January 2024 Investment Letter

January 2, 2024

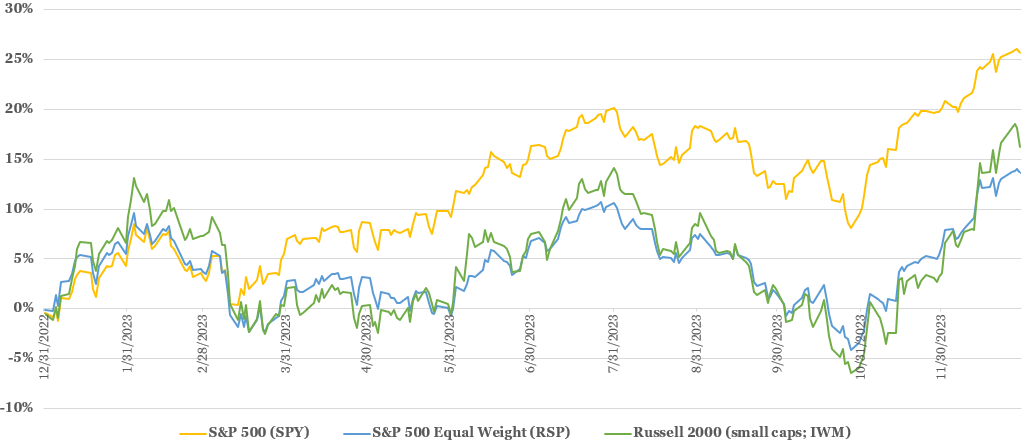

A big fourth quarter rally capped off a very strong year for the stock market. The S&P 500, a market cap-weighted index of the 500 largest publicly traded companies in the U.S., rocketed 11.8% higher in the fourth quarter, bringing the full year total return to 25.6%.

For most of the year, there was a dramatic divergence between the so-called “Magnificent 7” – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META), and Tesla (TSLA) – and the rest of the market. Through October 31, these seven mega capitalization stocks were up an average of 69%, while the average stock in the S&P 500 (as reflected by the Invesco S&P 500 Equal Weighted ETF) actually declined 3%, and small caps fairly even worse.

Beginning in late October, the rally broadened out, led by small caps. The Russell 2000 index of small cap stocks, which overall are more interest-rate sensitive and exhibit greater economic sensitivity than large cap stocks, surged 24% off its October lows. By the end of the year, the Russell 2000 halved its performance deficit to the S&P 500 to 9 percentage points.

Figure 1: Stock Markets Surged in November and December

Source: Yahoo Finance (inclusive of dividends)

Spurring stocks of all sizes higher were increasing signs that the Federal Reserves can pull off a difficult soft landing. Throughout 2022 and much of 2023, the prevailing wisdom was that the aggressive interest rate hikes the Fed had to take to quell persistently high inflation would surely cause the economy to enter a recession sometime in 2023. This caused many market participants to take a more defensive posture and aggressively shift their positioning to higher-yielding bonds and money market funds and away from stocks.

Instead, encouraging economic growth and inflation data in the fourth quarter encouraged the Fed to pivot to a more dovish, or market-friendly, stance on interest rates. Third quarter real (inflation-adjusted) GDP came in at a robust 4.9% (versus 2.1% in the second quarter), the November unemployment rate came in at a better than expected and historically low 3.7%, and PCE inflation slowed to 3.0% in October (down from a peak of 7.0% in June 2022), and 3.5% when excluding volatile food and energy. Forward looking data suggests that core inflation will slow to below 3% in the months ahead.

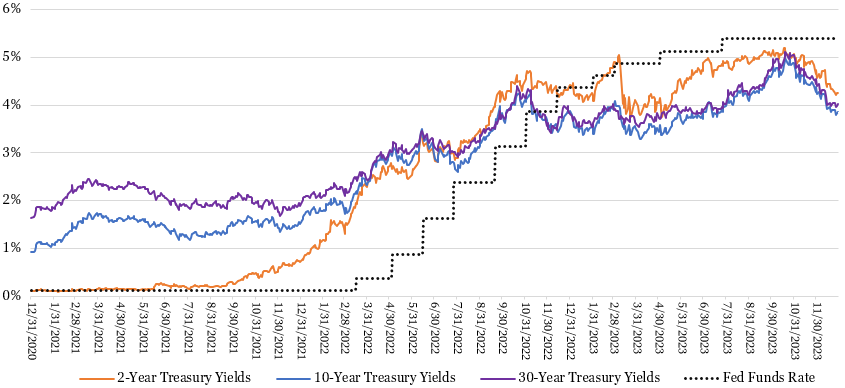

Indeed, the Fed in its December 13 Summary of Economic Projections forecasts core PCE inflation to slow to 2.3%-3.0% in 2024 (vs 2.3%-3.6% projected three months prior), not far from its longstanding 2.0% target. As a result, members of the FOMC now project a median of three 25 basis point cuts to its federal funds rate in 2024, four cuts in 2025, and three cuts in 2026 (to 2.75-3.00% from 5.25-5.50% currently). The bond market anticipates an even faster pace of interest rate cuts.

Figure 2: Treasury Yields Round Tripped Back to Year Ago Levels

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System (Treasury yields). https://fred.stlouisfed.org/series/DGS2. https://fred.stlouisfed.org/series/DGS10. https://fred.stlouisfed.org/series/DGS30.Forbes Advisor (Fed Funds rate) https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Treasury yields made a rather dramatic reversal to the year-to-date gains they had through October. Declining yields, as long as they are not due to growing economic concerns (not the case presently), can be highly supportive to stock prices for three primary reasons: (1) bonds provide less competition for stocks when they yield less; (2) stocks are worth more today when their future estimated earnings and cash flows are discounted back to the present at lower interest rates; and (3) companies can sustain higher debt levels and incur less interest expense when interest rates are lower.

Market Outlook

Fourth quarter and full year stock performance is further evidence that it is largely a fool’s errand to try to predict and act on which direction the market will go. For much of the year, if you watched financial newscasts, listened to financial podcasts, or read financial journalism, there was a good chance you were peppered with alarming headlines and warnings of a faltering economy and stock market.

Over the last 20 years I have learned to tune out the noise, stay fully invested (if your cash needs and risk tolerance levels allow), and stick to individual company fundamentals. This approach allows my clients to benefit from the strong market rallies even when I am not particularly encouraged by the market’s prospects, as was the case entering the fourth quarter.

With the new year upon us, frankly it does not matter what I think could be in store. For what little it is worth, I do think the Federal Reserve can stick the soft landing, with a healthy economy (albeit not as strong as last year) and core inflation approaching 2% by year end. If that is indeed the case, then it is plausible the market could rally another 10% to 20% or more in 2024. That sounds less farfetched when you consider major market indexes merely recovered what they lost in 2022.

At the same time, it is wise to expect the unexpected, and a host of things could pressure the market. Out of consensus possibilities include a tapped-out consumer (possibly driven by depletion of excess savings from pandemic-era stimulus), resurgent inflation (possibly due to continued tight labor conditions or higher oil prices), and a worsening geopolitical environment (possibly caused by a Chinese invasion of Taiwan). These scenarios, and countless others, are nearly impossible to predict with any degree of accuracy.

It will certainly be an interesting political year as well, with two polarizing candidates likely engaging in a presidential election rematch. At this point I do not foresee major stock market implications, partly because the Trump tax cuts of 2017 made the corporate federal income tax reductions permanent (potential extension of personal tax cuts beyond 2025 arguably has a lesser impact on stocks).

Client Positioning

I take a long-term view that focuses on compounding returns in a tax-efficient manner. I allocate the bulk of my clients’ equity exposure to “quality growth” companies that possess durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. I generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate my investment thesis and retaining stocks of companies with solid fundamentals. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

My investment philosophy was in favor this year as the market rewarded companies with strong earnings growth and low debt levels. Indeed, my clients’ stock holdings outperformed the major market indexes by healthy margins. Clients who invested with me throughout 2023 saw the individual stocks portion of their asset allocations increase by a range of 28% to 38%, with a median of 32%.

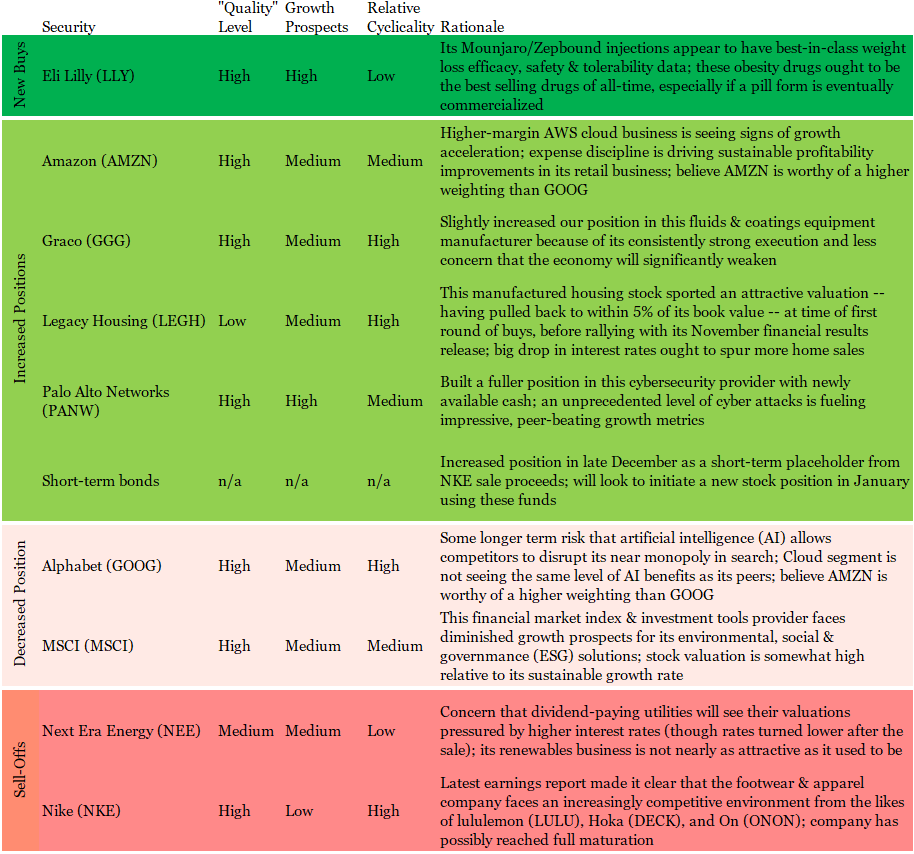

The fourth quarter was a busy period of portfolio optimization. There was no specific theme to the trades. Rather, there were largely idiosyncratic, or company-specific, reasons for the buys and sells, as specified in Figure 3. Two stocks were sold off (NEE and NKE) and one was purchased for the first time (LLY).

Figure 3: Portfolio Changes in Majority of Client Accounts in 4Q 2023

Sources: Glass Lake Wealth Management

I am waiting to see how January unfolds before initiating a new position with the proceeds from the Nike sale. Often the biggest winners of the prior year underperform to start the new year, and vice versa. This is playing out in the first trading day of 2024. Most of the stocks I am considering had a strong 2023, so I am being a little patient.

Looking beyond the next month, I am likely to maintain an asset allocation near current levels. Previously I had been looking to incrementally increase clients’ fixed income allocations given the opportunity to generate 5%+ returns with little credit risk, but the recent big drop in bond yields makes bonds less appetizing. There is a role for fixed income in most investors’ portfolios, but I intend to continue to hold the overwhelming majority of client assets in stocks when their investment horizon is at least 10 years.

You can expect me to continue to abstain from stocks in long-term challenging industries such as banking, traditional energy, airline, and autos. I will also continue to avoid the most speculative areas of the market such as the unprofitable, companies going public through SPACs, and pump-and-dump meme stocks. As always, I will keep an open mind and be on the hunt for the next great long-term investment.

I hope you and your loved ones enjoyed a wonderful holiday season. May you have a happy, healthy, and wealthy 2024.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.