Stock Feature — “What’s Not to Heart About Edwards Lifesciences?”

By Jim Krapfel, CFA, CFP

March 3, 2022

Background

I became familiar with Edwards Lifesciences Corp. (ticker EW) during my years as analyst and portfolio manager at RMB Capital Management, LCC in 2015-2019. We started buying shares for Glass Lake clients in July 2020. It was the fourth largest aggregate stock position as of March 3.

Company Description

Edwards is a manufacturer of heart valve systems and repair products used to replace or repair a patient’s diseased or defective heart valve. Its work in heart valves encompasses both surgical and transcatheter therapies targeting the aortic valve and has a pipeline of future technologies focused on the less invasive repair or replacement of the mitral and tricuspid valves of the heart. The company also makes brain and tissue oxygenation monitoring systems used to measure a patient’s cardiovascular function in the hospital setting.

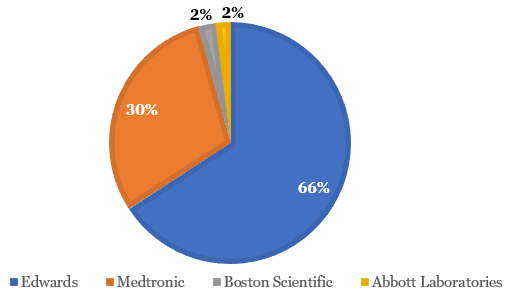

Edwards’ transcatheter aortic valve replacement (TAVR) segment encompassed 65% of 2021 revenue. Its TAVR products were first commercialized in Europe in 2007, then in the U.S. in 2011, and in Japan in 2013. Edwards dominates the TAVR market with its two-thirds market share, while Medtronic PLC (ticker MDT), Abbott Laboratories (ticker ABT), and Boston Scientific (ticker BSX) make up the rest of the market. Meanwhile, Edwards’ surgical structural heart, critical care, and transcatheter mitral and tricuspid therapies (TMTT) segments made up 15%, 8%, and 2% of its 2021 revenue, respectively.

Figure 1: Edwards Dominates the Worldwide TAVR Market (2021)

Sources: Company filings, Glass Lake Wealth Management

Edwards was incorporated in 1999 and went public through an initial public offering in 2000. Geographic breakdown of revenue in 2021 was 57% U.S., 23% Europe, 10% Japan, and 11% rest of world.

Investment Thesis

The biggest component to our bullish thesis on Edwards is the robust long-term growth opportunity for TAVR. A May 2021 Barclays Research report estimates that less than 150,000 patients in the U.S. are being treated for traditional open heart surgery (50,000) or TAVR (80,000 – 90,000) out of a prevalence pool of around 1.4 million people (with roughly 1 million being symptomatic).

Edwards should be able to address a growing share of heart disease sufferers as positive clinical data becomes available that shows how its valves can enable patients to experience a better quality of life sooner than patients receiving traditional surgical therapies. TAVR is currently indicated for symptomatic severe aortic stenosis patients, but this surgery could expand into a broader patient population that could include treating moderate aortic stenosis patients and/or those who do not yet have symptoms.

Edwards expects the worldwide market opportunity for TAVR to grow to $10 billion in 2028 from $5 billion in 2021 because of greater overall awareness, label and geographic expansion, and new technologies. This implies a 15% cumulative average market growth rate. There are no indications that Edwards’ competitors are making major inroads so Edwards should be able to grow its TAVR revenues by about the same rate.

The second major reason to own Edwards for at least the next few years is the large market opportunity to treat sufferers of mitral and tricuspid valve disease (pertains to Edwards’ TMTT segment). Abbott, Medtronic, and Edwards estimate 4-4.5 million people in the U.S. suffer from moderate to severe mitral or tricuspid regurgitation, but less than 2% receive treatment because of various estimates for the prevalence of disease and many unknowns about the particular therapy patients will respond to given the varying nature of the disease.

Edwards estimates the global market opportunity for TMTT will balloon to $5 billion in 2028 from $1 billion in 2021 because of positive clinical trial results, strong real-world clinical outcomes, and commercial approval in new geographies (Edwards only has commercially availability in Europe so far). This implies a 26% cumulative average market growth rate. Abbott was first to market and controls >90% of the global market, but Edwards could be a strong #2 player.

A third expected positive driver for Edwards is a reduction in Covid-19 hospitalizations that should allow surgical procedures to normalize at higher levels. We estimate Edwards’ revenues were negatively impacted by 10-15% in 2020 and by a few percentage points in 2021 due to constrained hospital resources stemming from Covid-19.

Economic Moat

We believe Edwards possesses an economic moat, or sustainable competitive advantage, largely because of its patent portfolio built on robust clinical data. An ongoing stream of supportive data from clinical trials and significant product innovation should deepen its moat. Indeed, it reinvests heavily into its business, having spent 17% of its 2021 sales on research and development.

Growth, Profitability & Valuation

Sustainable revenue growth over the next five years looks to be in the 10-15% range, largely driven by its TAVR and TMTT segments. Its Surgical Structural Heart and Critical Care segments should grow at slower rates in the low-single digits to mid-single digits as these products are further along the maturity curve.

Annual margins should gradually expand as selling, general, and administrative costs grow slower than revenue, propelling sustainable EPS growth to the low- to mid-teens. Over the next two quarters margins should bounce back from recent declines as TAVR procedures normalize and the company better leverages its fixed costs.

Figure 1: Edwards Is Set for Resumption of Sustainable Growth

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Edward’s stock price does not appear cheap at 43.5x next 12 months (NTM) consensus earnings, well above the S&P 500 at 23.8x NTM. However, we believe Edwards has more than earned its valuation owing to its sustainably superior growth outlook, strengthening economic moat, little economic cyclicality, high profitability margins, and fortress balance sheet (more cash than debt on its balance sheet).

Given the solid but not overly aggressive growth profile and premium stock valuation, we do not expect Edwards’ stock to be among the market highfliers. Rather, we see Edwards as a “quality compounder”, a stock we expect to appreciate approximately in-line with its earnings growth rate over the next 3-5 years, with less downside risk than most stocks with similar growth profiles.

Key Risks

The biggest fundamental risk to the company is that new data for its products fail to impress as expected, driving slower than anticipated growth in TAVR and TMTT. Its large medical device competitors could also out innovate Edwards and result in Edwards forfeiting market share.

An additional risk to the stock price would be a continued rapid increase in the 10-year U.S. treasury yield because Edwards is considered a growth stock. Growth stocks are more sensitive to rising yields than value stocks because they have a greater proportion of expected cash flows further in the future, and those further out cash flows are worth less today when discounted at higher rates.

Disclaimers

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in the State of Illinois. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.