October 2022 Investment Letter

October 3, 2022

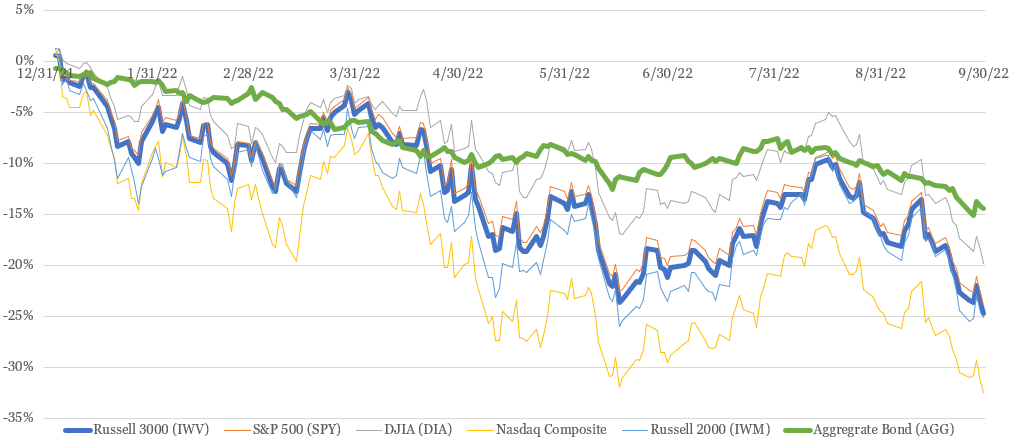

The bear market selloff continued in the third quarter, with an interim rally through August 16 ultimately faltering. In the third quarter the iShares Russell 3000 ETF (ticker IWV), a broad measure of market performance, declined 4.4%. That pushed the year-to-date decline to 24.7%.

Other oft-cited stock market benchmarks had similarly tough starts to the year. The S&P 500 (largest 500 stocks by market capitalization), Dow Jones Industrial Average (price-weighted index of 30 stocks), Nasdaq Composite (mostly comprised of technology and growth stocks), and Russell 2000 (small capitalization stocks) fell 23.9%, 19.8%, 32.4%, and 25.1%, respectively, over the past nine months. Even bonds, which typically serve as ballasts in investors’ portfolios, have performed poorly. In fact, the iShares U.S. Aggregate Bond ETF (ticker AGG), which owns taxable, investment-grade U.S.-dollar-denominated bonds with at least one year until maturity, slumped 14.4% year-to-date.

Figure 1: Stock and Bond Markets Have Endured a Challenging Year

Source: Yahoo Finance (inclusive of dividends)

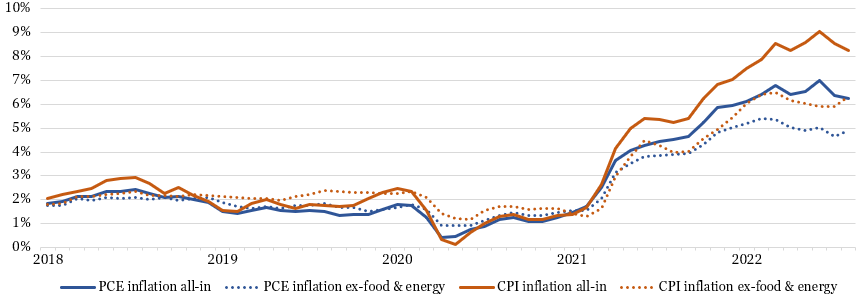

By far the strongest market headwind has been the Federal Reserve. After being late in removing its easy money policies as inflation began to ramp last year, the Fed is now in aggressive catch-up mode with inflation lingering at uncomfortable levels. Indeed, the two primary measures of inflation, the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE), show prices rising well above the Fed’s goal of 2%. August inflation data that was reported in September was particularly worrisome because it showed core inflation -- inflation after stripping out more volatile food and energy costs -- reaccelerating on a year-over-year basis.

Figure 2: Inflation Readings Remain Well Above the Fed’s 2% Target

Sources: U.S. Bureau of Labor Statistics (PCE) https://fred.stlouisfed.org/series/PCEPI, Fred St. Louis Fed citing U.S. Bureau of Economic Analysis (CPI) https://data.bls.gov/cgi-bin/surveymost

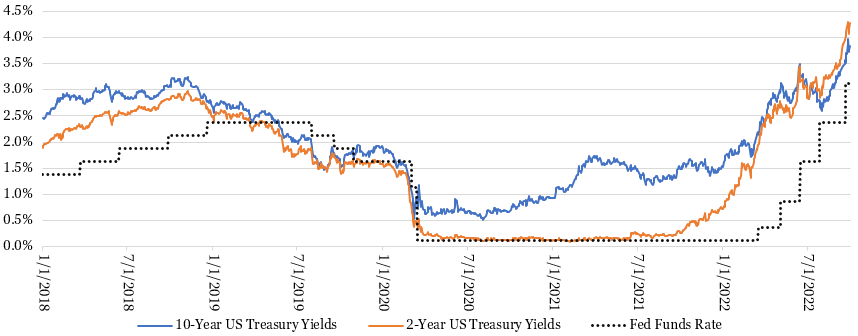

Persistently high inflation has forced the Fed to be much more aggressive in raising the federal funds rate than previously expected. It has increased the federal funds rate five times this year by a cumulative 3% to a range of 3.00-3.25%. In updated projections, the Fed has signaled plans to lift rates by another 1.25 percentage points by the end of 2022, bringing the federal funds rate to 4.25-4.50%. This compares to year-end Fed projections of 3.25-3.50% three months ago and 0.75-1.00% last December. The tough Fed talk caused the influential 2-year and 10-year U.S. treasury yields to blow out throughout this year.

Figure 3: Fed’s Tough Talk Pushed Up Treasury Yields Aggressively

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System (treasury yields). https://fred.stlouisfed.org/series/DGS2. https://fred.stlouisfed.org/series/DGS10. Forbes Advisor (fed funds rate) https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Higher interest rates negatively impact stocks in a number of ways. First, individual companies’ future earnings and cash flows are worth less today when discounted back to the present at higher interest rates. Second, when one- to two-year treasuries yield upwards of 4%, they can effectively compete against the stock market for investors’ capital. Third, the higher interest rates go, the more pressure it puts on economic growth, and ultimately companies’ earnings prospects. All these interest rate factors, as well as an interrelated appreciation in the dollar, acted as gravitational pulls to stock market performance during the quarter and year-to-date.

Market Outlook

We believe the Fed will continue to drive stock market performance for the foreseeable future. As long as they maintain a hawkish stance on monetary policy and U.S. treasury yields push higher, then stocks will have trouble finding a bottom. Better inflation data would go a long way to turning things around.

We are optimistic inflation figures will begin to meaningfully ease in the months ahead because of leading indicators that point to lower inflation. For instance, shipping costs, such as ocean freight and trucking, along with commodity prices, like crude oil, steel, copper, and lumber, have all receded in recent months. Further, we are starting to see products shift from acute shortages to major oversupply situations, such as in semiconductors, apparel, and used cars. Other product categories are likely to soon follow, pushing down prices.

High inflation in rent and labor has been stubborn, but we have already seen a definitive downturn in housing and employment markets are known for operating at a considerable lag to economic activity. We expect more companies to pause hiring before ultimately downsizing to reflect weakened consumer demand and to protect profit margins. Although painful to those impacted, a normalization in the unemployment rate is what is needed to ultimately bring inflation back to the Fed’s 2% target.

We do have concern that the Fed’s executed and planned federal funds rate increases are going too far, too fast and will sink the U.S. economy. We continue to believe there is approximately 80% odds of a recession by the first half of 2023 (if we are not already in one), with a 35% probability of a mild recession, 35% chance of a moderate recession, and 10% risk of a severe recession. This compares to a Bloomberg survey of economists in September that saw a 50% probability of recession in the next 12 months. Our recession odds are supported by reviewing prior Fed tightening cycles, with 9 of the last 12 ending in recession since the 1950s.

If there is just a mild recession or no recession at all, and inflation cools as we expect, then we think the stock market is very close to a bottom. If there is a moderate recession, then we could see scope for another 10-15% decline, bringing the total market decline to around one third. In the unlikely event we experience a severe recession, ala 2008, then we could see another 25%-30% plunge. We find this scenario the least plausible because consumer and corporate balance sheets are healthy, and the financial system is functioning well.

The economy and the markets are inherently uncertain, especially now, but we are confident that a new bull market will emerge in due time. For now, it’s best to stay the course and remain invested for the eventual market thrust off its lows, which always seems to happen when investors least expect it.

Client Positioning

We take a long-term view that focuses on compounding returns in a tax-efficient manner. We allocate the bulk of our clients’ equity exposure into “quality growth” companies that have durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. We generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate our investment thesis and retaining stocks that execute well. We believe this investment philosophy affords our clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

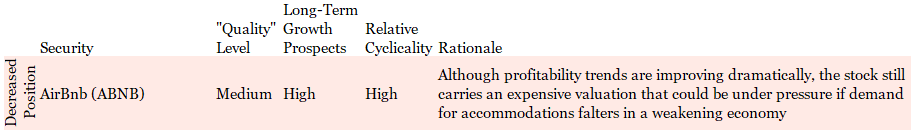

As a reminder, we made a greater-than-usual number of changes to client portfolios in the second quarter to reflect our more pessimistic view of the economic outlook and the higher interest rate environment. Indeed, we reduced exposure to aggressive growth and highly economically sensitive companies and selectively purchased short-term treasuries in the April to June period. Given our consistent economic outlook and lack of major surprises in individual holdings in the third quarter, we made minimal changes to client portfolios over the last three months.

Figure 4: Portfolio Changes in Majority of Client Accounts in 3Q 2022

Source: Glass Lake Wealth Management

Because of our quality growth investment philosophy, clients should expect their equity allocation of their overall portfolio to do best versus the market when inflation is low or decelerating and 10-year treasury yields are low or declining. If we are right in that (1) inflation starts to make concrete downward progress in the months ahead, and (2) economic data deteriorates further, then 10-year treasury yields ought to retreat, allowing growth stocks to outperform value stocks.

You are unlikely to see us chase stocks in the best performing year-to-date sector -- oil & gas. Although oil and natural gas prices have been boosted this year by the Russia/Ukraine situation, the oil & gas sector is notorious for boom-and-bust cycles. We seek to avoid the painful part of the cycle, which could be sooner than expected if the global economy dramatically weakens or if the world finds effective solutions to circumvent Russian energy.

You can also expect us to abstain from the most speculative areas of the market, such as unprofitable growth companies, SPACs, cryptocurrency plays, and meme stocks. As always, we will keep an open mind and be on the hunt for the next great long-term investment.

We would look to shift a portion of clients’ asset allocations to bonds and away from stocks if the stock market can meaningfully bounce as long as interest rates remain around current levels. For the first time in a long time investors can earn attractive yields without taking a lot of credit or duration risk (duration risk is the sensitivity of bond prices to changes in interest rates… bond prices move inversely to interest rates).

We hope you and your loved ones stay happy, healthy, and wealthy this fall.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.