April 2022 Investment Letter

April 3, 2022

The stock market endured a great deal of turbulence in the first quarter as it contended with a persistent acceleration in inflation, a dramatically more hawkish Federal Reserve, an unanticipated invasion of Ukraine by Russia, and emerging economic recession fears. Indeed, the iShares Russell 3000 Index (ticker IWV), a broad measure of market performance, reached a peak year-to-date decline of 13% on March 14. Yet with all the negative headlines and major market volatility, the Russell 3000 finished the quarter down just 5%.

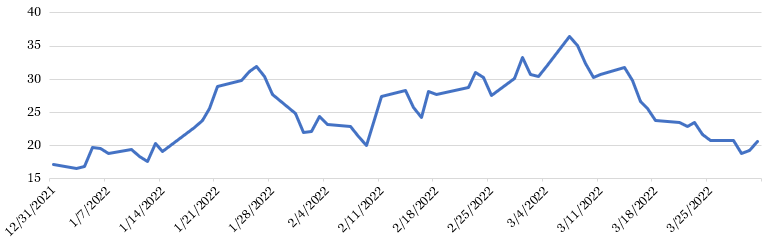

The late quarter market rally largely resulted from extreme oversold levels and excessive fear, as indicated by the CBOE Volatility Index (ticker VIX). VIX readings can be interpreted this way -- 25 reflects an anxious market, 30 a fearful market, and 35 a panicked market. When fear and pessimism dominate investor psychology, the market has likely priced in all the bad news, at least on a short-term basis, setting up for a sharp rally with little catalyst. That’s what happened in March.

Figure 1: VIX Spike to >35 Suggested Excessive Fear and an Imminent Market Rally

Source: Yahoo Finance

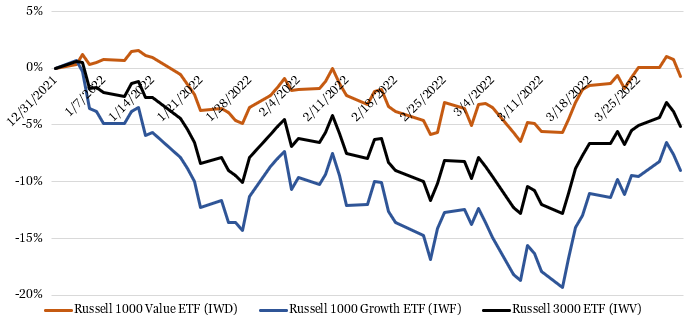

There were distinct divergences within the stock market during the first quarter. A key one was value stocks’ outperformance over growth stocks, with the iShares Russell 1000 Value Index (ticker IWD) down just 1% and the iShares Russell 1000 Growth Index (ticker IWF) down 9%. The dramatic rise in 10-year U.S. treasury yields (see Figure 4) particularly hurts growth stocks because growth stocks have a greater proportion of expected earnings further into the future in comparison to value stocks. When these more distant earnings are discounted back to the present at higher interest rates, they are worth less today. The higher yields in the first quarter also served to pressure housing stocks as investors worried higher mortgage rates will temper home buyer demand.

Figure 2: Markets Bounced Back Strongly in March, but Growth Stocks Lagged

Source: Yahoo Finance (inclusive of dividends)

Value stock outperformance was boosted in part by Russia’s invasion of Ukraine. The invasion quickly led to escalating economic sanctions and worries over supply disruptions, which drove commodity prices higher nearly across the board. Namely, crude oil surged 33% and natural gas spiked 125% during the quarter as Russia is a supplier of 11% of global oil and 17% of global natural gas. High commodity prices powered strong performances for the value-oriented energy, basic materials, and utilities sectors, up 37%, 7%, and 4% respectively, as measured by the iShares U.S. Energy ETF (ticker IYE), iShares U.S. Basic Materials ETF (ticker IYM), and iShares U.S. Utilities ETF (ticker IDU).

Now that we have touched on what drove first quarter performance, let us dive into the major influential market factors for the rest of the year.

My Outlook

Inflation

Already high inflation appears likely to worsen before it gets better. Global supply chains continue to be disrupted by factors such as Covid-19 lockdowns in China, port congestion, and shortage of truckers. Meanwhile, demand for goods and services in the U.S. continues to be robust as consumers release pent-up demand following the worst of Covid and money continues to be cheap despite recent Federal Reserve actions. The resultant supply-demand imbalances across swaths of the economy have been exacerbated by Russia’s war on Ukraine because of its impact on energy prices and certain commodities such as wheat and palladium.

The Fed’s preferred inflation measure -- PCE – climbed to 6.4% in February, the highest in 40 years (CPI inflation hit 7.9%). I expect inflation to peak this summer before ebbing in the fall as supply constraints ease and demand pulls back as pent-up consumer demand begins to exhaust itself, people balk at higher prices, and the Fed continues to withdraw its accommodative monetary support. My best guess if for inflation to reach 5-6% at year-end, before gradually declining further into 2023, though still likely above the Fed’s 2% target inflation level.

Figure 3: Inflation Has Skyrocketed Since Early 2021

Sources: FRED citing the U.S. Bureau of Economic Analysis. https://fred.stlouisfed.org/series/PCEPI. https://fred.stlouisfed.org/series/PCEPILFE

The Federal Reserve/10-year treasury yields

The Federal Reserve finally admitted it is behind the curve on inflation. It now seeks to increase its federal funds rate to a median 1.9% by year end, up from its December projection of 0.9% by the end of 2022. By way of comparison, it currently resides at 0.25-0.50%, up from 0.00-0.25% prior to the conclusion of its policy meeting on March 16. Federal Reserve Chairman Jerome Powell hinted the Fed could frontload the rate increases with a series of 50-basis-points hikes in coming meetings while also more quickly selling off its vast U.S. mortgage-backed security and Treasury holdings.

A large increase in the 2-year and 10-year U.S. treasury yields reflects the more aggressive Fed. I surmise the 10-year yield would have risen even more dramatically if the Fed had not become this hawkish because delayed Fed action could allow consumer inflation expectations to become more entrenched, thus forcing the Fed to eventually raise rates even more aggressively to combat inflation. I believe the 10-year treasury yield has largely made its move for the year, with yields unlikely to pierce 3%.

Figure 4: U.S. Treasury Yields Spiked in the First Quarter

Source: St. Louis Fed/Board of Governors of the Federal Reserve System. https://fred.stlouisfed.org/series/DGS2. https://fred.stlouisfed.org/series/DGS10.

It is worth noting that on April 1, 2022, the 2-year treasury yield exceeded the 10-year treasury yield (by 0.07%) for the first time since 2019. This “curve inversion” is much discussed because the curve has inverted before each recession since 1955, with a recession following 6 to 24 months afterwards. However, not every inversion leads to a recession and some recessions that were predicted by an inversion resulted from an unforeseeable economic shock, such as the pandemic in 2020. Whether we enter a recession in the next two years could depend on whether inflation can be brought under control.

Russia/Ukraine

It is very difficult to know how the largest land invasion in Europe since World War II will play out, especially because it is directed by a seemingly irrational dictator in Vladmir Putin. Conceivably the unjust war could end in a few weeks if a peace deal were reached (seems very unlikely though), but it could easily drag on for a couple years too.

Either way, I would be quite surprised if Russia soon set its sights beyond Ukraine given the strong international condemnation and significant military and economic losses Russia has already sustained. I also do not expect China to directly involve itself in the conflict because of the unwelcome economic sanctions it would invite upon itself. (If China was to seriously involve itself it could be disastrous for the U.S. economy as the sanctions would wreak havoc on American companies’ already stressed supply chains and directly impact companies that sell to China)

Rather, I expect the primary impact of the war to be a sustained period of high commodity costs until the fighting ends.

Client Positioning

I take a long-term view that focuses on compounding returns in a tax-efficient manner. You will not see me make dramatic asset allocation changes based on my views of legislation, Fed policy, geopolitical events, or other factors. Further, I allocate the bulk of my clients’ equity positions in “quality growth” names that have strong and sustainable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

Indeed, I continue to invest around 80% of clients’ equity allocations in companies I would characterize as “quality growth.” The remainder of clients’ portfolios continue to be invested in lower quality companies that have a strong three-year growth or recovery outlook. Overall, clients should expect their equity portfolio to do best versus the market when growth stocks outperform value stocks, which tends to occur when inflation is low or declining and 10-year treasury yields remain tame. I believe the turning point for growth outperformance will arrive when it is clear that inflation is peaking, which could be by this summer.

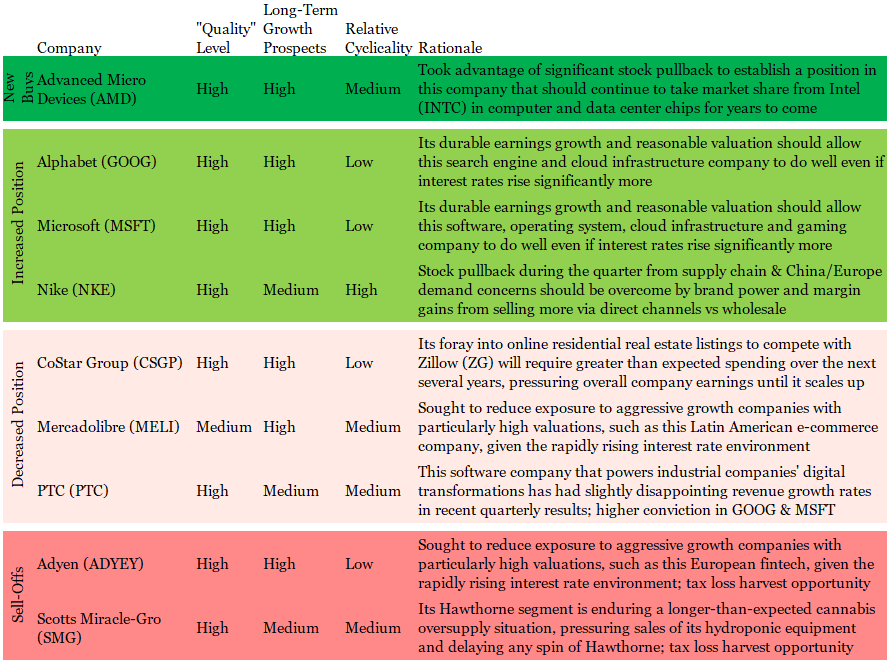

Figure 5: Portfolio Changes in Majority of Client Accounts in 1Q 2022

Source: Glass Lake Wealth Management

Portfolio changes in the first quarter were primarily made to modestly reduce portfolio duration, that is to reduce the portfolio’s sensitivity to higher interest rates, by shifting the portfolio to less-rapid growers with more certain longer-term outlooks and lower valuations. These changes also allowed us to harvest losses for tax purposes and initiate or add to existing positions in stocks that offered compelling buy points.

You are highly unlikely to see me chase stocks in the oil & gas or basic materials sectors because I believe the favorable macroeconomic and geopolitical environment these stocks enjoy is unlikely to persist through the three- to five-year-plus investment horizon I use for most client holdings. You can also expect me to abstain from the most speculative areas of the market, such as unprofitable recent IPOs, SPACs, or Reddit-fueled meme stocks. As always, I will keep an open mind and be on the hunt for the next great long-term investment.

I hope you and your loved ones stay happy, healthy, and wealthy into the spring.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in the State of Illinois. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.