Be Firm with Term If Life Insurance Make Sense for You

By Jim Krapfel, CFA, CFP

February 2, 2022

Life insurance can be an essential component to a family’s financial plan. A common reason to own life insurance is to cover funeral costs and provide financial security to beneficiaries such as a spouse or children via a death benefit upon the policyholder’s untimely death. Many Americans have sought such protection with 52% of adults being covered by some type of life insurance in 2021, according to LIMRA.

However, coverage options are myriad and policy terms can be complicated and opaque. What’s more, commissioned insurance agents may put their interests first, steering consumers towards expensive policies they do not actually need. The insurance procurement process can be daunting.

Glass Lake Wealth Management neither sells life insurance, nor profits from its use in any way. Rather, my objective here is to educate and direct prospective life insurance shoppers in the right direction. I identify necessary conditions that typically make life insurance a prudent purchase. I also explain why term life insurance, rather than a permanent policy such as whole life, is most often the proper choice when life insurance is advisable.

Term Life Insurance Overview

Compared to permanent life insurance, term life insurance is relatively straightforward. One can purchase a certain level of coverage that lasts over a predetermined number of years, typically in multiples of five, up to 30 years. The most popular is a $500,000 policy that lasts 20 years. The premium payment is established upon policy purchase and remains the same every year. One may buy additional insurance after the policy term, but payments would rise considerably to reflect the higher mortality risk later in life.

Almost all life insurance policies will pay the tax-free death benefit for any cause of death after the second year except when (1) a beneficiary murders the policyholder or (2) the policyholder dies while engaging in an excluded activity such as skydiving. If death occurs within the first two years, the insurance company may review the information given on the insurance application, such as health indicators, and may deny payment if they were given the wrong or incomplete information. Most people need not worry their beneficiaries will not receive their life insurance proceeds though. According to the American Council of Life Insurers (ACLI), fewer than one in 200 claims are denied.

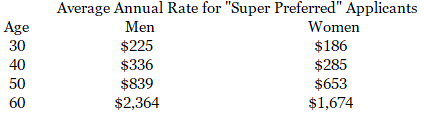

Term life insurance can be surprisingly affordable. The table below reflects the average of the three lowest rates surveyed for each age and sex by Quotacy. This reflects the best rates that applicants in the lowest health risk category, commonly referred to as “super preferred,” might see.

Figure 1: Life Insurance Rates Based on a $500,000, 20-year Term Policy

Source: Nerdwallet.com, sourcing Quotancy. “Average Life Insurance Rates.” https://www.nerdwallet.com/article/insurance/average-life-insurance-rates

Rates can increase considerably from there based on additional factors such as smoking status, pre-existing health conditions, height and weight, family medical history, driving record, occupation, and lifestyle. Policies can be obtained without a medical exam, but in such policies premiums reflect the higher risk to the insurance company. Notably, insurance companies cannot base premiums on ethnicity, sexual orientation, credit score, or marital status.

Suggestions for Buying Term Life Insurance

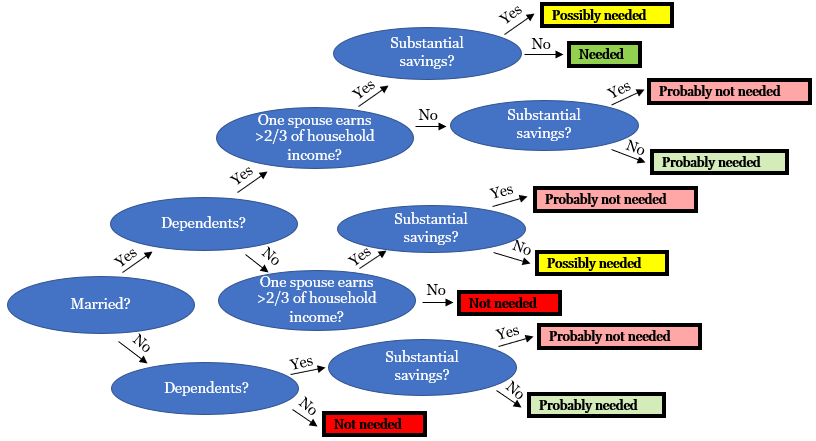

Term life insurance is most critical when dependents or a spouse rely on one person’s income for their financial needs or standard of living. On the other end of the spectrum, a single person with no dependents clearly does not need life insurance. Figure 2 provides a general framework for suitability based on major factors such as being married, having children, one spouse making up an outsized share of family income, and savings level. There are many instances when it could go either way, so a need for life insurance is better assessed when considering the individual’s full financial situation, goals, and preferences.

Figure 2: Guide to When Term Life Insurance May Be Needed

Source: Glass Lake Wealth Management

The amount of insurance purchased should roughly cover the amount of money that would make the family financially whole if the policyholder were to pass away. A good rule of thumb is to buy coverage equivalent to 7-10 times annual income. Keep in mind that employer’s life insurance plans typically cover 1-2 times annual income while employed. Policy duration need only extend to the point in which financial support is needed for a dependent or loved one. For example, a policy on the family breadwinner may only be advisable until his or her children are expected to graduate from college.

Once a term policy is purchased, it is imperative that the policy not be canceled prior to expiration. Term policies are not a good deal in the first few years because mortality risk is relatively low and premiums are higher than actuarially reasonable. However, term life insurance becomes a much better value proposition through the policy term as fixed premiums pay for escalating mortality risk. Indeed, the probability of death in a given year for 40-year old men and women jump over 4-fold once they reach 60, to 1.1% and 0.7%, respectively.

More reason to retain a term life insurance policy for its entire duration are findings that when policyholders do just that, on average insurance companies lose money. Term insurance policies overall are still profitable because so many people cancel their policies before mortality risk rises. In 2009-2013, the most recent period in which industry data was available, the annual policy lapse rate for term life insurance policies was 6.2% annually, with the highest lapse rates in the first three years. About half of all policies lapse by around year 11. As a result, 85% of term policies ultimately fail to pay a death benefit.

Permanent Life Insurance Overview

Permanent life insurance, which comprises whole life, universal life, and variable universal life, is much more complicated than term life insurance. There are two primary ways they work differently: (1) the death benefit continues for the policyholder’s entire life, and (2) a portion of the paid premium goes into a cash value account that earns tax-deferred interest.

It is worth spending a moment on the cash value feature of permanent life insurance policies. Growth in the cash value account can be used for any purpose by the policyholder during his or her lifetime. Policyholders can also borrow against the full cash value on a tax-free basis. However, any outstanding loan balance at the time of death reduces the death benefit and the borrowing incurs interest. Notably, the cash value at death does not go to designated beneficiaries, but rather to the insurance company.

The primary difference between whole life and universal policies is that whole life, similar to term, has fixed premiums, while universal policies exhibit greater flexibility with adjustable premiums and death benefits.

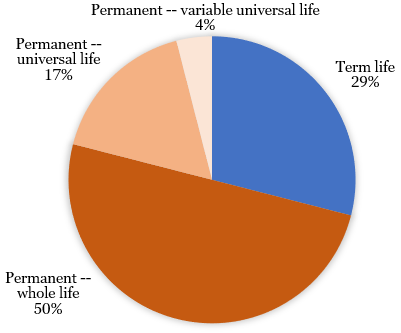

Despite permanent life insurance policies’ numerous drawbacks, as I will discuss in a moment, they remain heavily utilized. In 2011, the most recent year I could find such data, 71% of issued policies were some form of permanent insurance.

Figure 3: Permanent Life Insurance Policies Are Heavily Utilized

Source: Society of Actuaries and LIMRA. “U.S. Individual Life Insurance Persistency.” 2019. https://www.soa.org/globalassets/assets/files/resources/research-report/2019/2009-13-us-ind-life-persistency-update-report.pdf

Why Permanent Life Insurance Is Ill-Advised for Most People

One of the big drawbacks of permanent life insurance is that lifetime coverage is typically unnecessary, since most dependents do not stay dependents forever. Coverage permanency comes at steep cost. Indeed, a 40-year old male or female super preferred applicant seeking $500,000 of coverage can expect to pay 19 times more on average for a whole life policy versus a term policy. Large upfront sales commissions, which can be 130%-150% of the first-year premium, and policy surrender charges mean you will probably lose all or most of your cash value if you quit the policy within the first five years.

Further, life insurance is not a good retirement planning strategy. Policyholders tend to face steep investment fees that cap returns. There is scant performance data publicly available, but whole life policyholders can reasonably expect a mere 1-3% annual growth in their cash value accounts. And remember that the policy’s cash value at time of death goes to the insurance company, not to beneficiaries.

A sound alternative for most life insurance seekers is to buy a term policy and invest the saved policy premiums into 401(k) plans, health savings accounts, IRAs, and individual brokerage accounts. Invested funds ought to compound at a higher rate of return over decades, leaving a significantly larger inheritance to beneficiaries upon death.

There are limited situations in which a permanent life insurance policy could be advisable:

Very high degree of risk aversion. Permanent life insurance policies offer guaranteed, minimum returns on the invested cash value, usually 1%-2%, which is tax deferred. Although this rate of return is much less than what one can expect to earn in a diversified portfolio over the long run, downside is well-protected.

Large estate. Since death benefits are tax free to the recipient, there are advanced estate planning strategies that entail using life insurance to avoid estate taxes. For reference, the federal estate tax exemption of $12.06 million in 2022 will fall back to $5 million in 2026 under current law. Any taxable estate above that level is taxed at 40%.

Bottom Line

If life insurance is something you desire, opt for affordable term coverage for only the years in which there is financial dependency on you. Be sure to maintain coverage through the full policy term to maximize economic value.

Conversely, steer clear from overly promoted permanent life insurance products like whole life and universal life unless you are extremely risk averse or expect to have a very large estate. Their expensive premiums, rarely necessary lifetime coverage, high fees, and lackluster investment performance make it a poor value proposition. It is usually smarter to invest the saved premiums in the stock market and leave a substantially larger inheritance to your loved ones.

It is best to talk to a financial planner to see if, what type, how much, and for what length of time life insurance makes sense for your situation.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in the State of Illinois. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice.

This article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, insurance or accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.