Moderna (MRNA) on November 16. Each was shown to be at least 94.5% effective in preventing Covid-19, well above the 50-70% rates most expected and 50% threshold needed for approval, without having serious side effects.

The initial rollout has been disappointing. According to the Centers for Disease Control and Prevention, only 2.8 million people received their first vaccination through December 31 versus the 20 million year end goal set by the Trump administration. It would take several years to inoculate even half the adult U.S. population at that rate. Still, the pace of vaccinations should ramp in the months ahead as Pfizer and Moderna increase production, logistical kinks are worked out, and more healthcare workers are hired to inoculate people.

The incoming Biden administration’s goal to administer 100 million doses in its first 100 days would get a shot in the arm with more vaccines being approved. Johnson & Johnson (JNJ) is expected to present data for its vaccine candidate early this month and could be authorized for use by regulators in February if shown to be safe and effective. Vaccines from AstraZeneca (AZN) and Novavax (NVAX) could arrive shortly after that.

My Prediction: Significant loosening of Covid-19 restrictions begins once the majority of the most vulnerable and exposed people receive their shots in the March/April timeframe, aided by five vaccines approved and in distribution by then. A more robust economic reopening takes place in May/June as the vaccine becomes available to the general population. A 60% to 70% population vaccination rate by August drives herd immunity and a 95%+ decline in Covid-19 cases by the end of the summer. The economy surges beginning in the second quarter as life transitions back to normal and substantial pent-up demand unleashes for certain spending categories like leisure and travel.

Election

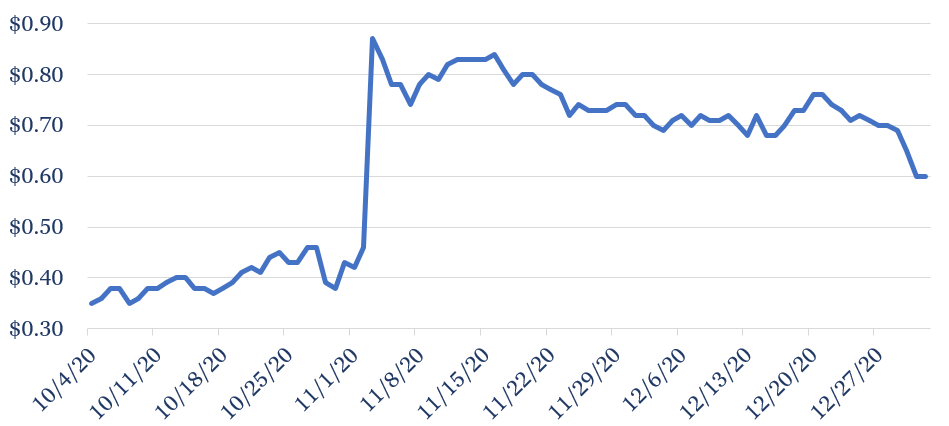

Stock markets received another green light by seemingly avoiding the worst-case scenario of a Democratic sweep of the presidency and Congress. Entering the election, it looked like a clean sweep was the most likely outcome, which would clear the path for Joe Biden to increase corporate tax rates to 28% from 21%. Although Biden won as most pundits predicted, Republicans did much better than expected in the Senate, securing 50 seats versus Democrats’ 48, with the two Georgia seats going to a runoff election on January 5. If Democrats do not win both, Republicans will control the Senate and likely stymie Joe Biden’s efforts to raise taxes. Real money odds of Republican control of Senate are on the decline following an election day spike, as illustrated below.

Figure 2: Contract Prices for Republican Control of Senate on the Decline

Source: PredictIt

My Prediction: Republicans narrowly win control of the Senate, as expected. Trump’s corporate and personal tax cuts stay in place through at least the mid-term elections in 2022.

Market Outlook

I see scope for further stock market appreciation through at least the first half of 2021. That said, much of the good news is priced into the market, so the pace of gains is unlikely to mirror the historical rate over the last nine months. We are likely to see bouts of selling pressure as the vaccine rollout experiences hiccups, inflation worries build, and some of the froth comes off many of the high-flying, speculative, hyper-growth companies. However, a highly accommodative Fed and robust economic growth expectations should keep any sell-off from reaching bear market territory, defined as at least 20%. A virus mutation sufficient to deem approved vaccines significantly less efficacious represents the most significant market risk to me, followed by successful tax legislation and greater than expected inflation.

I understand the temptation to try to time the market by darting in and out, but legendary investor Peter Lynch put it best – “far more money has been lost by investors trying to anticipate corrections, than has been lost in corrections themselves.”

Client Positioning

As a reminder, we take a long-term view focused on compounding returns in a tax-efficient manner. You will not see us make dramatic asset allocation changes based on our views of Fed policy, the economy, elections, or other factors. Further, we strive to allocate the bulk of our clients’ equity positions in “quality growth” names that have strong and sustainable competitive advantages, above-average long-term growth prospects, and prudent levels of debt. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

Indeed, over 80% of clients’ equity allocations are invested in companies I would characterize as quality growth. Top five holdings aggregated across client accounts are index licenser MSCI (MSCI), payments company PayPal (PYPL), e-commerce and cloud computing provider Amazon (AMZN), electronic payments network Visa (V), and Latin American e-commerce marketplace Mercado Libre (MELI). Each has high margins or free cash flows, double-digit long-term EPS growth, and little to no debt. I anticipate owning all these for the foreseeable future.

That said, this a time to additionally own some lower quality, highly cyclical companies that will benefit most from an economy on the precipice of a staged reopening. These companies make up 10-18% of clients’ equity allocations, little changed from three months ago. Some of our “quality growth” companies have above-average cyclicality as well, meaning they would disproportionately benefit from a resurgent economy. When including these, the cyclical mix rises to 44-50% of clients’ equity portfolios.

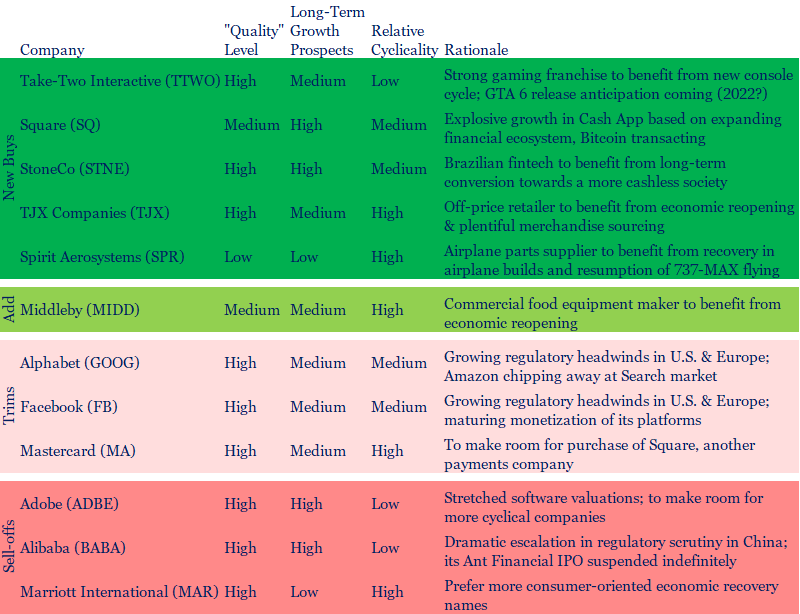

Below are the stock holding changes across most client accounts and their rationale, subject to tax and other considerations.

Figure 3: Portfolio Changes in Fourth Quarter

As positioned today, clients might expect their equity portfolio to do best versus the market when economic optimism and interest rates are contained. That is because their portfolios are tilted towards technology and growth-oriented stocks that tend to do better when there is a scarcity of companies with earnings growth. When economic optimism surges or interest rates rapidly increase, long-avoided and secularly challenged banks and energy companies tend to be among the market leaders. My “barbell” approach of pairing the core quality growth names with companies that should strongly rebound in a post-Covid world should keep these factors from overwhelming portfolio performance. I will continue to monitor the market environment, but do not anticipate going “all-in” on the cyclical names at any point, especially considering the tax consequences of selling highly appreciated stocks.

I hope you and your loved ones stay happy, healthy, and wealthy. We have a lot to look forward to this year.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Education Planning

529 College Savings Plans Are Best in Class

The full cost to send a newborn to college in 18 years could easily top $150,000, and that is for just four years at an in-state institution. Thinking a private university could be in the cards? That could run nearly $400,000. These are daunting figures for most families that multiply with more than one child. For those who have the desire and means to fund their loved one’s education, it is imperative to plan early in the child’s life. This article will guide you on what kind of education plan to utilize and how much to contribute to the plan each year.

529 Plans

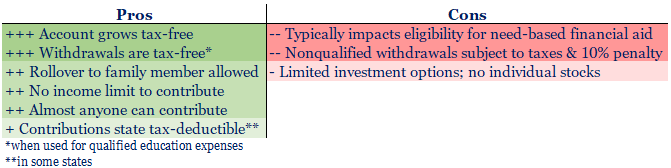

Contributing to a 529 plan is the best option for most families. Created in 1996 when Congress passed the Small Business Job Protection Act, a 529 plan is a tax-advantaged savings plan designed to help pay for education. They are legally known as “qualified tuition plans” and are sponsored by all 50 states and the District of Columbia. There are two types of 529 plans: college savings plans and prepaid tuition plans. We will focus our discussion on the more commonly used and typically better-suited college savings plans.

Contributions can be made by parents, grandparents, single people with no dependents, and trusts. Unlike other college savings programs like Coverdell ESAs, UGMAs, and UTMAs, there is no income limit with 529s. An individual can contribute up to $15,000 annually per child without triggering gift taxes, and $30,000 for married couples. A special election may be made that entails contributing five years’ worth of contributions in one year, or $75,000 from an individual or $150,000 from a married couple, and no contribution the following four years. Contributions are not deductible for federal tax purposes, but some states give a tax deduction, such as my home state of Illinois.

Owners of 529 plans, who are the contributors and not the beneficiary, can typically choose among a range of mutual funds, exchange-traded funds (ETFs), and fixed income portfolios. Just like a 401(k) or IRA, accounts grow tax free. Withdrawals are also tax-free when used to pay for qualified education expenses such as tuition, mandatory fees, books and supplies, computers, and room and board during one’s undergraduate and graduate years. As a result of Trump’s Tax Cut and Jobs Act, tax-free withdrawals up to $10,000 per year are also now allowed for K-12 tuition. This inclusion largely eliminates the benefit of enrolling in a Coverdell ESA.

If the 529 plan has unspent funds in it, perhaps due to overfunding or the person does not enroll in college, the beneficiary can be changed to a family member of the original beneficiary, such as a parent, sibling, or first cousin. If 529 withdrawals are not used for qualified education expenses, they will be subject to federal and state income taxes and an additional 10% federal tax penalty on earnings. Another potential downside of 529 plans is that they typically impact a student’s eligibility to receive need-based financial aid.

Figure 4: Pros and Cons of 529 Plans

It is important to choose the right state plan to participate in because of their nuances and state income tax breaks in some states. It would take quite a bit of research to pour through every state’s plan offering. Thankfully, research firm Morningstar has done the heavy lifting for us. They awarded their highest “Gold” rating to three state plans in 2020 – Illinois’ Bright Start, Michigan’s Education Savings Program, and Utah’s my529. Ratings are based on having investment options they expect to outperform and exhibit some combination of the following features: a well-researched asset-allocation approach, a robust process for selecting underlying investments, and appropriate set of options to meet investor needs, strong oversight from the state and investment manager, and low fees. Check to see if your home state has state income tax breaks before choosing an out-of-state plan.

A Word on Prepaid Tuition Plans

Prepaid tuition plans are the second, less frequently used type of 529 plan. Although 22 states used to offer them, just 11 do as of 2020 – FL, IL, MA, MD, MI, MS, NV, PA, TX, VA, WA – and IL and VA are no longer accepting new enrollees. They are similar to aforementioned college savings plans in many respects except that they lock in future college tuition costs at today’s rates by your handing money over to the state today and letting the state invest the money to pay for future costs. A parent comes out ahead with this option if tuition increases exceed what their 529 plan would have earned under the college savings plan.

They also differ in that in order to receive the full benefit, one must enroll in an in-state institution. There are other restrictions with prepaid tuition plans, such as a lack of coverage for graduate school tuition and undergraduate room & board in most states. This plan option is only suitable for highly risk-averse investors living in one of the nine states that are accepting new enrollments who are confident their child will attend an in-state college. Worth noting is that there is a private prepaid tuition plan that allows for locking in tuition at around 300 private colleges in over 30 states.

How Much to Contribute

Now that we have determined that 529 college savings plans are the best means to save for college for most people, it is helpful to determine how much to set aside each year. We want to maximize the odds that we accomplish our college funding goals without overcontributing so we do not get hit with taxes and penalties if some funds must be reclaimed. Proper budgeting is subject to a host of assumptions we make in the below exercise, including the type of institution attended, years of attendance, cost inflation, scholarship/grant amounts, desired funding level, and plan returns.

Let us start with college costs. As shown in Figure 5, the average total cost of tuition, required fees, books, and room & board for the 2020-21 academic year was $21,220 for 4-year in-state public schools, $38,339 for 4-year out-of-state public schools, and $48,801 for 4-year nonprofit private schools. All these costs can be borne by a 529 plan. Keep in mind that other necessary living expenses, such as transportation and entertainment, are not eligible.

Next, we project costs when the student is attending college. A helpful guide to future inflation is past inflation. According to data from educationdata.org, the cumulative average growth rate (CAGR) in four-year tuition over the past 10 years was 1.2% above inflation per year for public four-year universities and 2.1% above inflation per year for private four-year universities. This compares to the 4.9% and 1.5%, respectively, real (above inflation) CAGRs in the prior decade, from 2000-01 to 2010-11.

Figure 5: Distribution of College Costs at 4-Year Institutions

Source: educationdata.org

*Room & Board assumes average on-campus living costs

For our exercise let us assume that total tuition costs rise 4% annually, comprised of a 2% real (above inflation) increase and a 2% economy-wide inflation increase, for all school types. Let us also project books and room & board costs to rise with overall inflation of 2%. Compounding these inflation figures on average 2020-21 school costs for a newborn gets us to freshmen year college costs of $35,870 for public 4-year in-state, $70,550 for public 4-year out-of-state, and $91,093 for private 4-year.

Our remaining assumptions are (1) student receives no scholarships nor grants; (2) desire to cover 100% of undergraduate expenses, (3) constant contribution amount each year, (4) college entered at age 18 ½ with full annual tuition due upfront, and (5) 6% annual 529 plan return.

Under these assumptions the calculations work out such that a 529 plan should be annually funded as follows: $4,072 for a 4-year in-state public student, $8,009 for a 4-year out-of-state public student, and $10,341 for a 4-year private student. If we assume a more conservative 4% rate of return on plan assets, then our annual contribution level should be $5,177, $10,182, and $13,147, respectively. Of course, annual contributions can be raised or lowered if you are tracking above or below plan or if your financial circumstances change.

Figure 6: Estimated Annual Contributions to Fully Fund 4-Year College for a Newborn

Source: educationdata.org, my calculations

Bottom Line

Look no further than 529 College Savings Plans to fund your child or grandchild’s education. Illinois’ Bright Start 529 Plan is a great option, especially for Illinois residents. If you wish to send him or her on a full ride over four years, be prepared to contribute $4,000 to $13,000 annually to the plan depending on school choice and return assumptions.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in the State of Illinois. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice.

The investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

The investment letter and financial planning article are being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.