Better to Rent Than Buy at Present Unless You Stay Put

By Jim Krapfel, CFA, CFP

February 1, 2023

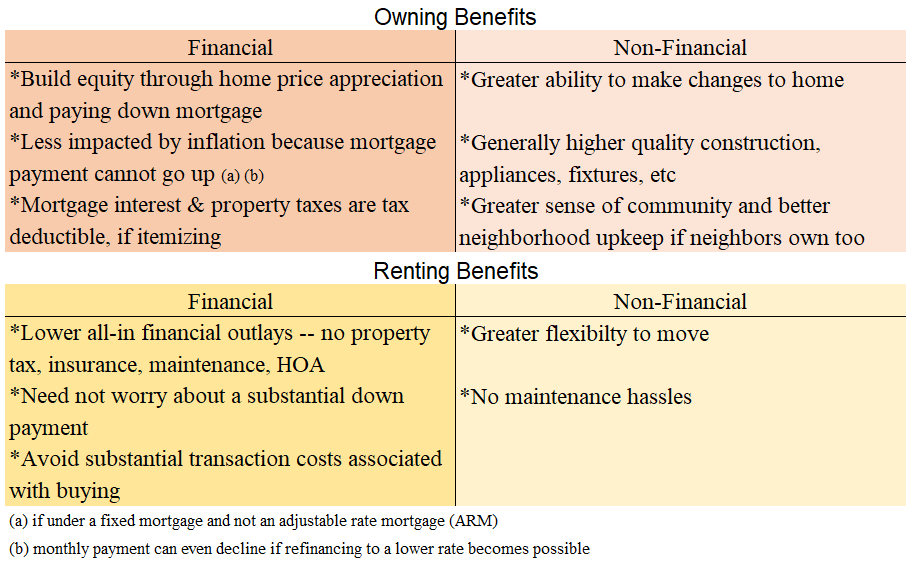

A question most of us ask ourselves at least once in our life is “should I/we buy or continue renting?” Buying can be the means to generate substantial long-term wealth if done smartly, while choosing to rent could save oneself a small fortune if conditions are not right to buy. Of course, money is not the sole determinant in making this big decision. In this blog we highlight the major financial and nonfinancial considerations of buying versus renting and provide our views of the timeliness of buying in today’s housing market.

Virtues of Buying versus Renting

Most of us start our independent lives renting for a host of reasons. Financially, we may be forced to rent because we are less likely to possess the assets necessary for a down payment nor the income to afford a mortgage on a desired property. When we rent we also have the flexibility to move upon lease expiry if our neighborhood preferences change, we can afford a nicer place, or our career takes us to new destinations.

However, at some point we might tire of paying an ever-greater sum for rent that we never get back. Instead, we can take advantage of the best virtue of home ownership, which is building equity over time. Putting some numbers to it, 28% of all U.S. wealth (excluding the top 1 percentile) came from equity in one’s home in 2020. Since roughly one-third of households rent, home equity counts for an even larger percentage of homeowners’ wealth.

Once we have crossed the financial hurdles of homeownership, we need to consider some practical considerations, such as our willingness and ability to tackle home maintenance or tending to the yard. If we lead very busy lives or live on our own, we might not want to be responsible for such upkeep. Or, if we want that big house and yard for a family and seek a greater sense of community, we might prefer to buy.

Figure 1: Benefits of Owning and Renting

Source: Glass Lake Wealth Management

But when does it make financial sense to buy? It comes down to three primary factors: (1) comparison of home prices to rents; (2) assessments of home price affordability; and (3) anticipated duration of ownership. Next we dive into each factor.

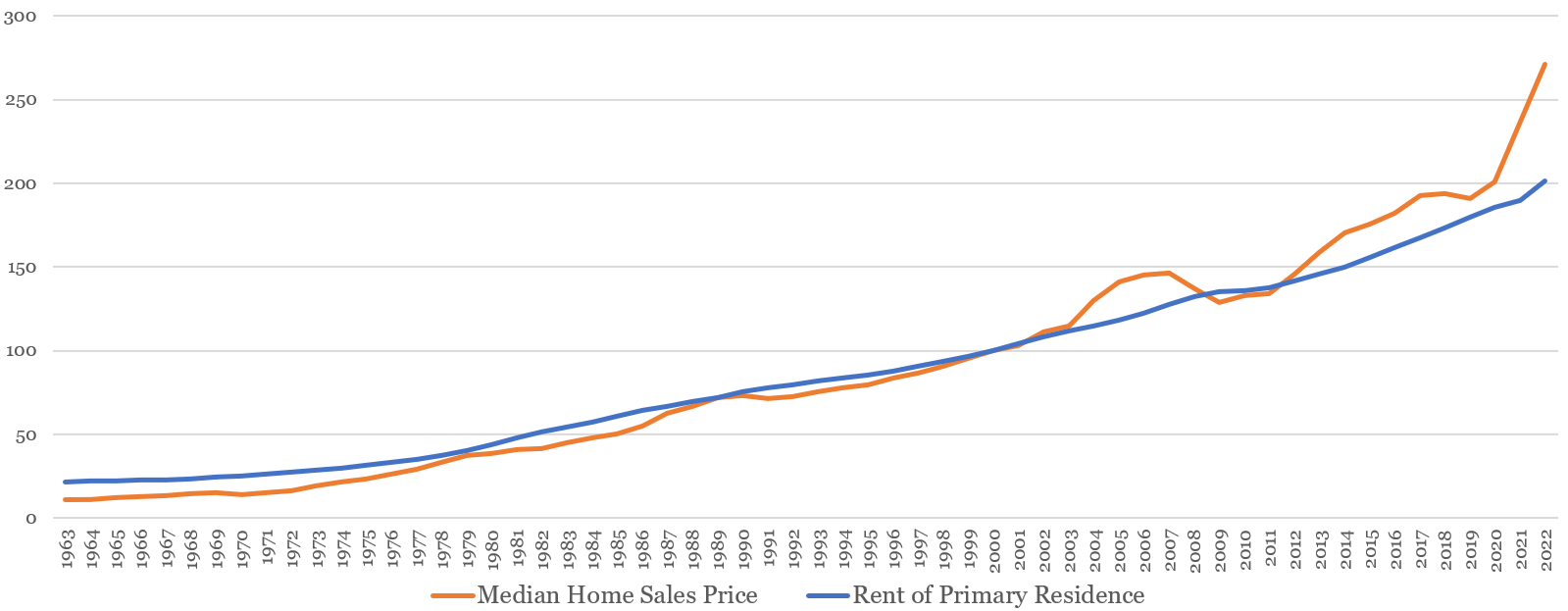

Home Prices vs Rents

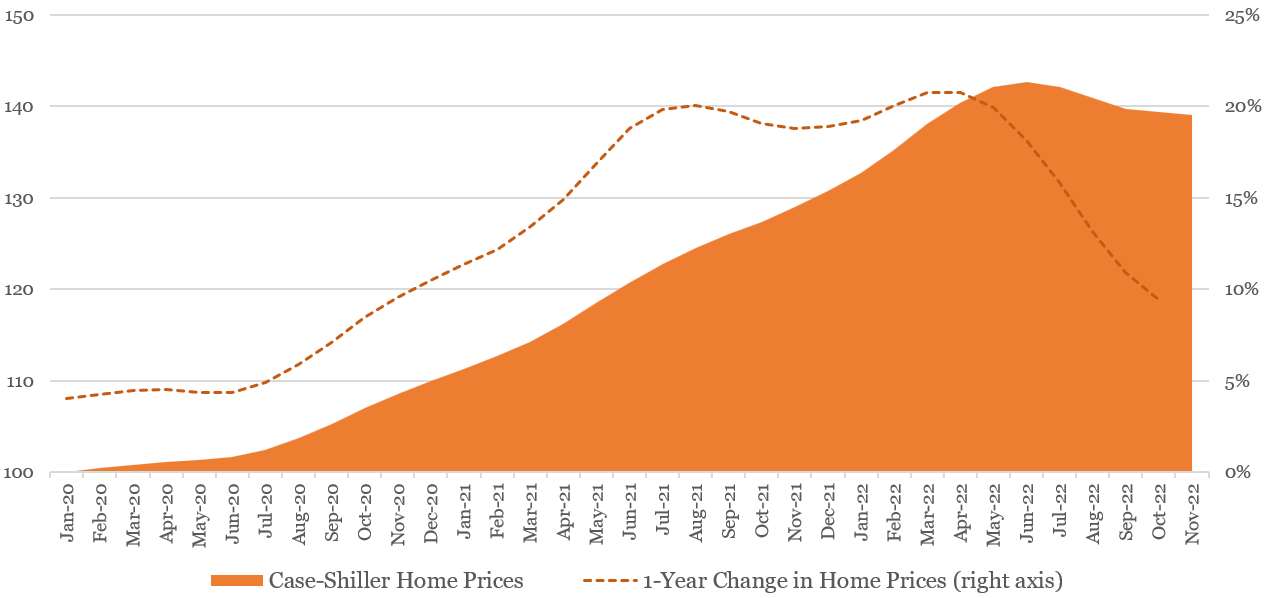

Comparing home prices to rents is a direct way to assess the relative attractiveness. Below we analyze 60 years of national data on median home prices and rents of primary residences, and index both sets of data to 2000 levels. We can see that the last few years of heady home price appreciation have put home prices at a steep premium to rents. The chart below augurs for home prices to pull back from their extended levels, or at least allow rents to play some catch up over the next few years.

Figure 2: Home Prices Are Elevated Relative to Rents

Sources: St. Louis Fed citing the US Census Bureau and Housing and Urban Development (median home prices) https://fred.stlouisfed.org/series/MSPUS; St. Louis Fed citing the U.S. Bureau of Labor Statistics (rent data) https://fred.stlouisfed.org/series/CUUR0000SEHA; Glass Lake Wealth Management

*Median home price and rent data are indexed to 100 in 2000

A major caveat is that real estate is about location, location, location, so certain markets will look vastly different. For instance, big cities such as San Francisco, Austin, and New York have some of the most pronounced home price premiums versus rents, while Pittsburgh, St. Louis, and Cleveland score highly on buying over renting.

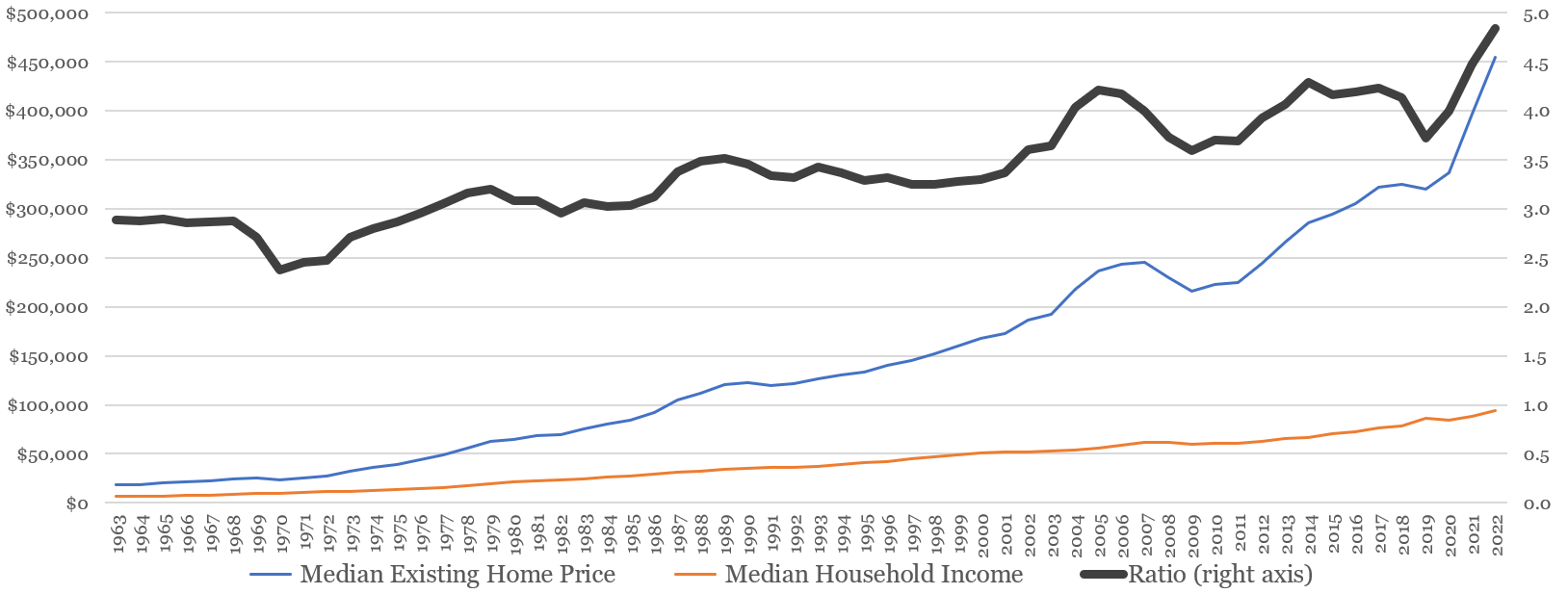

Home Price Affordability

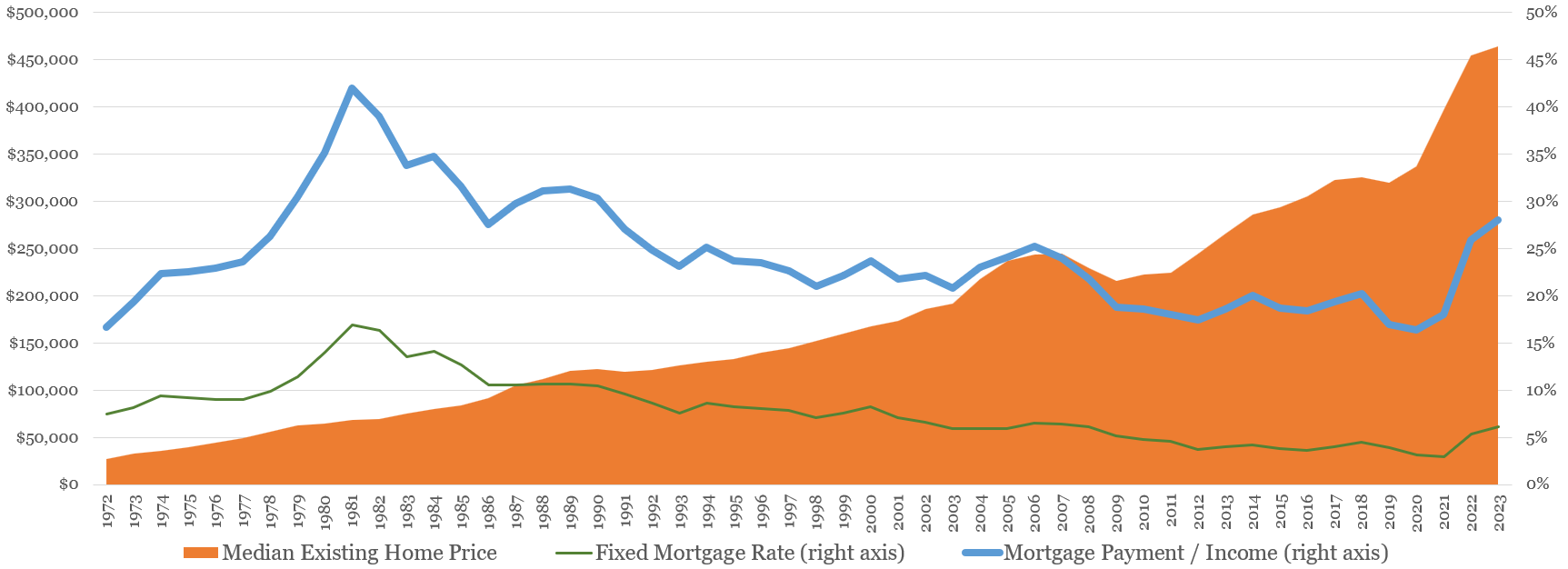

Another way to assess the attractiveness of buying is to look at housing affordability metrics. Two affordability metrics stand out to us: (1) a comparison of home prices to incomes and (2) mortgage payments to incomes. The first is applicable to all prospective home buyers, including cash buyers who make up roughly a quarter of the home purchase market in a typical market (the all-cash buyer percentage rose to 32% in October 2022 as mortgage rates surged). The second metric is arguably the more pertinent one for those who finance most of their purchase.

Figure 3: Home Prices Are Historically Unaffordable vs Incomes

Source: St. Louis Fed citing the US Census Bureau and Housing and Urban Development (median home prices) https://fred.stlouisfed.org/series/MSPUS; St. Louis Fed citing the U.S. Census Bureau (median household income) https://fred.stlouisfed.org/series/MEFAINUSA646N; Glass Lake Wealth Management

Figure 4: Mortgage Payment vs Income Relationship is Extended, but Not at Extreme Levels

Sources: St. Louis Fed citing the US Census Bureau and Housing and Urban Development (median home prices) https://fred.stlouisfed.org/series/MSPUS; St. Louis Fed citing the U.S. Census Bureau (median household income) https://fred.stlouisfed.org/series/MEFAINUSA646N; St. Louis Fed citing Freddie Mac (30-Year Fixed Rate Mortgage) https://fred.stlouisfed.org/series/MORTGAGE30US; Glass Lake Wealth Management

*Mortgage payment assumes 20% down on a median priced home financed with the average prevailing 30-year fixed mortgage rate

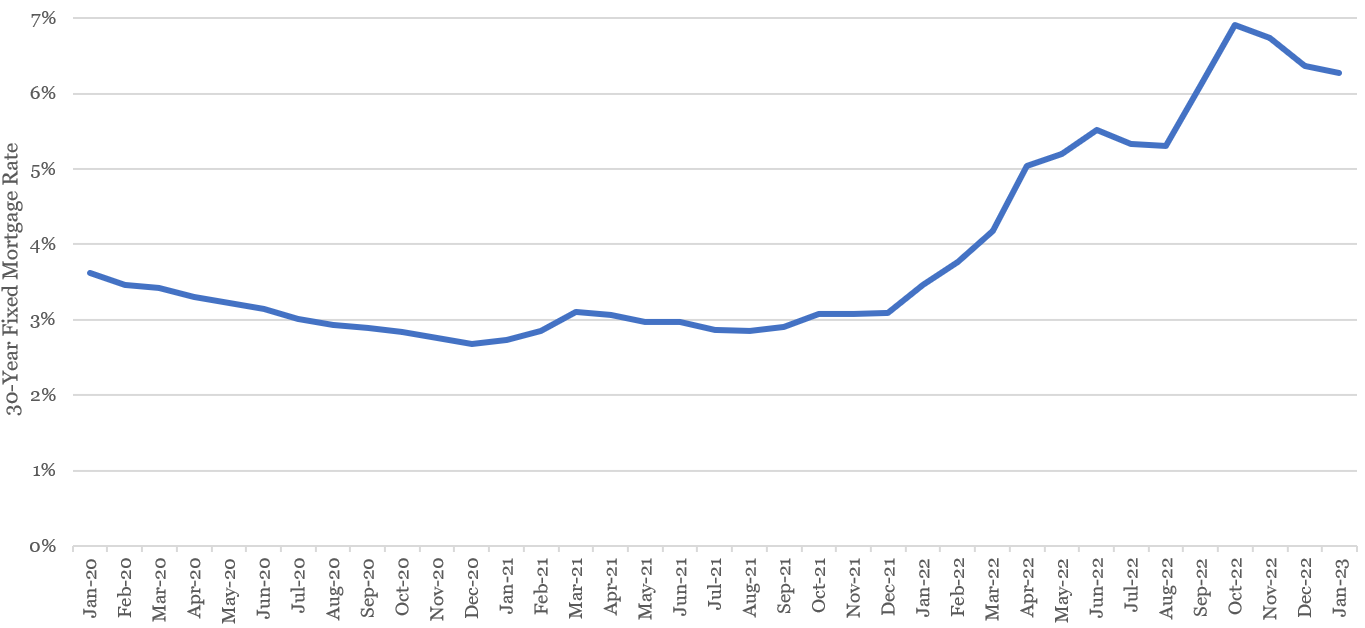

Current home prices appear historically unaffordable on both accounts. As such, we expect national home prices to remain constrained over the next few years. If the recent decline in mortgage rates continues (down roughly 1 percentage point from October highs to 6.12%) and the economy can avoid a recession, then we see scope for home prices to increase by a low-single-digit percentage rate over the next few years. However, if mortgage rates remain in the 6% range or higher, or many people feel like their jobs are no longer secure because of a possible recession, then home prices could correct by 10%. Either way, we believe it is unlikely that home prices rise by a rate faster than underlying inflation for the foreseeable future.

Anticipated Duration of Ownership

The third major factor of whether it makes sense to buy is the anticipated duration of ownership because of the substantial transaction costs required to buy and sell a home. When buying, items like required title insurance, transfer fees to municipalities, and attorney fees usually add up to around 1.5% of the purchase price. It is much pricier to sell because the seller pays for both the selling agent’s commission and the buyer’s agent commission, which usually runs 5-6% of the sales price. Tacking on the title insurance, transfer fees, and attorney fees the seller pays brings the sum to 6-7% of the sales price.

The substantial fees of transacting a home can be sobering. On day one of ownership, using typical transaction fees of buying and selling, a homeowner must climb out of an approximate 8% hole (1.5% buyer costs + 6.5% seller costs) to break even when selling. For buyers who put down the necessary 20% down payment to avoid paying private mortgage insurance, they effectively lose 40% of their down payment, or home equity, to fees. When home prices are rising quickly, as they had been through much of the pandemic, these fees are quickly overcome and forgotten. However, when home prices languish or decline, they can really sting.

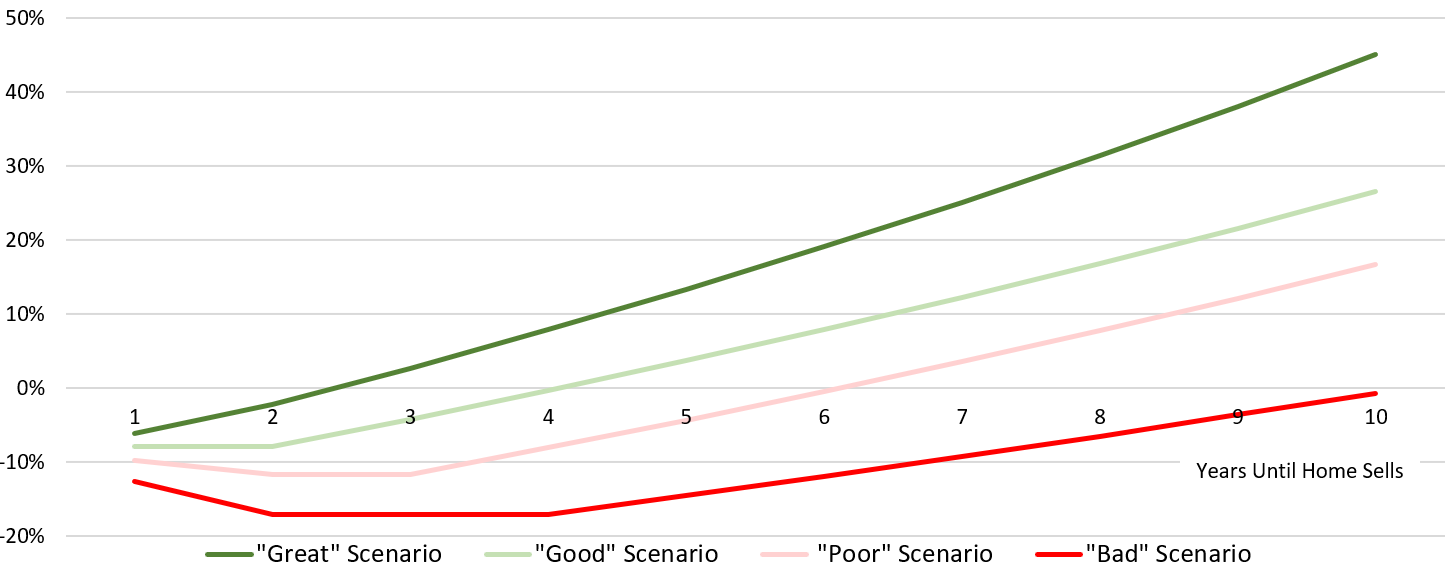

The key then is to own your home long enough to financially recover from the substantial round trip transaction costs. How long it takes to recover greatly depends on the trajectory of home prices. Below we look at four plausible home price scenarios in today’s housing market. When looking at Figure 6, which uses the scenarios from Figure 5, it becomes apparent that it can take a number of years to break even. Note that our analysis does not account for homeowner-specific expenses such as renovation work upon home purchase (generally not recouped into home prices dollar-for-dollar), ongoing maintenance (around 1% of home value per year), insurance, property taxes, and HOA dues, so the true break-even period is longer than shown.

Figure 5: Annual Home Price Changes Used in Our 10-Year Home Price Scenarios

Figure 6: Economics of Selling Home Within 10 Years of Purchase Under Various Home Price Scenarios

Source: Glass Lake Wealth Management

Bottom Line

Although there are numerous nonfinancial considerations that favor buying or renting, financial considerations are often the most prominent. Based on our assessment of home prices relative to rents, and affordability metrics like home prices and mortgage payments to income, we believe there is not much scope for further home price appreciation for the next few years (in most markets). There could even be an extended period of modestly declining national home prices if mortgage rates stay elevated or there is an economic recession.

This does not bode well for the prospective home buyer that has to incur substantial transaction costs upon purchase and (especially) sale. We believe that for a home purchase to pan out economically, one should expect to live in their home for at least seven or eight years rather than the typical four-to five-years required. Of course, real estate is local, so one could adjust the required timeframe up or down based on factors such as local affordability and migration trends.

APPENDIX: Recent Housing Data Charts

Source: St. Louis Fed citing the S&P Dow Jones Indices LLC https://fred.stlouisfed.org/series/CSUSHPISA

*Indexed to 100 in January 2020

Source: St. Louis Fed citing Freddie Mac https://fred.stlouisfed.org/series/MORTGAGE30US

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, insurance or accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.