January 2023 Investment Letter

January 5, 2023

The bear market went into a short hibernation for much of the fourth quarter, only to reappear with a December swoon. Quantitatively, the iShares Russell 3000 ETF (ticker IWV), a broad measure of market performance, rallied 13.7% from September 30 to December 1, then dropped 5.8% for the rest of December. Over the full quarter the Russell 3000 rebounded 7.0%.

The bounce helped to soften the blow in what was otherwise a challenging 2022. All the major market indexes suffered major declines for the year -- the Dow Jones Industrial Average (price-weighted index of 30 stocks), S&P 500 (largest 500 stocks by market capitalization), Russell 2000 (small capitalization stocks), and Nasdaq Composite (mostly comprised of technology and growth stocks) had total returns of -7.0%, -18.2%, -20.5%, and -33.1%, respectively. All had their worst year since 2008, the year the financial crisis began.

Bonds did not provide ballasts to investors’ portfolios as they typically do when stocks sink. In fact, it was easily the worst year ever for bonds. In the 46 years of calendar year returns prior to 2022 for the Bloomberg Aggregate Bond Market index, the worst performance was -2.9% in 1994. In 2022, the index had a total return of -13%.

Figure 1: Stock and Bond Markets Were Crushed in 2022

Source: Yahoo Finance (inclusive of dividends)

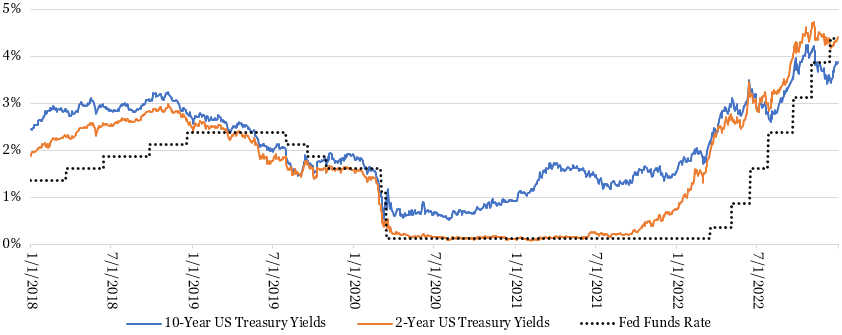

By far the strongest market headwind has been the Federal Reserve. After being late in removing its easy money policies as inflation began to ramp in 2021, the Fed has been in aggressive catch-up mode since early last year. It wound up hiking short-term rates by 425 basis points versus its own expectation entering the year of raising by 75 basis points. In updated projections, the Fed has signaled plans to lift rates by another 75 basis points in 2023, bringing the federal funds rate to 5.00-5.25%. Fed rate hikes and ongoing tough Fed talk pushed 2-year treasury yields, and to a lesser extent, 10-year treasury yields, to blow out throughout the year.

Figure 2: Fed Hikes and Tough Talk Pushed Up Treasury Yields Aggressively

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System (treasury yields). https://fred.stlouisfed.org/series/DGS2. https://fred.stlouisfed.org/series/DGS10. Forbes Advisor (fed funds rate) https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Higher interest rates negatively impact stocks in several ways. First, individual companies’ future earnings and cash flows are worth less today when discounted back to the present at higher interest rates. Second, when one- to two-year treasuries yield over 4%, they can effectively compete against the stock market for investors’ capital. Third, the higher interest rates go, the more pressure it puts on economic growth, and ultimately companies’ earnings prospects. All these interest rate factors, as well as a soaring U.S. dollar, acted as major headwinds to stock performance last year.

Market Outlook

We believe the Fed will continue to act as one of the two primary market drivers in 2023 (more on the other in a bit). Although the Fed has continued to talk tough to slow the economy and keep inflation expectations down, we believe in the coming months it will pivot its rhetoric to signal an upcoming conclusion to its interest rate increases. Once this happens it should allow the sharp valuation multiple compression of 2022 to largely cease. In other words, investors ought not to feel compelled to pay a perpetually lower amount per dollar of companies’ earnings.

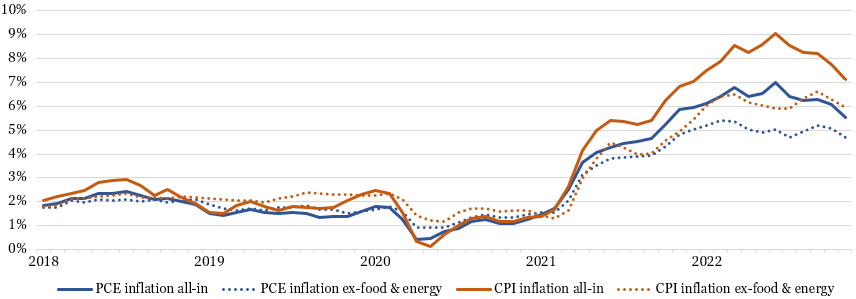

What makes us optimistic that the Fed will soon fail to act as a market deterrent is a continued cooling of inflation. Inflation has clearly peaked with meaningful progress in recent months in the two primary measures of inflation, the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE). The latest data shows that November PCE and CPI inflation moderated to 5.5% and 7.1%, respectively, from their June peaks of 7.0% and 9.1%.

Figure 3: Inflation Readings Have Clearly Peaked and Are Headed Lower

Sources: U.S. Bureau of Labor Statistics (PCE) https://fred.stlouisfed.org/series/PCEPI, Fred St. Louis Fed citing U.S. Bureau of Economic Analysis (CPI) https://data.bls.gov/cgi-bin/surveymost

The goods component of PCE inflation, weighted at 39%, has driven the improvement. Goods prices have fallen by 0.9% from June to November. Lower commodity costs in items such as oil, steel and copper, as well as easing supply bottlenecks and consumers shifting spending to experiences over things, has filtered to lower prices for used cars, semiconductors, apparel, and shipping cargo. We expect goods prices to continue to ease overall, driven by declining used car prices and shipping rates.

The services component of PCE inflation, the remaining 61%, has proven stickier. Recent monthly increases are consistent with 5-7% annualized inflation. Tight labor markets, the aforementioned shift of spending to experiences, and the lagged effects of higher housing costs have pushed services prices higher. We expect a gradual deceleration in services inflation throughout 2023 due to:

a cooling labor market -- we believe a smattering of recent technology company layoff announcements foreshadow greater layoffs in the months ahead through much of the technology sector, and eventually beyond to a certain extent, thus bringing the labor market into a closer state of equilibrium

satiating pent up demand for travel, dining, and entertainment; and

the dramatic reversal in home price and apartment rental trends becoming reflected in the inflation data -- we estimate an approximate 18-month lag of changes in housing prices and rents showing up in the housing inflation components

The other primary market driver this year should be the evolution of the economy and what that portends for companies’ earnings. So far major economic indicators such as consumer sentiment, retail sales, industrial production, and pending home sales have all weakened to contraction territory, yet the economy continues to grow. We are not so certain that can continue well into the new year because of the lagged effects of the Fed’s rate increases. We continue to believe it is likely the economy enters a recession by mid-2023 but think the odds of a moderate to severe recession have fallen because inflation is clearly trending in the right direction, thus lowering the risk the Fed must severely damage the economy via more aggressive rate increases.

If there is only a mild recession or no recession at all, inflation continues to work towards the Fed’s 2% target, and the Fed raises the federal funds rate by no more than 75 basis points, as we expect, then we think the stock market has limited downside potential. If we are wrong and there is a more significant recession, inflation remains stubbornly high, and/or the Fed pushes rates higher for longer, then we could see a further market drop of up to 20%. That would bring the peak-to-trough market decline to around one-third. Other stock market risks include a Chinese invasion of Taiwan and “unknown unknowns,” which are difficult to quantify.

Client Positioning

We take a long-term view that focuses on compounding returns in a tax-efficient manner. We allocate the bulk of our clients’ equity exposure into “quality growth” companies that have durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. We generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate our investment thesis and retaining stocks of companies with solid fundamentals. We believe this investment philosophy affords our clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

In the fourth quarter we went further in reducing our exposure to stocks with a high degree of economic cyclicality. As Figure 4 illustrates, the selling was largely concentrated on several technology companies, most notably semiconductors that have entered an industry down cycle. We used those proceeds to increase our weighting in fixed income securities, especially U.S. Treasuries with maturities one to two years in the future and yield-to-maturities in the 4.25-4.75% range.

Figure 4: Portfolio Changes in Majority of Client Accounts in 4Q 2022

Source: Glass Lake Wealth Management

We may opt to continue to shift clients’ asset allocations to bonds and away from stocks if the stock market can stage a meaningful rally and/or treasury yields advance further. For the first time in many years, investors can earn attractive yields without taking much credit or duration risk, which is the risk that rising yields negatively impact bond prices (shorter-term bonds carry lower duration risk).

Because of our quality growth investment philosophy, clients should expect their equity allocation of their overall portfolio to do best versus the market when inflation is low or decelerating and treasury yields are low or declining. If we are right in that (1) inflation continues to make downward progress in the months ahead (although it is unlikely to reach 2% by the end of this year), and (2) the Fed signals an upcoming end to its rate hike cycle, then treasury yields ought to be well contained, allowing quality growth stocks to do well versus the overall market.

You are unlikely to see us chase stocks in the best performing sector in 2022 -- oil & gas. We seek to avoid the oil & gas sector because it is notorious for boom-and-bust cycles, has historically been poor allocators of capital, and faces longer-term threats from declining oil demand. Although oil and natural gas prices were temporarily boosted by Russia’s invasion of Ukraine, they have given up all their gains and now reside near where they entered 2022.

You can also expect us to abstain from the most speculative areas of the market such as unprofitable growth companies, SPACs, cryptocurrency plays and meme stocks, all of which got trounced in 2022. As always, we will keep an open mind and be on the hunt for the next great long-term investment.

We hope you and your loved ones stay happy, healthy, and wealthy into the new year.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in North Carolina and Illinois. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.