Steris Offers Infection Prevention, Portfolio Protection

By Jim Krapfel, CFA, CFP

September 2, 2025

Background

I started buying Steris (ticker STE) for client accounts in April 2022 in the $225-$250/share range. It had been among our smallest stock positions until I boosted our position immediately following its fiscal first quarter 2026 earnings results on August 7, 2025 at $235.54/share. As of August 31, Steris was the 15th largest stock position across client accounts, putting it in the middle of the pack.

Company Introduction

Steris is all about infection prevention. Its products and services are essential to the operations of a sterile environment for healthcare processing departments, healthcare procedural centers, such as operating rooms and endoscopy suites, and medical device and pharmaceutical manufacturers.

It provides capital equipment such as sterilizers, surgical tables, and automated endoscope preprocessors. Consumables offerings include detergents, endoscopy accessories, barrier products, instruments and tools. Services provided include equipment installation and maintenance, microbial reduction of medical devices, instrument and scope repair, laboratory testing, and outsourced reprocessing.

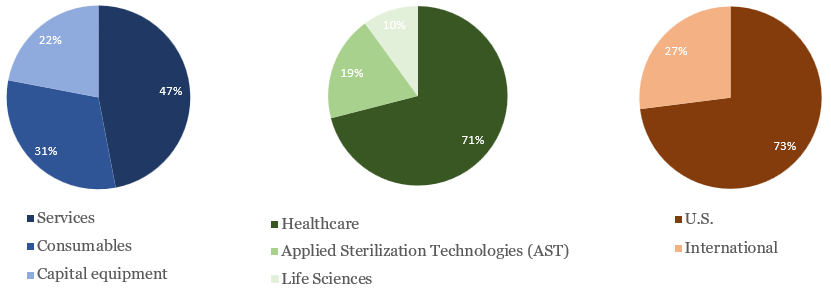

Revenue is broken down by type, reportable segment, and geography below.

Figure 1: Revenue Composition (FY25-end March 2025)

Source: Company filings

The company has operational headquarters in Mentor, Ohio, is incorporated for tax purposes in Ireland, and carries a market capitalization of $24 billion. The company was founded in 1985, IPO’d in 1992 at $7/share, and joined the S&P 500 in 2019.

Investment Thesis

Over the last three years, we have owned Steris because it is a high quality company (see Economic Moat section), with solid, albeit unspectacular growth prospects. From a portfolio composition perspective, it helps dampen overall portfolio volatility given its defensive characteristics (even within the healthcare sector) while offering decent absolute share price appreciation potential.

There exists a couple of secular, or long-term, growth drivers that should allow its organic revenue (which excludes effects of currency changes and acquisitions) to grow slightly faster than nominal GDP. The biggest driver is simply an aging of the population, as an increasing number of people are entering their prime healthcare consumption years. Greater medical procedures in particular help drive Steris’ business, including preventative screenings such as endoscopies and colonoscopies.

There also exists greater emphasis on infection prevention and sterile environments. Hospitals and health systems are under intense pressure to reduce healthcare-associated infections, especially those caused by multidrug-resistant organisms. Because treating resistant infections is more difficult and costly, prevention becomes more critical. Further, development of new therapies (including antibiotic alternatives, biologics and vaccines) often requires ultra-sterile manufacturing conditions. Steris is at the center of preventing infections and providing sterile environments.

That said, over the past several years, Steris was hamstrung by supply chain constraints, poor dental segment results, weak bioprocessing volumes, and a dramatic falloff in vaccine production. That caused the stock to be essentially range bound and underperform the overall stock market. Since then, its supply chain issues ceased (in early 2024), it sold its dental segment (in May 2024), bioprocessing activity has resumed a normal growth trajectory, and vaccine demand does not have much room to weaken further.

Steris’ most recent earnings release gave strong credence to the notion that the company is back to consistently stronger growth. Quarterly organic revenue growth accelerated by two percentage points to 8%, healthcare capital equipment order growth accelerated to 14% versus 12% for all of fiscal 2025, and total capital equipment backlog increased 19%. Management commentary on the conference call was the most confident I have heard during our ownership period. Accordingly, we materially increased our position in the stock immediately following the results.

Economic Moat

I believe Steris possesses a wide economic moat, or sustainable competitive advantages, that should prevent disruption and allow it to continue to generate strong profitability metrics.

Steris’ products are not flashy but they are indispensable. Hospitals and pharmaceutical companies cannot run without what it provides, and that necessity is the first layer of protection around the business.

The moat gets wider when you consider switching costs. Once Steris’ sterilization equipment or surgical infrastructure is installed in a hospital, it is not coming out. It is tied into workflow, safety protocols, and regulatory compliance. To rip it out and start over with a competitor would be quite costly and risky, so customers are loathe to do it. Instead, they keep buying Steris consumables and service year after year — a steady annuity stream for shareholders.

Another protective wall is regulation. Infection control is one of the few areas where the rules only get stricter. Every new guideline from regulators, accrediting agencies, or global health authorities creates more demand for what Steris already does best. Competitors cannot just show up with a cheaper solution; hospitals need proven compliance, and Steris’ brand reputation and regulatory expertise are top notch. Customers do not “shop around” for sterilization the way they might for office supplies.

Growth, Profitability & Valuation

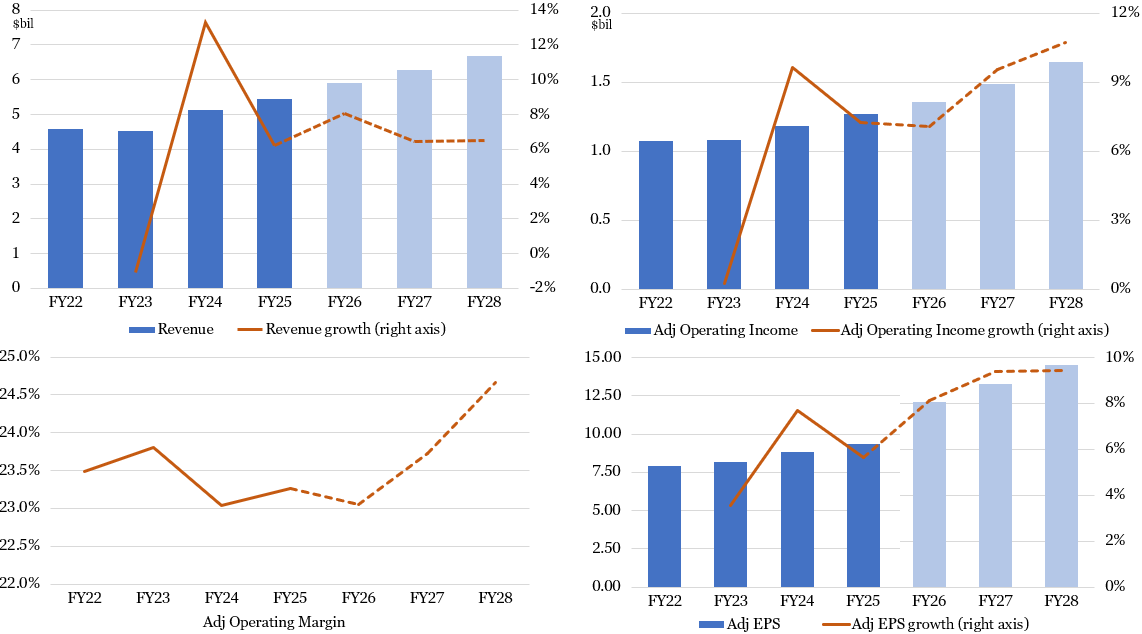

Steris has a good shot of improving its organic revenue growth profile from 6% in fiscal 2025 to 7-9% in the coming years. The company reiterated its fiscal 2026 guidance for 6-7% organic revenue growth in early August but I expect it will increase its guidance with another strong quarter in November. The company has made 50 acquisitions of various size over the last 10 years, so there should be some additional growth via acquisitions. The company’s long-term outlook conservatively calls for mid-single-digit organic revenue growth and mid- to high-single-digit total revenue growth. It averaged 8% and 12% growth, respectively, over the past five years.

Its margins ought to be fairly stable. In the near-term it dealing with increased tariff costs, which are expected to reduce full-year pre-tax profits by $45 million, an 80 basis points (0.8%) hit to margins. The company expects to offset that through ~2% price increases and productivity enhancements. A continued paydown of debt (which lowers interest expense) and some share repurchase activity should allow EPS to grow faster than revenue. Annual EPS growth of 10-13% appears like a reasonable assumption over the next five years.

Figure 2: Steris Should Generate Consistent, Accelerated Growth

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Steris sports a next 12 months’ (NTM) price to earnings (P/E) multiple of 23.8x, down from the 26-32x range it held for much of 2020 and 2021, and essentially in line with the S&P 500’s 23.7x. I believe a small market premium is deserved when combining its average to slightly above average EPS growth profile, less than average cyclicality, and wide economic moat.

Key Risks

The biggest idiosyncratic, or company-specific risk, is probably execution around its acquisition strategy. Throughout the company’s history, it has been active on the acquisition front, and it continues to be on the lookout across the purchase size spectrum. Prior execution on acquisitions has been mixed, with its largest acquisition of Cantel Medical for $3.6 billion in 2021 destroying shareholder value as evidenced by it later recognizing a large goodwill impairment loss tied to the transaction and ultimately selling the dental part of the business for $788 million.

There are also a few risks that could cause a key driver of its business – medical procedures and overall healthcare utilization – to weaken. This could include economic pressure on consumers, government funding pressures (via Medicare and Medicaid) on its healthcare, medical device and pharmaceutical customers, and future pandemics.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.