Stock Feature — “Skyline Champion Is Helping to Solve the Housing Affordability Crisis”

By Jim Krapfel, CFA, CFP

December 15, 2021

Background

I became familiar with Skyline Champion Corp. (ticker SKY) during my days as a homebuilding stock analyst at research firm Morningstar, Inc. (ticker MORN). After further research and meetings with Skyline’s management team as a stock analyst and portfolio manager at RMB Capital, I became convinced that Skyline was set to disproportionately benefit from an extended housing upcycle supported by years of housing underproduction and favorable demographic trends.

I started buying Skyline shares for myself in August 2017 and by early 2018, I made it one of my largest personal holdings. I have also consistently purchased it for client accounts upon client onboarding since my firm’s founding in April 2020. Skyline was the second largest aggregate stock position across client accounts as of December 15.

Company Description

Skyline Champion was formed via the larger, then-privately held Champion Enterprise Holdings, combining with publicly traded Skyline in June 2018. It is the second largest U.S. manufactured housing (MH) company with a 17% market share across its 40 manufacturing plants and 18 retail locations. Unlike conventional site-built homes, MH are factory-built, then shipped via trucks, installed at the home site, and connected to utilities.

Investment Thesis

The biggest component to my long-running bullish thesis on Skyline is that it addresses the housing affordability crisis. Skyline sold its U.S. factory-built homes to retailers (~60% of industry sales) and community operators (~40% of industry sales) for an average of $63,400 in its fiscal 2021 that ended in March. Retailers charge end consumers an average of $106,800, a substantial discount to the $407,700 for a median new single-family home and $353,900 for a median existing home. On a per square footage basis, MH cost over 50% less than site-built homes (discount is less when including land). The cost differential largely results from increased efficiencies from producing homes in a controlled indoor environment with standardized assembly operations.

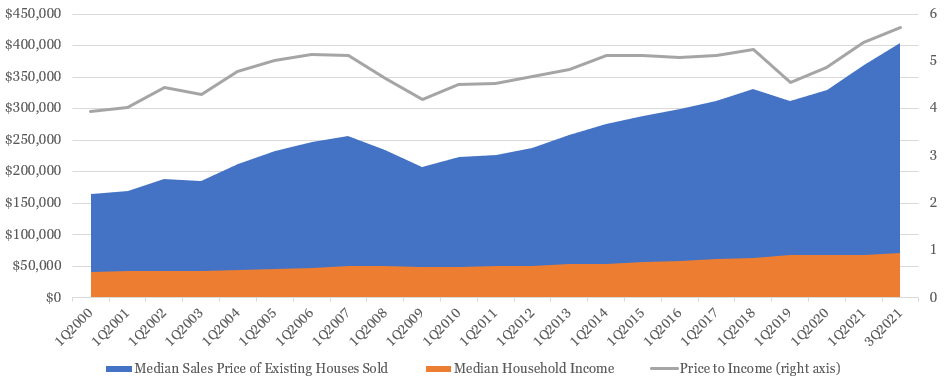

The MH industry’s value proposition is only getting stronger. Median existing home prices have skyrocketed since the start of the Covid-19 pandemic after already having expanded significantly since 2012. Home prices have increased much faster than median household incomes, as shown in Figure 1. Explanatory factors for high home prices include historically low mortgage rates, the large millennial generation aging to their family creation years (therefore needing more space, good schools, etc.), anti-development provisions that keep housing supply in check, and shortages (and resulting inflation) of land, labor, and materials. Other than historically low mortgage rates, these factors appear likely to sustain for the foreseeable future.

Figure 1: Home Prices are Becoming Increasingly Unaffordable

Source: FRED citing the U.S. Census Bureau (median sales price data link; median household income link)

Another big industry tailwind is improved consumer financing. Financial institutions exited the MH loan market from 1999 through 2002 as consumer default rates soared and prices of the relatively poorly-constructed homes of the 1990s soured. MH buyers either had to pay cash or rely on financing from the several remaining lenders that charged rates around five-percentage points higher than conventional loans. Due in part to Fannie Mae’s and Freddie Mac’s recent initiatives to foster expanded financing options for MH buyers, many MH lenders have entered the fray. The increased capital has greatly compressed mortgage rate spreads over conventional loans and lengthened the allowed loan period, drastically reducing consumers’ monthly payments.

There are a few company-specific reasons to like Skyline too. It has correctly been more bullish on MH demand than its publicly traded peers, adding manufacturing capacity at a steadier clip through organic growth and acquisitions. Further, the company has adeptly navigated industry supply chain constraints, sought to automate more of its manufacturing operations (potential to reduce labor costs), and reduced costs by standardizing its product line. Finally, unlike its largest peers, Skyline does not have an in-house lending arm and therefore has realized the full benefit from expanded and cheaper financing options for its customers.

To be sure, the MH industry has had some obstacles to overcome. Perhaps most notably is a certain stigma around buying a manufactured home due to its perceived quality. However, the industry has made strides with higher-quality materials and craftsmanship over the last 10-20 years. Having seen the finished product at manufactured home retailers, there is little discernable quality deficit versus a site-built starter home. Obtaining the necessary permits to build MH communities close to major job centers remains a constraint on industry growth, but municipalities may begin to embrace MH as a solution to deepening housing affordability concerns.

Economic Moat

Although Skyline has many positive attributes, it is among the few client holdings that I do not consider to be in possession of an economic moat, or sustainable competitive advantage. The MH industry has limited points of differentiation to the consumer and it does not take a lot of time, nor capital, to get a new manufactured home plant permitted and built. However, accessing labor is a key constraint in this very tight labor market. There is also a certain amount of manufacturing best practices that can take years to perfect. So, although strong economic returns are unlikely to sustain over the very long run (10+ years from now), I expect a multi-year period in which Skyline can achieve outsized profits.

Further supporting Skyline is an increasingly rational industry pricing environment, due in part to industry consolidation over the past five-plus years. According to data from a 2019 Skyline investor deck, Clayton Homes, owned by conglomerate Berkshire Hathaway Inc. (ticker BRK.B), Skyline, and Cavco Industries, Inc. (ticker CVCO; also owned across client accounts) together made up 77% of the U.S. MH industry by units. Deals consummated since then, most notably Cavco’s purchase of the 4th largest builder, Commodore, in September 2021, increases the Big 3’s market share to around 80%. Worth mentioning is the third pure-play publicly traded MH company, Legacy Housing Corp. (ticker LEGH; owned in some client accounts), which has a 2% industry market share in MH.

Growth, Profitability & Valuation

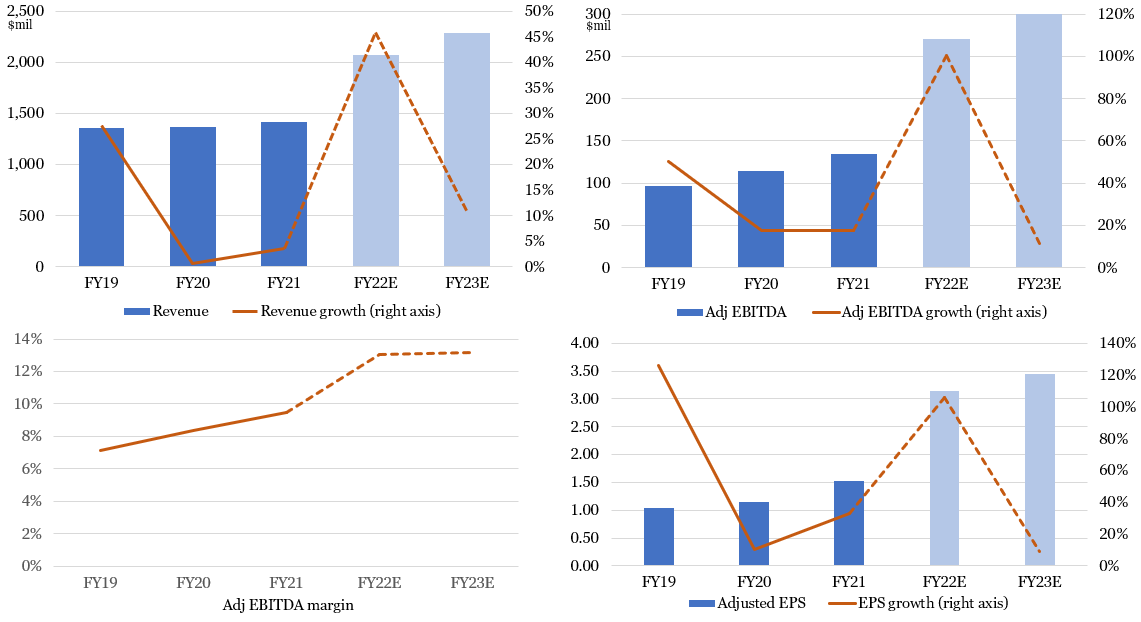

Skyline Champion is seeing a breakout fiscal year across all financial metrics. Demand has exploded over the past seven quarters, with its backlog of orders not yet fulfilled expanding from $127 million to $1.4 billion over that timeframe. As of the September quarter end, its backlog stretched out to 40 weeks versus 4-6 weeks in more normal times. Although Skyline’s elongated backlog has undoubtedly led to lost sales and frustrated customers, the same is generally true industrywide.

The supply/demand imbalance and strong value proposition over site-built homes has given Skyline tremendous pricing power. Indeed, in its most recently reported quarterly results, Skyline’s average U.S. sales prices shot up 32% from year ago levels, easily exceeding labor and material cost inflation. This drove 280 basis points (2.8%) of gross margin expansion from the previous quarter and 520 basis points (5.2%) of expansion from the year ago quarter. Its margin performance has wildly outperformed my and consensus analyst expectations. I believe margins have room for further improvement, especially if material costs begin to normalize.

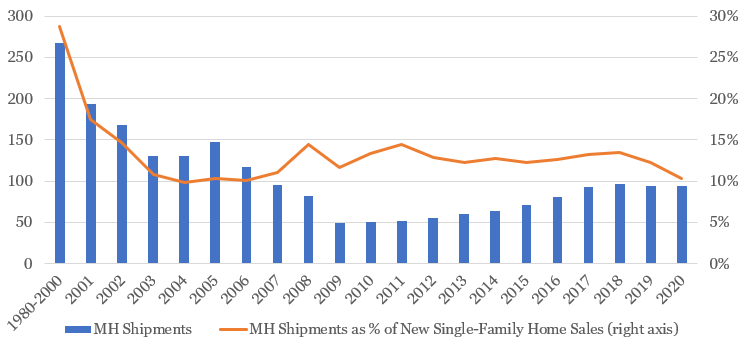

Meanwhile, volume growth is well-supported over the next 3-5 years as Skyline should take market share within the MH industry and the MH industry should take market share from site-built homes. MH shipments have hovered between 10% and 14% of new single-family home sales since 2003, but MH shipments look set to break out of the range. Available 2021 data through October show that HUD-code MH shipments increased by 13% from year ago levels while new single-family home sales declined by 4%. The robust backlog figures reported by Skyline and Cavco indicate that their unit growth will grow well above traditional homebuilders in calendar 2022. All the positive industry drivers discussed earlier could drive MH shipments to 20% of new single-family sales by the end of this decade.

Figure 2: MH’s Share of New Home Sales Has Been Stagnant, but Set to Take Off

Sources: U.S. Census Bureau (MH shipment data), Cavco presentation citing the Manufactured Housing Institute and U.S. Census Bureau (MH shipment as % data)

The company’s supercharged near-term growth prospects and robust medium-term growth drivers have been rewarded with a 142% share price performance in 2021, but valuation multiples have not gotten out of hand. The stock trades for 23.7x next 12 months consensus earnings, according to Koyfin, about in line with the 23x it traded at two years ago and 22.2x for the S&P 500. I expect the stock to appreciate roughly in line with a 20%+ earnings growth rate over the next few years.

Figure 3: Skyline Is Seeing Tremendous Growth This Fiscal Year

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

What is most likely to derail my bullish thesis is any economic recession which would likely curtain housing demand. A rapid increase in the 10-year U.S. treasury yield, which is most correlated with mortgage rates, could also hurt demand for manufactured homes as affordability would get hit.

Disclaimers

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in the State of Illinois. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.