Roth Conversions Can Really Pay Off, if Timed Well

By Jim Krapfel, CFA, CFP

August 1, 2022

In a blog we published last year, we explained how stashing as much money as possible into Roth accounts makes particular sense in one’s lower income years. That gives the account owner the ability to grow assets tax-free, withdraw tax-free upon retirement age, and avoid annual required minimum distributions starting at age 72.

In that blog we also showed how the Backdoor Roth IRA – that is contributing after-tax money to a traditional IRA, then converting it to a Roth IRA – is a no-brainer for anyone who (1) makes too much to qualify for Roth IRA contributions, AND (2) has no existing pre-tax IRA assets, AND (3) has the means to contribute more than the 401(k) contribution required to receive the full employer 401(k) match.

There is another financial maneuver that can yield even larger retirement benefits – the Roth conversion. A Roth conversion involves converting pre-tax IRA or 401(k) money in a former employer’s plan into a Roth IRA. Because taxes are paid upon conversion, a careful tax analysis is necessary before proceeding. In this blog we highlight when a Roth conversion makes sense, quantify potential economic benefits, and identify strategies for taking partial conversions.

When It Makes Sense to Complete a Roth Conversion

There is one overriding consideration used to evaluate the merits of Roth conversions, and that is your marginal tax rate. Roth conversions make sense when your current marginal tax rate is less than what your marginal tax rate is likely to be when funds are withdrawn in your retirement years. Keep in mind that even if you expect to stop working prior to tapping your retirement account, your income (and marginal tax rate) could still be elevated. Retirement income includes asset sales required to fund your lifestyle, dividends, interest, rental income, Social Security, and required minimum distributions from a traditional 401(k) or IRA accounts.

Below are the three primary situations that would result a tax-efficient Roth conversion.

1) Current taxable income is relatively low

This is the most common and financially advantageous reason to execute a Roth conversion. Examples of life events that could be ripe for Roth conversions are going back to school to pursue a master’s degree, a spouse temporarily existing the workforce or working part time to raise a young child, starting a business, taking extended time off work to recharge or travel the world, or retiring or semi-retiring before collecting Social Security or drawing on retirement savings.

2) Federal income tax brackets are expected to be higher in retirement

Current marginal income tax rates are low relative to most of history. Top marginal tax rates in 2022 are 37% for single filers with taxable income over $539,900 and married filing jointly filers with taxable income over $647,850. The top marginal tax rate was 63% prior to Ronald Reagan becoming president in 1981 and was as high as 94% after the conclusion of World War II in 1945. While future tax rates are unlikely to approach those levels, many view our nation’s tax base as insufficient to fund growing obligations like Social Security and Medicare and therefore believe tax rates will need to rise over time, especially for higher earners.

3) Assets in the account to be converted have meaningfully declined

Taking a Roth conversion after a meaningful market decline can be tax-smart because you will be taking the initial tax hit on a lower investment balance and allowing the money to potentially bounce back at above-typical rates of return with no tax consequences. Leaving the money to grow in a pre-tax account could result in a ballooning balance with upsized associated required minimum distributions that could bump you into a higher marginal tax bracket.

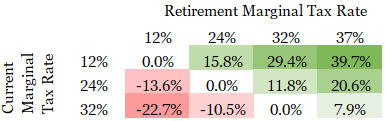

When used properly, Roth conversions can greatly enhance your after-tax retirement dollars. Figure 1 displays how a Roth conversion helps or hinders one’s retirement account under different marginal tax rate scenarios. We compare how a Roth-converted account fares versus a non-Roth retirement account after the account is fully distributed – that is, funds are withdrawn from the account so it can be spent. Perhaps this comes as a surprise, but to the extent higher returns (and eventual required minimum distributions) do not bump you into a higher tax bracket, it does not matter the rate of return earned nor the time invested to determine the percentage differential between the two outcomes. Again, the Roth conversion outcome fully depends on optimizing marginal tax rates.

Figure 1: Extra Return Earned (or Lost) When Executing a Roth Conversion

Source: Glass Lake Wealth Management

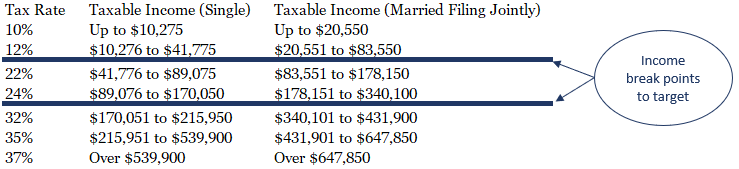

Best Strategy to Execute the Roth Conversion

Executing the Roth conversion is not an all-or-nothing proposition. The optimal strategy is to convert up to the point at which the next converted dollar (inclusive of all other taxable income) is taxed at a rate no greater than your estimated marginal tax rate at retirement. A couple break points stand out in today’s tax code – the demarcations between the 12% and 22% tax rates and the 24% and 32% tax rates. It is usually ill-advised to execute Roth conversions if have breached the 32% tax bracket because of the reduced likelihood of having a marginal tax rate that high at retirement.

Figure 2: 2022 Tax Brackets

Let us look at a couple of examples to illustrate effective Roth conversions.

Example 1: Aria has $15,000 in her IRA and experiences a temporary drop in her income from $100,000 to $30,000. It would be wise to fill up the 12% tax bracket with taxable income via a partial Roth conversion. In this case, she would convert $11,775 of her IRA to a Roth IRA ($41,755 - $30,000). If she expects another year of lower income, perhaps because she went back to school, then she can save the remainder of her IRA -- $3,225 ($15,000 - $11,775) – to convert next year. If she expects her income to recover next year, she might still consider doing a full conversion if she expects her marginal tax rate to exceed 22% in retirement.

Example 2: Niko and Katherine are married, Niko has $150,000 in his Traditional IRA (Katherine has everything in a Roth IRA), and the couple experiences a drop in their combined income from $400,000 to $300,000. They expect their income to bounce back to around $400,000 the following year. Here it probably makes sense to fill up the 24% tax bracket with $40,100 of income ($340,100 - $300,000) via a partial Roth conversion. If they have good reason to believe their marginal tax rate will exceed 32% in retirement, then they could convert more of Niko’s IRA (though only up to $431,900 of combined income, saving the balance for the following year).

Other Considerations

There are a few elements beyond tax rate arbitrage that can make Roth conversions attractive. First, ridding assets in pre-tax IRAs make execution of Backdoor Roth IRAs a bit easier since pro rata rules need not apply (see our Backdoor Roth IRA article for an explanation on this).

Second, Roth conversions today reduce taxable income from 401(k) and IRA distributions during your retirement years, which helps keep premiums down for Medicare Part B and Medicare prescription drug coverage.

Finally, beneficiaries of an inherited Roth IRA account need not pay income tax on distributions, whereas beneficiaries of an inherited traditional IRA must pay tax. If your beneficiaries are likely to have a higher marginal tax rate (i.e., working-age high earner), then Roths work better. However, if your beneficiary is likely to have a lower marginal tax rate, then traditional retirement accounts do better.

Bottom Line

Roth conversions can really juice your after-tax retirement savings if you experience a temporary decline in income, you expect tax rates to be higher in your retirement years, or your non-Roth retirement account suffers a meaningful decline. They can also hurt you if not timed well. Depending on how your current income compares to major tax break points, it might make sense to do a full conversion in one year or spread it out across multiple years to maximize tax efficiency.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in the State of Illinois. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, insurance or accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.