A Backdoor Roth IRA Could Pad Your Retirement

By Jim Krapfel, CFA, CFP

April 2, 2021

Most understand Roth retirement accounts’ primary benefit is that money grows tax-free and can be withdrawn tax-free during retirement. Some also know that Roths avoid required minimum distributions. But few realize there is a method to move money into these tax-advantaged accounts above and beyond contributing to a Roth 401(k) for those whose income disqualifies them from directly contributing to a Roth IRA. In this article I explain the virtues of the backdoor Roth IRA, who is best suited for it, and how to execute the savvy maneuver.

401(k) Refresher

Saving for retirement traditionally starts with a 401(k) account through an employer. The employee can contribute up to $19,500 annually, or $26,000 if over 50 with a $6,500 catch-up contribution. Employers often offer a matching contribution to the employee’s 401(k), with the total employee + employer contribution subject to a $58,000 limit in 2021, or $64,500 with the catch-up contribution. It is well appreciated how advantageous it is to contribute an amount that will generate the full employer match.

A 401(k) participant can opt for pre-tax traditional, post-tax Roth (75% of employer plans offer a Roth option), and/or post-tax non-Roth contributions for amounts over the employee max (fewer employer plans allow this). Although pre-tax elections result in tax savings in the year of contribution, the associated retirement withdrawals are fully taxable and the account is subject to required minimum distributions (RMD) at age 72, unless one is still working for his or her employer. Conversely, a Roth contribution sacrifices immediate tax savings but gains tax-free treatment of retirement withdrawals and is not subject to RMD, so unabated tax-free growth is possible.

Carefully choosing whether to opt for traditional or Roth 401(k) contributions can optimize long-term outcomes. As Exhibit 1 illustrates, a 25-year-old maxing out Roth contributions in his or her lower-earning years, then switching to traditional contributions as incomes ascend to higher marginal tax brackets, does better than sticking to either. If we forecast higher tax rates across all income levels, which is reasonable since tax rates are set to revert to higher levels in 2026 (if not sooner through new legislation), Roth contributions become more valuable than shown here. (Side note: this chart also reminds us of the power of compounding returns!)

Exhibit 1: Some Mix of Roth 401(k) Contributions Tends to Come Out Ahead in the Long Run

Assumptions: (1) max, static 401(k) contributions inclusive of catch-up contributions; (2) no employer match; (3) retirement age of 65; (4) 6% rate of return on 401(k) assets; (5) RMDs start at 72 for traditional 401(k); (6) 5% after-tax return on non-retirement assets; (7) marginal federal + state tax rates: 27% at age 25-29, 29% at 30-39, 37% at 40-64, 29% at 65+; (8) “Hybrid Approach” makes Roth 401(k) contributions through age 39 and Traditional 401(k) contributions thereafter

Source: Glass Lake Wealth Management analysis

The upside of 401(k) plans is that there are no income limits to neither (1) receive a tax deduction in the case of traditional contributions, nor (2) elect Roth contributions.

IRA Refresher

Once 401(k) contributions are maxed out, people with the ability and desire to find additional means to invest for retirement typically look to IRAs (and Health Savings Accounts if they have an eligible healthcare plan; read my article to explore the virtues of HSA accounts). One can annually contribute up to $6,000 to an IRA, or $7,000 if over 50 with a $1,000 catch-up contribution, as long as there is earned income.

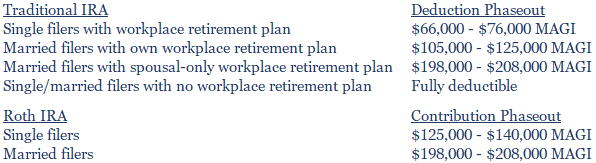

Like 401(k)s, contributions to IRAs can be classified as pre-tax traditional, post-tax Roth, or post-tax non-Roth (more on post-tax non-Roth in a bit). Traditional IRAs share traditional 401(k) traits such as penalty-free withdrawal allowance at age 59 ½, fully taxable distributions, and being subject to RMD at age 72. Unlike 401(k)s, the ability to make tax-deductible traditional IRA contributions and the ability to contribute at all to Roth IRAs are phased out at modified adjusted gross incomes (MAGI) specified below.

Exhibit 2: IRA Deduction and Contribution Phaseout Levels in 2021

Source: IRS.gov. “New income ranges for IRA eligibility in 2021.” Published 11/4/20

Due to these income limits, many who would like to contribute to an IRA either do not qualify for a tax deduction in the case of a traditional IRA, or do not qualify to contribute at all in the case of a Roth. However, those who earn too much to receive a deduction for a traditional IRA contribution may still contribute after-tax dollars. In this case, the account still grows tax-free, and withdrawals are taxed in proportion to the amount the traditional IRA has appreciated over time. For example, say $100,000 is invested with after-tax dollars into a traditional IRA that appreciated (tax-free) by $50,000 over time to $150,000. At time of withdrawal, one-third would be taxable because that represents the proportion of the account that had taxable gains.

The Backdoor Roth IRA

The good news is one can circumvent income limits of Roth IRAs by contributing after-tax dollars to a traditional IRA, then converting those assets to a Roth IRA. For example, a single 38-year-old with a MAGI of $180,000 could contribute $6,000 to a traditional IRA in 2021 using after-tax dollars (because he or she made too much to qualify for a pre-tax contribution), then convert those assets to a Roth IRA potentially tax-free, where it can grow and eventually be withdrawn tax-free.

Potentially is the operative word when it comes to taxability. That is because traditional IRA to Roth IRA conversions are subject to IRA aggregation and pro rata rules. For purposes of IRA conversions, the IRS pools together all traditional IRA accounts. Therefore, the portion of the Roth conversion that is considered taxable income in the year of conversion is proportionate to all traditional IRA assets containing pre-tax money. Assets in Roth IRAs and any 401(k)s are not factored in here.

This is not an easy concept, so let us look at a hypothetical scenario. Say Jack has $54,000 in a pre-tax, traditional IRA. Because he earns too much to qualify for a pre-tax contribution this year, he contributes the maximum $6,000 of after-tax money to a new IRA that he then converts to a Roth IRA. In determining the taxability of the conversion, the IRS looks at not only the $6,000 conversion, but also the $54,000 pre-existing IRA. Since $54,000 of the $60,000 invested in IRA accounts, or 90%, contains pre-tax money, 90% of the $6,000 conversion is considered taxable income. Put simply, Jack’s pre-existing traditional IRA makes most of the conversion taxable income, which could also push him to a higher income tax bracket.

As such, backdoor Roth IRAs are most suitable for high earners those who have no existing pre-tax IRAs. For those investors, post-tax contributions to a traditional IRA can be converted to a Roth IRA completely tax free. This scenario is most likely to present itself to someone in their 20s or 30s who has been with their employer for an extended duration and has either not had the option to or opted not to rollover his or her 401(k) to an IRA.

The tax savings of indirectly funding a Roth IRA versus an alternative of making contributions into a taxable account can be dramatic, as depicted in Exhibit 3. In this scenario of someone who withdraws 5% of their account value after retiring at age 65, the spread in account values dramatically widens out during retirement because a taxable account holder would pay long-term gains tax on positions presumed to have low cost bases from the many years of compounded growth. A Roth IRA owner need not worry about taxable gains.

Exhibit 3: Backdoor Roth IRAs can Significantly Boost One’s Retirement

Assumptions: (1) max, static backdoor Roth IRA contributions inclusive of catch-up contributions; (2) equal contribution put into a taxable account for comparison; (3) retirement age of 65; (4) 6% investment returns; (5) 25% annual portfolio turnover; (6) proportion of sale proceeds that is a taxable long-term gain is 20% in pre-retirement and 50% in post-retirement; (7) 20% long-term gain tax rate; (8) 5% of account value is withdrawn each year after retirement

Source: Glass Lake Wealth Management analysis

If one owns pre-tax IRAs, it does not necessarily mean a Roth conversion is nonsensical. Converting a portion of a pre-tax IRA could still be advantageous when an investor expects a higher marginal tax rate after turning 72. A higher tax rate could result from working through one’s 70s while also taking RMDs, a higher prevailing tax regime, or moving to a higher income tax state. One might also consider converting some pre-tax IRA assets to a Roth IRA is if he or she is planning to leave retirement assets to heirs in their peak earning years. Inherited Roth IRA assets generally do not incur income taxes upon sale, but inherited traditional IRAs generate taxable income because of their RMDs.

Bottom Line

A backdoor Roth IRA -- that is contributing after-tax money to a traditional IRA, then converting to a Roth IRA -- is a no-brainer for anyone who (1) makes too much to qualify for direct Roth contributions, AND (2) has no existing pre-tax IRA assets, AND (3) has the means to contribute more than the 401(k) contribution required to receive the full employer 401(k) match. When these conditions are satisfied, continually executing a backdoor Roth IRA can tremendously enhance one’s retirement portfolio.

Deciding whether to convert pre-tax assets to a Roth IRA is a less straight-forward exercise. If certain events cause a reduction in income, such as losing a job, starting a business, or retiring before age 72, and/or one’s marginal tax rates are expected to increase after age 72, then a Roth conversion may be advisable. An evaluation of a potential conversion should consider other factors not mentioned in this article and be discussed with a financial advisor, tax accountant, and/or estate planning attorney.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in the State of Illinois. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice.

This article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.