Exploit This Loophole to Invest >$10k in Inflation-Linked I Bonds

By Jim Krapfel, CFA, CFP

October 20, 2022

Inflation continues to rage, as evidenced by the latest Consumer Price Index (CPI) report that showed a hotter-than-expected 8.2% inflation rate in September. As remarked in our recent investment letter, high inflation is causing the Federal Reserve to aggressively raise interest rates, which has stocks and bonds on pace for one of their worst years on record. There have not been many places to safely invest, let alone keep up with inflation, except for U.S. Treasury’s I bond.

This formerly obscure bond has risen to prominence this year and represents the best way for investors to directly benefit from high inflation with no credit risk. If you purchase these bonds by October 28, you can lock in a 9.62% return for six months and 6.47% for the following six months, a much higher return than other safe alternatives such as savings accounts or certificates of deposit. The U.S. Treasury limits $10,000 of electronic purchases per person, per year, but we recently discovered a legal loophole that allows for purchases multiple times greater than that.

Before we get into how to exploit the loophole to invest more than $10,000 in these high-yielding securities, we first provide an overview of I bonds through Q&A.

I Bond Overview Q&A

What are I bonds?

I bonds, short for Series I Savings Bonds, are a type of savings bond created by the U.S. Treasury. They were created in 1998 as a financial tool that people can utilize to protect their savings from the negative impacts of high inflation. With an I bond, you earn both a fixed rate of interest and a variable rate. The fixed rate component has been 0% since November 2019. The variable rate component adjusts every six months based on inflation.

What is the interest rate now?

People who buy I bonds by October 28 will earn an annualized interest rate of 9.62% for a full six months, then should receive a 6.47% yield for the next six months (formal announcement is due November 1), for an average yield of 8.05% for the first 12 months. After 12 months, the interest rate depends on inflation, as explained in the next question.

People who buy I bonds after October 28 will miss out on the 9.62% interest rate and instead earn 6.47% for the first six months, and the interest rate thereafter will depend on inflation.

Figure 1: Yields Earned on I Bonds Will Depend on Your Purchase Date

Sources: TreasuryDirect, Glass Lake Wealth Management

How is the interest rate calculated?

The interest rate is based on data from CPI for All Urban Consumers (CPI-U) for the preceding six months. This accounts for all components of inflation, such as food and energy costs. Every May and November it calculates inflation for the prior six months of data.

Here is why we believe 6.47% will be the new yield on I bonds -- the U.S. Treasury will use September’s CPI figure of 296.808, divide that by March’s figure of 287.504, subtract by 1 to arrive at a percentage change, and multiple that by 2 to get to an annualized figure. ((296.808/287.504) – 1) * 2 = 6.47%

Also worth noting is that the interest is compounding, meaning the interest earned is added to the original principal to earn interest off. This treatment is more favorable than typical bonds that pay interest off a fixed par value.

How long does an I bond earn interest?

You can hold an I bond for up to 30 years but cannot cash in (redeem) before 12 months for any reason. If you cash in the bond in less than 5 years, you lose the last 3 months of interest. For example, if you cash in the bond after 15 months, you get the first 12 months of interest.

Is there a maximum amount I can buy?

Yes, there are limits, and it depends how you are contributing. There are four possible buckets:

(1) Electronic I bonds – may contribute up to $10,000 per person per calendar year (minimum $25). On September 27, 2022, a couple senators introduced legislation called the “Savings Security Act of 2022” that would increase the annual electronic purchase cap to $25,000. It is unknown how likely the legislation will become law, but it almost certainly will not be in effect in time to secure the current 9.62% interest rate.

(2) Paper I bonds – may contribute up to an additional $5,000 using your IRS tax refund (minimum $50) to the extent you have a refund. If you owe taxes at the end of the year, then no paper I bonds can be purchased that year. The proposed legislation keeps the $5,000 cap for paper I bonds.

(3) Electronic I bonds for businesses – can contribute up to $10,000 per business per calendar year. If you have three businesses with three distinct Employer Identification Numbers, then you can contribute $30,000 per year across the businesses using the same procedure for personal electronic I bond purchases. The proposed legislation retains the $10,000 cap for businesses.

(4) Gifting – this is where the loophole comes into play. We will explain in depth on how this works later.

What is the taxability of I bonds?

Interest is taxable at the federal level, but not at the state and local level. You can choose whether to report each year’s interest income or wait to report the cumulative interest earned when you cash out the bond. Most people choose to wait to report income until the bonds are redeemed.

If you use the proceeds for qualified higher education expenses, then you will be able to exclude the interest income if all the following conditions are met: (1) you were at least 24 before your savings bonds were issued, (2) filing status is not married filing separately, and (3) your modified adjusted gross income is less than the cut-off amount set by the IRS, which was $98,200 for singles and $154,800 for married people in 2021.

How do I buy electronic I bonds?

You can only buy electronic I bonds through TreasuryDirect’s website. You cannot purchase them through a bank or brokerage account, nor can your financial advisor do this for you.

Go to TreasuryDirect’s website, click on “Create a New Account”, and follow the instructions. Once your account is created and you are logged in, click on “BuyDirect” at the top, select “Series I”, input purchase amount, and choose whether you would like to make a one-time purchase or schedule purchases. You will fund your account by supplying your bank’s account type, account number, and routing number during the registration process.

Security purchases are generally issued to your TreasuryDirect account within one business day of the purchase date. Security value inclusive of earned interest can be found on the Current Holdings tab at the top of the web page.

Supersizing Your I Bond Purchase Through Gifting

Gifting can take your I bond purchases to another level. You can gift I bonds to any person other than yourself. Businesses can neither gift to others nor receive gifts. Critically important, gifts are irrevocable, meaning they cannot be reassigned by the gifter.

Let us start with the mechanics of gifting an I bond. To make a gift, first select “Series I” and click on “Add New Registration”. Then either choose “Sole Owner” if you do not want to name yourself or someone else as the beneficiary (the person who receives the assets if the recipient dies) or choose “Beneficiary” if you would like to name a beneficiary. Next, input the recipient’s information under “First-Named Registrant” and the beneficiary information, if applicable, under “Second-Named Registrant”. Be sure to click on the “This is a gift” box. Once the new registration is complete, select the gift recipient and complete the purchase as usual.

Several days after gift purchase, the gift will show up in the gifter’s “gift box”, earning interest immediately. However, they are not in the recipient’s possession until the gifter “delivers” the gift to the recipient. At this stage the gift is in a sort of limbo – the gifter cannot cash it out because it is not theirs and the recipient cannot cash it out either because the bonds are not in their TreasuryDirect account yet. In fact, the recipient does not know you bought a gift for them until you deliver it to them. To make the delivery, the recipient must first open a TreasuryDirect account and supply the gifter with their account number. There is a minimum wait of five business days between buying and delivering a gift to make sure the gifter’s bank debit clears.

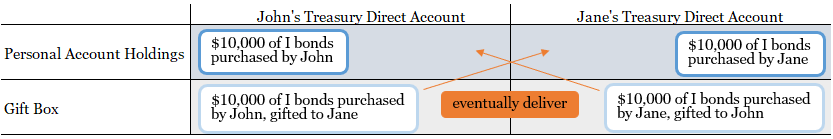

Figure 2: Overview of a TreasuryDirect Account Ledger

Source: Glass Lake Wealth Management

Here is where the loophole comes into play. First, the gift never counts against the gifter’s $10,000 annual electronic purchase limit and only counts against the recipient’s limit when it is delivered. Second, you can buy a seemingly unlimited number of $10,000 I bonds for the same person in the same calendar year, or spread out $10,000 worth of I bonds to many friends and family members. Key in executing gifting is having the gifter coordinate with the recipient so the combined delivery and personal purchase of I bonds does not exceed $10,000 in any calendar year. TreasuryDirect will automatically block gift delivery or personal purchases if this cap has already been reached.

A strategy for a married couple could be to each buy $10,000 of electronic I bonds for his and herself and each gift the other $10,000 of I bonds in the same year. That way they will have a total of $40,000 of purchases that can immediately earn the 9.62% interest rate for the first six months. Any time next calendar year each person can “deliver” the $10,000 gift to the other and not make any new personal purchases. If inflation remains high into the next year, thus providing an attractive ongoing I bond yield, then both may opt to delay delivering their gifts and instead purchase an additional $10,000 for themselves that year.

If you believe inflation will remain high for at least an additional year, then gifting two or more years’ worth of purchases could make sense. Again, interest would start accruing for the recipient immediately, and the gifter could space out the gift delivery such that only $10,000 is gifted each year.

Gifting I bonds, especially in large dollar amounts, has some notable caveats:

(1) Trust -- If employing a joint gifting strategy, you need to be comfortable that the other party will hold up their end of the bargain by buying and ultimately delivering the gift to you. If the relationship sours before the I bond is delivered, then things could get messy.

(2) Liquidity – Just like buying for yourself, the recipient cannot cash out their gift for at least 12 months. If you are gifting more than $10,000 to one person, then at least a portion of their money will be locked up for longer. For example, if you gift $30,000 to your husband in 2022 and he purchased $10,000 of I bonds for himself the same year, then $20,000 (+ interest) will not be accessible until 2023, $10,000 (+ interest) will not be accessible until 2024, and $10,000 (+ interest) will not be accessible until 2025. The 12-month holding period for cashing out a gift starts at purchase, not delivery.

(3) Low Inflation -- If inflation normalizes, yields in subsequent years that could look paltry relative to other investment alternatives. Using the same example, although your husband could cash out $20,000 of I bonds after 12 months if inflation (and the I bond’s yield) falls to 1% in subsequent periods (optimal strategy would likely be to hold for 15 months so he does not forgo 3 months of interest at 6.47%), the other $20,000 will be stuck earning 1% interest for the subsequent 1-2 years.

(4) Gift Tax – The annual gift tax exclusion is $16,000 per person. If gifting more than $16,000, then the donor must file a gift tax return under form 709. Note that gifts between married couples are exempt from the gift tax.

Buying for Children

Before we close, let us consider the merits of buying I bonds for minors. The main draw of buying for a minor is that it presents an additional means to get money into I bonds and the attractive yields they presently offer. However, there are a few drawbacks:

(1) Just like with gifting, buying for a minor is irrevocable, so you cannot legally sell I bonds from a minor’s account and spend it how you see fit.

(2) If you redeem the I bond before the minor reaches 18, then you will have to go through some hassle in filing a kiddie tax return. The upshot is that the first $1,150 of interest earned qualifies for the standard deduction and therefore, will not be taxable income. The next $1,150 of interest earned is at the child’s income tax rate, which starts at 10% if your child has no other income. Anything above $2,300 of income from the child is taxed at the parent’s marginal tax rate.

(3) I bonds have distinct disadvantages versus 529 plans: (a) 529 plans give flexibility to the contributor to switch beneficiaries, whereas I bonds remain the property of the minor originally specified; (b) 529 plan assets grow and can be withdrawn 100% tax-free if used for qualified education expenses, whereas I bonds tax benefits are limited to income thresholds, with no consideration to the use of proceeds (such as qualified higher education expenses); (c) over many years, 529 plan assets are likely to appreciate faster than I bonds because long-term stock markets have dwarfed inflation; and (d) only 5.64% of amounts in 529 plans count towards financial aid calculations versus 20% for I bonds.

The process of buying an I bond for a child are slightly different than buying for yourself or gifting to somebody else. Once you are logged into your TreasuryDirect account, first go to “ManageDirect” at the top, then “Establish a Minor Linked Account”, and fill out the child’s information. Once their account is set up, click on “ManageDirect” again, go to “Access my Linked Accounts”, select the child you would like to buy I bonds for, and proceed as usual by clicking on “BuyDirect”.

Once the child reaches 18, you can transfer the account to him or her. First, the young adult will need to open their own TreasuryDirect account and supply his or her account number to the original I bond purchaser. Then the original buyer can go to “ManageDirect”, “De-Link a Linked Account”, and enter the former minor’s account number.

Bottom Line

I bonds currently present a great opportunity to earn a high yield with no credit risk and offer protection should high inflation persist. Those with the means to set aside funds for at least one year should strongly consider buying I bonds by October 28 to lock in an 8.05% average yield over the next 12 months. Although the $10,000 per person annual contribution cap may deter some, the gifting loophole allows for purchases multiple times greater than that. Just be mindful of the liquidity and potential return limitations of supersizing your I bond purchases.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, insurance or accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.