Progressive to Drive Consistent, Profitable Auto Market Share Gains

By Jim Krapfel, CFA, CFP

March 1, 2023

Background

I started researching Progressive Corp (ticker PGR) while working as a portfolio manager and analyst at my predecessor firm in 2019. After a deep-dive analysis of the company I initiated a position in my personal account in November 2019 at a share price of $71.94.

Since our launch of Glass Lake in April 2020, we have consistently purchased the stock for client accounts. It has grown to become the third largest aggregate stock position as of February 28, 2023.

Company Description

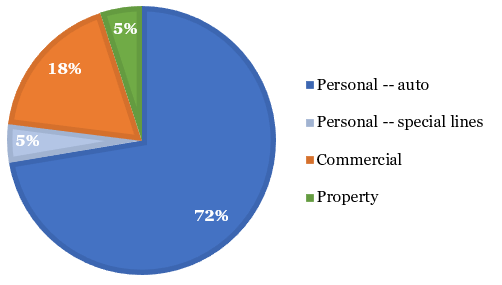

Progressive is an insurance carrier in the United States, operating the following lines:

Personal – auto: it ranked third in market share in the United States based on 2021 premiums written, after privately-owned State Farm and Berkshire Hathaway (ticker BRKB)-owned Geico. Industry data may show that it surpassed Geico to become the second largest auto insurance carrier in 2022. There are approximately 255 competitors in the market with the top 15 auto insurers comprising 84% of the market.

Personal – special lines: includes insurance for motorcycles, ATVs, RVs, watercraft, snowmobiles, and similar items. Progressive believes it is the largest insurer for motorcycle and boat products.

Commercial: auto-related liability and physical damage insurance, business-related general liability and property insurance predominately for small businesses, and workers’ compensation insurance primarily for the transportation industry. It believes it is the largest carrier for commercial auto insurance.

Property: residential property and renters insurance. It believes it is the 15th largest homeowners insurance carrier.

Figure 1: Sales by Insurance Line in 2022

Sources: Company filings, Glass Lake Wealth Management

Progressive was founded in 1937, went public in 1971, and is headquartered in Mayfield Village, Ohio.

Investment Thesis

We own Progressive for two primary reasons: (1) our expectation that it should disproportionately benefit from a long-term industry shift to the direct sales channel, and (2) its continuous track record of innovation that should allow it to underwrite new business at attractive profitability.

Like the travel industry, consumers of auto insurance have shifted their buying preferences to online and other direct means and away from agents. Indeed, in the auto insurance industry, the percentage of premiums sourced through the direct sales channel expanded to a projected 35% in 2022 from 24% in 2013.

Progressive has positioned itself well in the direct channel with 53% of its personal auto policies sourced there last year. Over the last five years its personal auto policies grew by a cumulative 68% in its direct channel versus 37% in its agency-sourced channel. We expect its disproportionate mix towards direct sales to help it grow faster than the rest of the auto insurance industry.

The second major reason for owning Progressive is its long-term track record of innovation that we expect to continue to drive its financial results. For example, it was the first to give consumers the ability to buy (not just quote) an auto insurance policy in real time online and it was the first insurer to introduce what is known as usage-based insurance (UBI). The latter innovation continues today and is the primary component of Progressive’s industry-leading customer segmentation.

Progressive’s UBI program has evolved over the years to what is now called Snapshot. In exchange for voluntarily installing a phone application or plugging in a device on their car that tracks how they drive, how much they drive, and where they drive, drivers receive a one-time 10% participation discount on their auto policy. After four to five months of tracking driving usage, 75% of drivers receive a discount on their next six-month policy (by up to 30%) and 20% see their premiums rise (by up to 40%). This system attracts the low-risk driver Progressive seeks (another market share driver) and weeds out higher risk drivers because Progressive can price renewing policies accordingly. The company is rolling out a continuous version of Snapshot across the country for ongoing monitoring that promises to deliver even greater savings for the low-risk driver and even better data for Progressive to optimize its pricing.

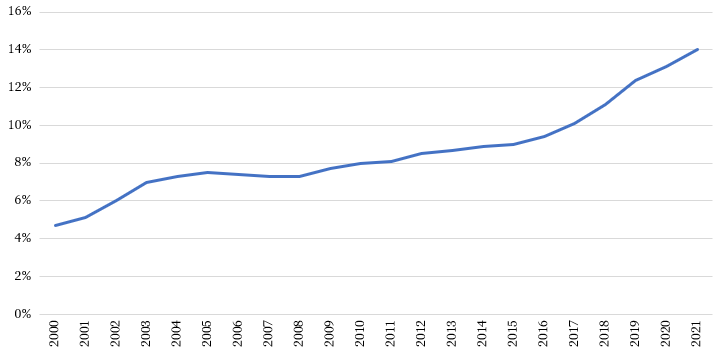

Progressive’s favorable sales channel mix and innovation-driven underwriting methods have driven consistent market share gains in personal auto policies, from 4.7% in 2000 to 14.0% in 2021. We expect positive sales mix shift effects and Progressive’s remaining at the forefront of underwriting innovation to drive its market share towards 20% in the years ahead.

Figure 2: Progressive’s Market Share in Personal Auto Policies Has Consistently Expanded

Sources: Company Annual Reports

The shorter-term company outlook is also favorable. Over the next year or so, Progressive’s profitability should receive a significant boost from recent pricing actions to combat cost pressures in 2022, such as losses from Hurricane Ian and inflationary car parts and labor. Indeed, Progressive raised its prices on new policies by 13.5% in 2022 and expects to take a further 3% of price increases in 2023. Progressive moved quicker than its competitors to improve its profitability via price increases, so its new business meaningfully slowed last year. The rest of the industry is just now catching up on price, so Progressive ought to resume healthy market share gains in the year ahead.

Although not core to our thesis, the higher interest rate environment should benefit Progressive’s $53.5 billion investment portfolio over time because 93% of it is invested in short-term and intermediate-term, investment-grade fixed-income securities.

Economic Moat

Progressive’s economic moat, or sustainable competitive advantages, is the result of scale-driven cost advantages and superior underwriting in auto insurance.

As a top three auto insurer among a couple hundred insurers, Progressive has the marketing heft to encourage consumers to buy their auto insurance directly with the company rather than going through an agent. To be sure, any viewer of live television is familiar with Flo and her band of fictional salespeople. Progressive’s advertising seems to be paying off given its success in the direct sales channel. When consumers buy directly, Progressive does better by cutting out the independent insurance agent middleman.

Progressive’s superior underwriting is partly explained by its industry leadership in deploying usage-based insurance, as we described earlier. Progressive’s underwriting is further aided by its almost singular focus on auto, its decades of writing policies, and other innovate ways to assess driver risk, such as collecting driver data from third parties. For example, Progressive has formed partnerships with General Motors and Toyota to acquire driver data from auto manufacturers that are increasingly installing the equipment necessary to sell data to insurers.

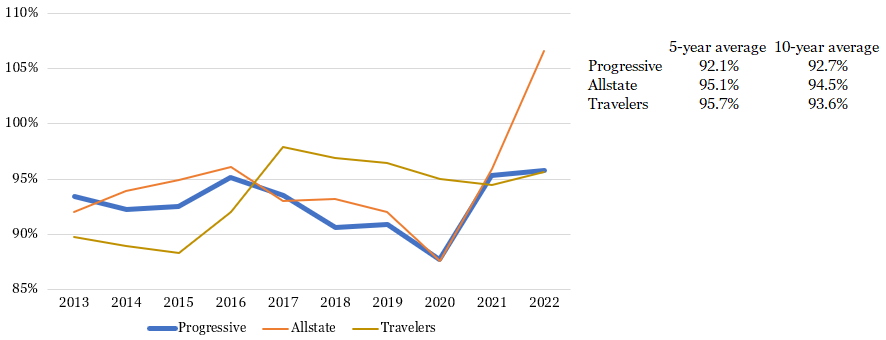

Progressive’s financials back up these qualitative claims. Its combined ratio – a key industry profitability metric that takes underwriting expenses (the cost to do the actual underwriting) and underwriting losses (insurance claims) and divides them by earned premiums – has consistently been lower (lower is better) than its closest publicly-traded peers Allstate (ticker ALL) and Travelers (ticker TRV). Further, Progressive’s return on equity has averaged a healthy 22% over the last 10 years.

Figure 3: Progressive’s Profitability Has Separated from its Competition Over the Last 5 Years

Sources: Company filings, Glass Lake Wealth Management

*Lower figures indicate a higher degree of profitability

Growth, Profitability & Valuation

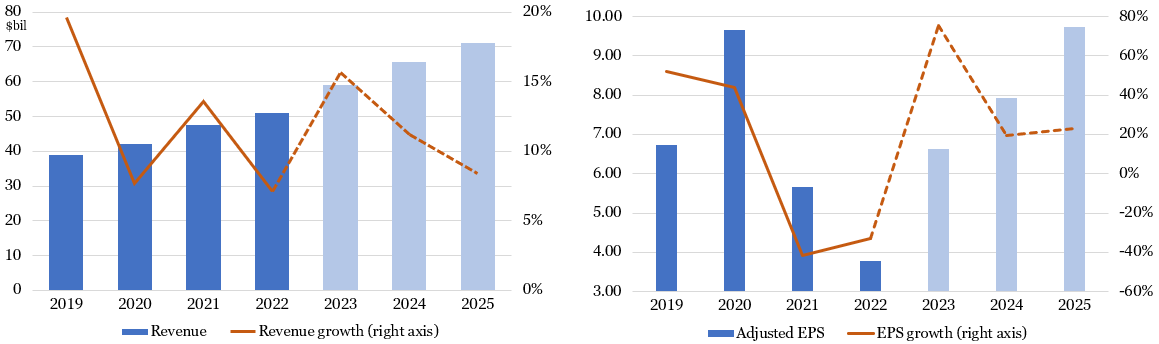

We expect Progressive to growth premiums written at least in the low double-digits for the next year or two and at least high-single digits in the longer term as it continues to gain market share in both personal and commercial lines of auto.

We expect Progressive’s combined ratio (again, lower is better) to recover strongly this year as its aggressive price increases fully reflect past and present inflation and it laps Hurricane Ian losses from last year. We expect its combined ratio to settle in the 90-95% range it had operated within pre-pandemic, well within its long-discussed guidepost of “96% or better”.

Because Progressive was earlier than its peers in pushing pricing and does not need to implement the same degree of pricing increases going forward, it should be able to resume healthy market share gains in 2023. Already in December and January it reported 15-16% net premiums written growth, up from its 0% growth nadir in September last year.

Figure 4: Progressive’s Growth and Profitability Set to Bounce Back This Year

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Progressive is priced at 21.6x next 12 months’ (NTM) consensus earnings, ahead of the S&P 500 at 17.9x NTM. Its valuation multiple has expanded over the past couple years to the low 20s from the 16x average it held from 2017-19 which we believe is warranted because Progressive achieved a rare feat among insurers – the ability to aggressively grow policies in force without sacrificing underwriting margins. What’s more, higher interest rates should drive better returns in its bond-heavy investment portfolio.

Key Risks

The largest idiosyncratic, or company-specific, risk facing Progressive is its ability to remain at the forefront of underwriting innovation and customer segmentation. This has been Progressive’s secret sauce over the years in profitably growing its franchise. There is also risk that Progressive becomes more aggressive on its relatively recent foray into property insurance lines where it has struggled to earn a profit.

Omnipresent industrywide risk factors are major weather events that cause unusual losses, greater than anticipated accident rates, and inflationary repair and replacement costs. Longer-term industry threats include an eventual proliferation of driverless cars, automakers aggressively entering the insurance industry due to their growing trove of consumer driving data and growing privacy concerns that could limit insurers’ ability to obtain data (such as usage-based) valuable to pricing policies.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.