Monolithic Power Is Charged Up for Superior Growth

By Jim Krapfel, CFA, CFP

June 1, 2022

Background

I was introduced to Monolithic Power Systems, Inc. (ticker MPWR) at an investment conference while I was working as an analyst and portfolio manager at RMB Capital Management, LLC. I was immediately impressed with founder and CEO Michael Hsing’s command of the business and the company’s track record of financial success. After further analysis I made my first purchase in my personal account in January 2018 at $120.

We consistently purchased the stock for client accounts upon client onboarding since our firm’s founding in April 2020. It was the sixth largest aggregate stock position as of May 31, 2022.

Company Description

Monolithic Power is a semiconductor company focused on power electronics solutions. Its direct current (“DC”) to DC products, which make up 95% of its revenue, are used to convert and control voltages. The company seeks to differentiate itself in the market through offering solutions that are more highly integrated, smaller in size, more energy-efficient, and more accurate with respect to performance specifications. These features make its solutions more cost-effective than many competing solutions.

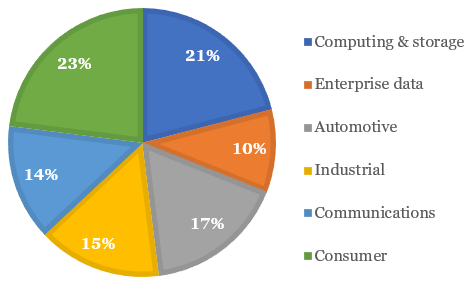

Monolithic Power serves a broad array of end markets and applications, as depicted below:

· Computing & storage: storage networks, computers & notebooks, printers, workstations

· Enterprise data: servers used in data centers and cloud computing

· Automotive: infotainment, advanced driver assistance systems, connectivity applications

· Industrial: power sources, security, point-of-sale systems, smart meters, other industrial equipment

· Communications: networking & telecom infrastructure, routers & modems, other wireless applications

· Consumer: set-top boxes, monitors, gaming, lighting, chargers, home appliances, cell phones, wearables, GPS, televisions, stereos, cameras

Figure 1: Sales by End Market in 2021

Sources: Company filings, Glass Lake Wealth Management

Monolithic Power was incorporated in 1997, went public through an initial public offering in 2004, and is headquartered in Kirkland, Washington. Most of its sales are to Asian distributors.

Investment Thesis

A large component to our bullish thesis on Monolithic Power is the company’s superior business model. Unlike many fabless semiconductor companies (fabless means it outsources the manufacturing of its integrated circuits to third parties), which utilize standard processes and design rules established by their foundry partners, Monolithic Power has developed its own propriety processes that it works with its foundry partners to install on its foundry partners’ equipment. This has driven more innovative chip designs and advancements in manufacturing that has resulted in sharp market share gains that should endure under Hsing’s leadership.

The company is also well positioned in targeting more higher value products that carry higher margins, particularly in automotive and enterprise data end markets. In automotive it is moving higher up the value chain from its strong position in infotainment to advanced driver assist systems and onboard electric vehicle systems. In enterprise data it is benefitting from long-term growth in data centers and cloud computing. Strong growth in these relatively new applications is reducing Monolithic’s reliance on its more cyclical and higher saturated consumer end market, 23% of revenue in 2021, down from 32% of revenue in 2018.

Monolithic Power benefits from its sole focus on the power management component of the broader semiconductor market. Besides being more innovative on design, the company has proven to be more proficient in responding to industry supply chain challenges. For example, in its most recently reported quarter, it increased its inventory to 178 days, just short of its 180-200 day target range. Therefore, it was uniquely able to fulfill strong customer demand and deliver impressive financial results.

Economic Moat

We believe Monolithic Power possesses a strong economic moat, or sustainable competitive advantage, because of its intangible assets in analog chip design and customer switching costs for its power management chips.

Its proprietary analog chip design has allowed its modules to integrate all of the power functions into a single, smaller silicon die. Being ultracompact is a big deal when space is at a premium on circuit boards that are becoming denser and smaller. Customer benefits from its higher power density include longer device battery lives and reduced cooling and ventilation needs (better energy efficiency). We believe it would be difficult for another chipmaker to replicate its process because its secret sauce is so protected that only a few people in the firm are known to understand the process end-to-end.

Once Monolithic Power is designed into a product, it is highly unlikely that the customer would switch out their power management needs to a different vendor because of the large amount of integration work done and low relative cost of Monolithic’s products. A customer looking to switch away from Monolithic would incur the time and financial burden in undergoing a complete system redesign with another supplier, likely incorporating several different chips or discrete transistors to achieve the same functionality that a singular Monolithic Power solution offers. Customers are loathe to go through the hassle when power management systems typically account for only 1%-2% of the overall bill of materials.

Growth, Profitability & Valuation

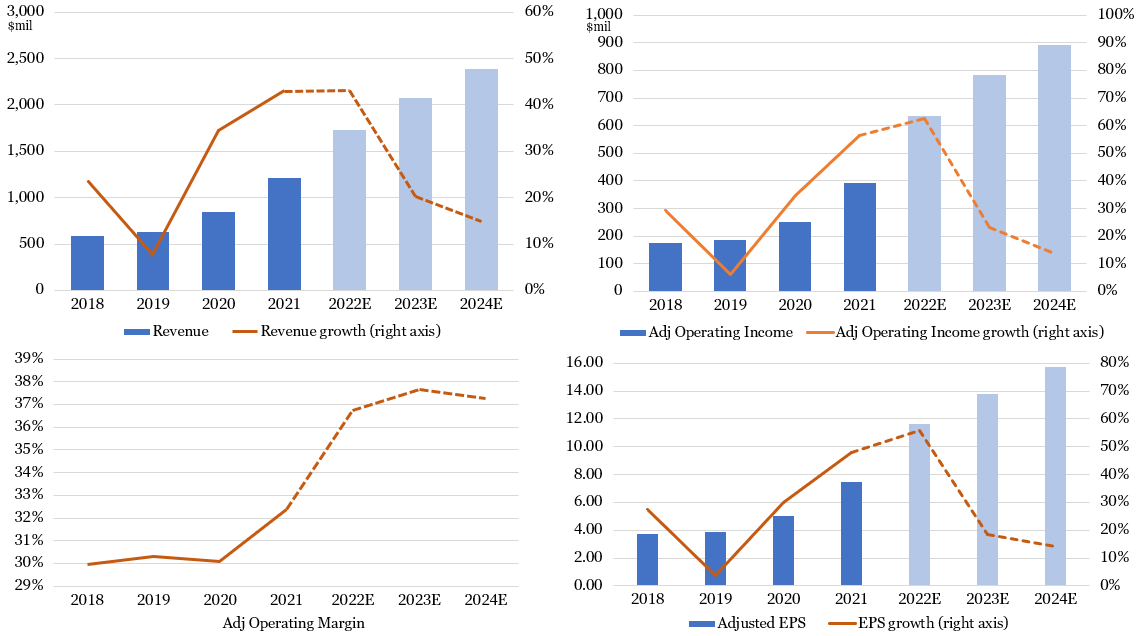

Monolithic Power’s long-term operating model calls for outgrowing the analog chip market by 10-15 percentage points per year. The firm has met or exceeded these ambitious targets in recent years. Indeed, Monolithic’s revenue growth of 8% in 2019, 35% growth in 2020, and 43% growth in 2021 compared favorably to the analog chip market’s 8% decline in 2019, 3% growth in 2020, and 30% growth in 2021. Monolithic is continuing its fundamental momentum into 2022 with 48% revenue growth reported in the first quarter of 2022 and 43-50% growth anticipated by management in its second quarter, well above analog’s 12% growth expected by semiconductor market research firm IC Insights.

While Monolithic will not be able to sustain over 30% revenue growth, it should be able to average at least high teens growth over time as the marketplace for analog semiconductors grows in the mid- to high-single-digits (IC Insights forecasts a 7.4% cumulative average growth rate in 2021-2026) and Monolithic Power outpaces industry growth by at least 10 percentage points. Growth ought to not be constrained by its singular operation within the power management market because it only commands a 2% worldwide market share.

Aggressive capacity expansions should allow Monolithic to better meet demand than its rivals. It increased capacity by 40% in 2021 and expansions planned in 2022 will allow for “well over $2 billion” in revenue versus $1.2 billion revenue earned in 2021. Management expects further capacity expansions to support $3-4 billion of revenue in the coming years before ultimately expanding to support $10-15 billion of revenue.

The other element of Monolithic Power’s long-term operating model is to expand gross margins by 10-20 basis points (0.1% to 0.2%) annually. The company is passing with flying colors here as well, with flat margins recorded in 2020, but 150 basis points of expansion in 2021. The gross margin gains are accelerating with 250 basis points of expansion reported in 2022’s first quarter and 240-300 basis points of expansion anticipated by management in its second quarter. Meanwhile, operating margins ought to expand roughly in line with gross margins as the company paces its research & development and capital expenditures with sales growth.

With modest anticipated annual operating margin expansion roughly offset by 1-2% of annual share count increases, Monolithic Power should be able to sustainably grow EPS roughly in line with its high teens or better revenue growth. Realization of an increasingly feared recession within the next 12 months could cause the firm to temporarily underperform its long-term trend line, but we would not be surprised to see Monolithic continue to greatly exceed market expectations. During its most recent earnings call on May 2, management said it did not foresee a deceleration of its revenue growth over the next year despite fears of a sharp economic slowdown or recession.

Figure 2: Monolithic Power’s Growth and Margin Metrics Continue to Impress

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Monolithic Power’s stock is priced at 37x next 12 months’ (NTM) consensus earnings, well ahead of the S&P 500 at 18x NTM. We believe Monolithic has earned its valuation premium owing to its far superior growth track record and outlook, strong economic moat, high profitability margins, healthy free cash flow generation (averaged 22% free cash flow margin over past four years), and debt-free balance sheet. Its earnings multiple is well off the 59x it averaged from April 1, 2020 to December 31, 2021 when U.S. treasury yields were lower, but is up somewhat from the 34x it traded in the three-year prepandemic period ending February 28, 2020.

We expect Monolithic Power’s stock price to exhibit more sensitivity to market swings than the average stock because of its growth profile, valuation, and above average cyclicality. Still, with the stock down 9% year-to-date, better than the VanEck Semiconductor ETF (ticker SMH) and iShares Russell 1000 Growth ETF (ticker IWF) at down 21% and down 22%, respectively, positive company-specific factors can and should allow the stock to outperform its peers. When the stock market becomes more comfortable with the inflation, interest rate, and economic growth outlook, we believe the MPWR can break out to new highs which are 27% above current levels.

Key Risks

The biggest fundamental risks to the company are a growth slowdown in the semiconductor market and normalization of its pace of market share gains. Catalysts for slower growth could come from an economic recession or its peers more effectively tackling supply chain issues that have tripped them up to a much greater degree. The company also faces key person risk since CEO Michael Hsing, age 62, has been so instrumental on the technological innovation front.

An additional risk to the stock’s valuation would be a continued rapid increase in the 10-year U.S. treasury yield because Monolithic Power is very much a growth stock. Growth stocks are more sensitive to rising yields than value stocks because they have a greater proportion of expected cash flows further in the future, and those cash flows are worth less today when discounted at higher rates.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in the State of Illinois. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, insurance or accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.