April 2023 Investment Letter

April 3, 2023

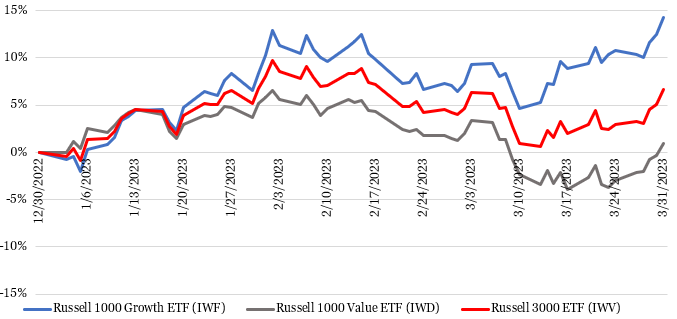

The first quarter was the opposite of how most of 2022 played out. Stocks generally rose, growth trounced value, and treasury yields plunged after their early March peak. These reversals defied almost all market pundits’ forecasts entering the year, which provides more fodder that consensus opinion is usually wrong and that trying to time the market is a fool’s errand.

All told, the iShares Russell 3000 ETF (ticker IWV), our preferred measure of overall market performance, rose 6.7% in the quarter. Strikingly, growth stocks soared 14.3% while value stocks only mustered a 0.9% gain. That was the widest gap between the two since the first quarter of 2020.

Figure 1: Growth Stocks Crushed Value Stocks in the First Quarter

Source: Yahoo Finance (inclusive of dividends)

Early in the quarter, growth stocks rebounded due to the abatement of tax loss harvesting (selling losing stocks before year end for tax purposes) and window dressing (selling losers before year end to avoid embarrassment of showing losing holdings). Growth stocks received a further boost in March due to: (1) excitement surrounding artificial intelligence chatbots, such as the recently launched ChatGPT, which could reaccelerate long-term growth for some cloud computing and semiconductor companies, and (2) decline in treasury yields. All else equal, lower yields boost growth stocks because their further afield earnings are worth more when they are discounted back to the present at a lower interest rate. Lower yields in the bond market also mean less competition for investors’ capital.

Value stocks’ underperformance was due to part to banks getting crushed in the quarter (energy stocks were another notable laggard). The large increase in treasury yields in 2022 and early 2023 caused some banks’ bond holdings to decline such that their assets no longer covered liabilities. Silicon Valley Bank’s (ticker SIVB) stock offering announcement (to shore up its capital position) on March 8 spooked its affluent customers with deposits over the $250,000 FDIC insurance cap. A rapid bank run ensued, which spilled over to other regional banks with had a high concentration of uninsured deposits. Ultimately, Silicon Valley Bank and Signature Bank (ticker SBNY) quickly failed, several others teetered, and the S&P Regional Banking ETF (ticker KRE) sold off 25% in the quarter. The very large bank stocks were less impacted but still mostly declined.

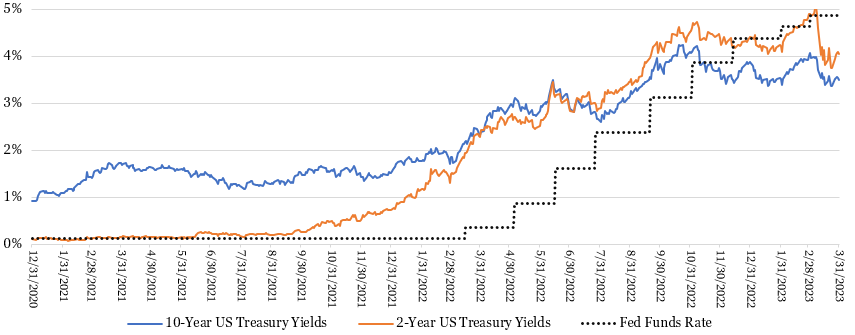

The banking scare had notable impacts on the bond market. Treasury yields, especially with shorter maturities that are more reflective of anticipated Fed policy, reacted strongly to the downside. Bond prices rise when yields fall, so fixed income performed well too, up 3.2% in the first three months as measured by the total bond ETF (ticker BND). One- and two-year treasury yields substantially below the fed funds rate indicate the bond market expects the Federal Reserve to soon halt, then reverse (in second half of 2023), their rate hiking campaign to avoid exacerbating the banking turmoil and in response to declining inflation as banks tighten their lending standards.

Figure 2: Treasury Yields Made Sharp U-Turn Lower in March

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System (treasury yields). https://fred.stlouisfed.org/series/DGS2. https://fred.stlouisfed.org/series/DGS10. Forbes Advisor (fed funds rate) https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Market Outlook

The primary near-term driver for the stock market is the interplay among inflation, the banking situation, the Fed, interest rates, and the economic outlook.

Inflation has figured prominently since it became clear the inflation spike in 2021 was not entirely due to transitory Covid-related effects. It appeared inflation was moderating at a healthy clip last fall but in recent months the pace of cooling slowed. Annual inflation in the 5-6% range remains much above the Federal Reserve’s longstanding target of 2%. Still, we remain optimistic that inflation will make continued downward progress in the months ahead due to the lagged effects of past Fed tightening and the deflationary impact of banks’ reducing access to credit.

Figure 3: Inflation Readings Have Plateaued at Still-High Levels

Sources: U.S. Bureau of Labor Statistics (PCE) https://fred.stlouisfed.org/series/PCEPI, Fred St. Louis Fed citing U.S. Bureau of Economic Analysis (CPI) https://data.bls.gov/cpi/data.htm

If inflation does not slow as quickly as desired, the Fed could still feel compelled to stop raising its fed funds rate if it is worried about financial instability. Actually, the stock market arguably prefers ongoing angst at banks, but not massive turmoil, such that they tighten their lending standards as presumed. This would slow the economy as desired without causing major disruption. Tighter lending for privately-owned startups could also offer major funding advantages (and ultimately less competition) for large, profitable public companies.

If the banking scare proves to be a short-term blip with no meaningful bank credit tightening, then the Fed likely resumes its fight on inflation via greater than anticipated fed funds rate increases. On the flipside, if the banking turmoil were to spread in an uncontrolled fashion, then the economy could be in for a hard landing that sends stocks lower because the favorable impact of lower interest rates would be more than offset by lower projected company earnings.

So far the economy has proven surprisingly resilient in the face of substantial Fed rate hikes, an early 2022 spike in oil prices, and poor consumer confidence readings. We expect the economy to weaken throughout the year, but we are less convinced we are headed towards a recession (still seems more likely than not by year end though). Absent a deep recession, which we believe is highly unlikely given strong consumer balance sheets and little prospect for massive job losses, we believe any stock market tumult ought to be contained.

Looking out several years, the greatest identifiable risks appear to be persistently high inflation, which would push interest rates to new cycle highs and pressure stock valuations, and a Chinese invasion of Taiwan, which could risk U.S. military involvement and rattle global supply chains. We are more concerned about the latter than the former.

Client Positioning

We take a long-term view that focuses on compounding returns in a tax-efficient manner. We allocate the bulk of our clients’ equity exposure into “quality growth” companies that have durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. We generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate our investment thesis and retaining stocks of companies with solid fundamentals. We believe this investment philosophy affords our clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

Our investment philosophy was in favor in the first quarter as treasury yields retreated and valuation multiples expanded across many of our growth holdings. Further, excitement around artificial intelligence chatbots raised growth prospects for a few of our holdings.

We also benefitted from our stance against owning banks and traditional energy companies that were hard hit in the quarter. Our longstanding view is that banks have too little competitive differentiation, are subject to significant (and necessary) regulation that limits returns, and are vulnerable to exogenous shocks that can shake investor confidence. Our longstanding view on traditional energy companies is that they are too cyclical, have not shown capital discipline over a full economic cycle, and face long-term disintermediation.

In the first quarter we made a few tactical trades, the most significant of which was swapping Edwards Lifesciences (EW) out for The Cooper Companies (COO). As explained in Figure 4, we believe Cooper’s valuation appears more attractive than Edward’s considering their respective growth rates. We also sold off or trimmed a couple of our more economically sensitive holdings, as we have been doing over the last several quarters.

Leftover cash went to further increasing our U.S. Treasury holdings with one- to two-year maturities. At the time of treasury purchases in January and February, yield-to-maturities were in the high 4’s to low 5’s percentages (versus generally 4% to 4.5% now). (Worth explaining is that yield to maturity is the sum of the bond’s stated yield and the difference between the bond’s purchase price and par value. For example, let us say we purchase a treasury bond with a stated yield of 1% that matures in 12 months for $965. The yield-to-maturity is 1% + ($1000/$965) -1 = 4.6%.)

Figure 4: Portfolio Changes in Majority of Client Accounts in 1Q 2023

Source: Glass Lake Wealth Management

We may continue to shift clients’ asset allocations to bonds and away from stocks if treasury yields approach and/or surpass their recent highs. Although not true to the same extent after the recent decline in treasury yields, investors can still earn attractive yields without taking any credit risk and little duration risk (duration risk is the negative effect higher interest rates have on bond prices; the effect is greater with longer maturities).

Because of our quality growth investment philosophy, clients should expect their equity allocation of their overall portfolio to do best versus the market when inflation is low or decelerating and treasury yields are low or declining. If we are right in that (1) inflation continues to make downward progress in the months ahead (although it is unlikely to reach 2% by the end of this year), and (2) the economy weakens, then treasury yields ought to be well contained, allowing quality growth stocks to do well versus the overall market.

You can expect us to continue to abstain from stocks in the banking, traditional energy, and other long-term challenged industries. We will also continue to avoid the most speculative areas of the market such as unprofitable growth companies, SPACs, cryptocurrency plays and meme stocks. As always, we will keep an open mind and be on the hunt for the next great long-term investment.

We hope you and your loved ones stay happy, healthy, and wealthy into the spring season.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.