CoStar to Shine Brightly Through the Economic Cycle

By Jim Krapfel, CFA, CFP

December 2, 2022

Background

I was introduced to CoStar Group (ticker CSGP) at an investor conference while working at my predecessor firm. After a deep-dive analysis of the company I initiated a position in my personal account in September 2019 at a split-adjusted price of $58.61.

Since our launch of Glass Lake in April 2020, we have consistently purchased the stock for client accounts. It was the sixth largest aggregate stock position as of November 30, 2022.

Company Description

CoStar is a provider of online real estate marketplaces, information, and analytics. Its service offerings span all commercial property types, including office, retail, industrial, multifamily, commercial land, mixed-use and hospitality. With its recent acquisitions of Homesnap and Homes Group (owner of Homes.com), it is a recent entrant into the residential real estate market.

It operates the following business segments:

CoStar Suite: operates a platform for commercial real estate intelligence such as property information, properties for sale, comparable sales, tenancies, space available for lease, industry professionals and their business relationships, industry news and market and lease analytical capabilities.

Multifamily: operates apartment marketing websites that connect apartment owners, professional property management companies and landlords with prospective tenants. Apartments.com is its flagship brand but it also owns sites such as apartmentfinder.com and forrent.com.

LoopNet: operates a marketplace for commercial property owners, landlords, and real estate agents to advertise, post, and submit data for for-sale and for-lease properties. LoopNet uses industry data from the CoStar Suite to enhance its marketplace.

Information Services: provides lease administration, lease accounting, abstraction, portfolio analysis, debt analysis, management and reporting services. It also provides benchmarking and analytics to the hospitality industry.

Residential: comprised of Homes.com, which operates a residential real estate portal similar to Zillow’s; and Homesnap, which provides software that manages residential real estate agent workflow and marketing campaigns.

Other Marketplaces: comprised of Ten-X, which operates an online auction platform for commercial real estate; LandsofAmerica, LandAndFarm and LandWatch, which operate online marketplaces for rural land for-sale; and BizBuySell, BizQuest and FindaFranchise, which operate online marketplaces for businesses and franchises for-sale.

Figure 1: Sales by Business Segment in 3Q 2022

Sources: Company filings, Glass Lake Wealth Management

CoStar was founded by current CEO Andrew Florance in 1987, went public in 1998 at a split-adjusted price of $0.90/share, and is headquartered in Washington D.C. In 2021 97% of its sales were in the United States and 79% of sales were generated from subscriptions.

Investment Thesis

We own CoStar for a few reasons, namely its (1) durable long-term competitive advantages, (2) sustainable double-digit revenue growth profile, (3) countercyclical elements to its business model that allow the company to perform well through economic downturns, and (4) excellent track record of expanding into new real estate verticals under long-time CEO Florance. His latest foray into the residential market could be the next big winner.

Let us dive into each of these points.

As discussed in detail in the forthcoming economic moat section, Florance has built a franchise that is incredibly difficult to replicate. No other firm can match the depth and breadth of information clients need to analyze the commercial real estate market. The sticky relationships CoStar has engendered with customers is evidenced by renewal rates that hover between 91-92% on annual contracts and 97-98% for customers who have been subscribers for at least five years. Its unique value proposition allows it to command premium pricing, as reflected by its 22% GAAP operating margins and 21% free cash flow (cash flow from operations less capital expenditures) margin in 2021.

We are optimistic that CoStar can sustain double digit organic (not including revenue from acquisitions) revenue growth for the foreseeable future. As the company creates more value for its customers through product enhancements – over 100 product enhancements are planned over the next few years – it should continue to attract new customers and drive healthy price increases that have averaged 4-6% in more subdued inflationary environments. The lagged effects of its aggressive salesforce expansion ramp should help growth too. CoStar is on track for 12-13% organic revenue growth in 2022 and we expect at least that rate of growth in 2023.

We are particularly optimistic about growth reacceleration within its Multifamily segment. That segment’s target market is owners of apartment communities with at least 100 units. These owners are more likely to advertise with CoStar when apartment vacancy rates are high. As vacancy rates hit cycle lows early this year, segment revenue growth decelerated to 6% in 4Q 2021 through 2Q 2022 from over 20% growth in 1Q 2021. With a worsening economy – apartment absorption was at its lowest in 11 quarters in 3Q 2022, according to CoStar data – and apartment units under construction nearing all-time highs, vacancies should rise dramatically. Segment revenue growth has already improved to 11% in 3Q 2022 and management expects 16% growth in 4Q 2022, up from its prior expectation of 14% growth. Its Multifamily segment could even sustain 20%-plus growth if it can better penetrate the vast market of apartment owners who do not advertise on its platform yet. Its penetration rate of the 21.3 million apartment units in the United States is sub-1% today.

Accelerated growth in its Multifamily segment, as well as some countercyclical features at LoopNet, should offset the potential for slower growth in its CoStar Suite segment and more economically sensitive parts of its other businesses. That is what is great about CoStar – when some areas of its business go through growth deceleration, other areas typically pick up the slack. This gives us comfort that if the overall economy falters, or the commercial real estate market specifically, then CoStar’s business fundamentals ought to hold up.

Perhaps the biggest reason to own CoStar is the adept leadership of Florance. Among the 40 business acquisitions since 1996, two have really transformed the company. LoopNet was purchased for $860 million in 2012, and that business’ revenue increased from $35 million to $208 million in 2021. Even more impressive was the acquisition of Apartments.com for $585 million in 2014. The number of apartments listed and monthly visitors have greatly expanded to easily overtake competitor ApartmentGuide.com, allowing segment revenues to balloon to $679 million in 2021 from $161 million in 2015.

The next big opportunity Florance has identified is in residential real estate. In his effort to aggressively enter the vertical, he was outbid on trying to buy CoreLogic for $7 billion in 2021, but he and his team pieced together several small acquisitions, most notably Homesnap for $250 million in December 2020 and Homes.com for $156 million in May 2021. Through these and likely future acquisitions, CoStar plans to take on Zillow, Redfin, and Realtor.com via empowering listed selling agents versus its competitors’ quest to drive lead generation for buyers’ agents.

CoStar is still in the early innings of expansion into this new vertical. This year it has been focused on aggressively spending to improve website content around neighborhoods, school, and parks. Next year it aims to advertise its new and improved Homes.com website to the public to drive traffic higher. CoStar has yet to fully articulate its monetization plan but it will entail selling listed selling agents premium posts and added content, similar to the business model employed by European brands. Management has already put forth an ambitious goal of $1 billion of annual residential revenue in 5-7 years, not far off from the $1.9 billion analysts expect industry leader Zillow to generate next year. We have our doubts on achieving this level of success, but it has been wrong to bet against Florance.

Economic Moat

We believe CoStar possesses a wide economic moat, or sustainable competitive advantages, in its CoStar Suite and LoopNet segments. Its commercial real estate database is the most comprehensive and it has the largest research department (over 1,400) in the industry. Real estate brokers, agents, owners, developers, landlords, property managers, financial institutions, retails, vendors, appraisers, investments banks, and government agencies view CoStar as the one-stop shop for commercial real estate information. CoStar’s database has been built over the course of over 30 years through a labor-intensive process that would be very expensive and time-consuming to replicate.

We believe its Multifamily business has some sustainable competitive advantages as well, but not to the same degree. Apartments.com crushes its competition in large apartment complexes that have at least 100 units, which are about one third of the overall rental market in the United States. However, Apartments.com has yet to really tap the independent owner and small apartment building owners who may not have the ability or willingness to advertise their listings. Despite an incomplete apartment listing database, Apartment.com’s monthly unique visitors were 17% higher than Zillow’s rental network in 4Q 2021 and 2.5 times greater than RentPath’s (owner of rental websites such as rent.com and apartmentguide.com).

Growth, Profitability & Valuation

We expect CoStar to sustain organic revenue growth in the double-digits for the foreseeable future given room to grow within its addressable markets, substantial pricing power, optimization and build-out of recent smaller acquisitions, and hopefully hockey stick-like growth in residential starting by 2024.

Meanwhile, we expect margins to inflect positively in a big way once spending on residential plateaus and/or residential revenue ramps. We estimate that the acquisition of the unprofitable Homes.com business and ramp up of residential spending from next-to-nothing in 2020 to $100 million in 2021 to $225 million in 2022 has cost the company 7-8 percentage points of margins. In other words, its implied guidance of 30.6% adjusted EBITDA margins in 2022 could have been around 39% if not for its foray into residential.

If its investments in residential pay off, which we expect to some degree in the coming years, then shareholders will be rewarded. If the investments do not pay off, then at least we expect CoStar management to have the discipline to sell or dissolve the business. Either way we expect this period of lower margins to be relatively short-lived.

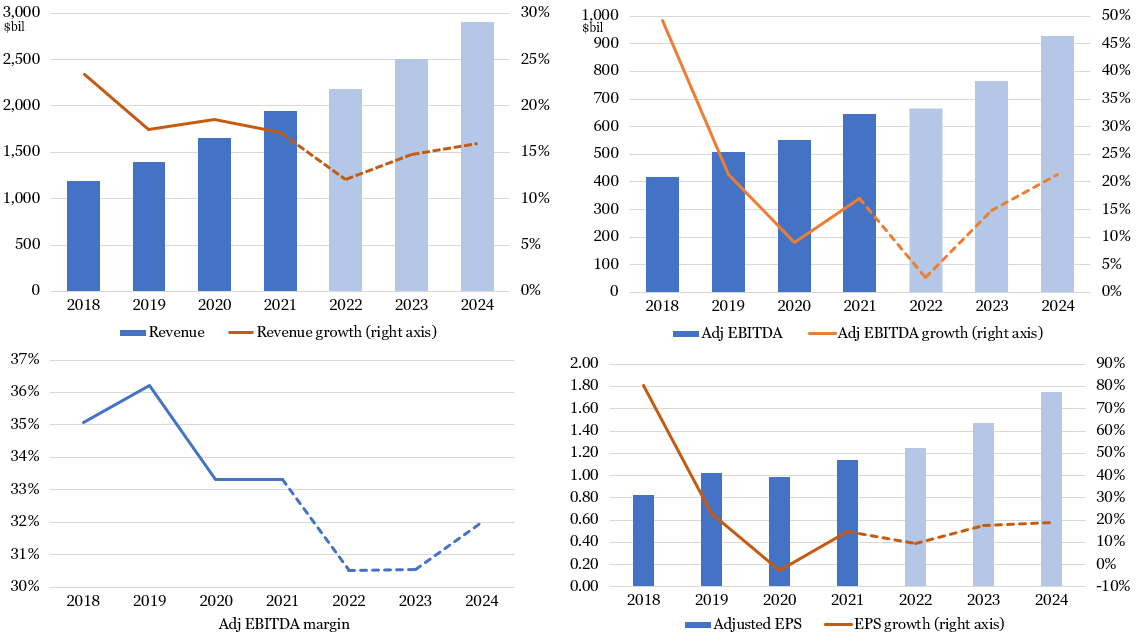

Figure 2: CoStar Should See Margins Inflect Positively by 2024

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

The aggressive investment mode CoStar is currently in makes near-term valuation metrics less helpful. Inclusive of residential, CoStar is priced at 57x next 12 months’ (NTM) consensus earnings, well ahead of the S&P 500 at 18x NTM. However, if we strip out estimated residential revenue and expenses, then the NTM multiple is closer to 45x. We believe this still-premium valuation is deserved because of its superior growth track record, long growth runway, strong economic moat, low degree of cyclicality, and strong net cash (more cash than debt) balance sheet.

We expect stock performance versus the overall stock market over the next 3-5 years to be most influenced by the degree of success within residential.

Key Risks

The biggest medium-term fundamental risk to CoStar is that it continues to ramp spending on residential without a commensurate improvement in monetization. This could cause company margins to continue to bleed lower instead of expectations of an improvement within a couple years. There is also risk that the company spends a lot of capital on acquisitions that do not pan out.

An additional risk to the stock’s valuation is a rapid increase in the 10-year U.S. treasury yield because CoStar is considered a growth stock and it carries a relatively high valuation multiple. Growth stocks are more sensitive to rising yields than value stocks because they have a greater proportion of expected cash flows further in the future, and those cash flows are worth less today when discounted at higher rates.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in North Carolina and Illinois. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.