October 2023 Investment Letter

October 2, 2023

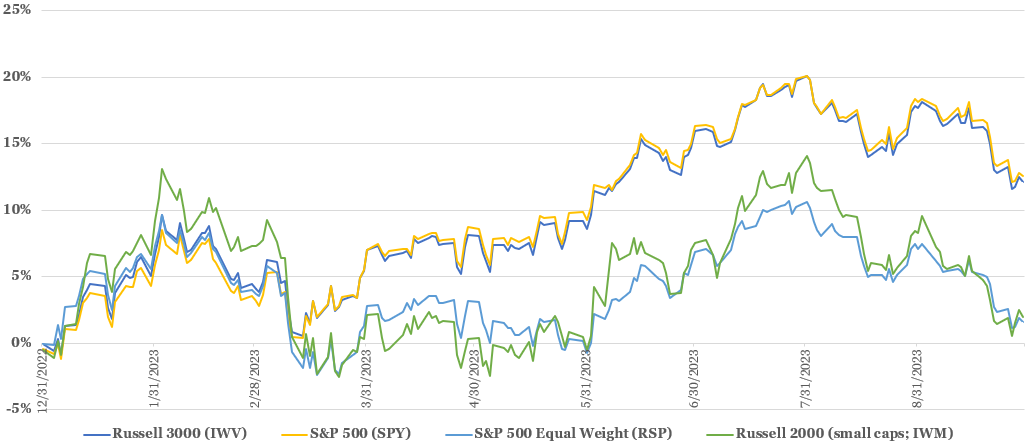

Stock market returns reversed course in the third quarter after a very strong first half of the year. The iShares Russell 3000, a market cap-weighted index of the 3,000 largest publicly traded companies in the U.S., declined 3.3% in the third quarter after rising 16% in the first half. Most of the decline occurred in September, when all the indexes referenced below slid 5-6%.

Market cap-weighted indexes such as the Russell 3000 and S&P 500 outperformed equally weighted and small cap indexes again in the third quarter. The strong performance in market cap-weighted indexes is heavily skewed by the 10 largest companies that mostly reside in the technology sector. Outside the few mega caps, stock market returns have been far more pedestrian, as evidenced by the 1.6% average year-to-date return for the 500 companies in the S&P 500 through September 30.

Figure 1: Stocks Pulled Back in August; Large Caps Continue to Lead Year-to-Date

Source: Yahoo Finance (inclusive of dividends)

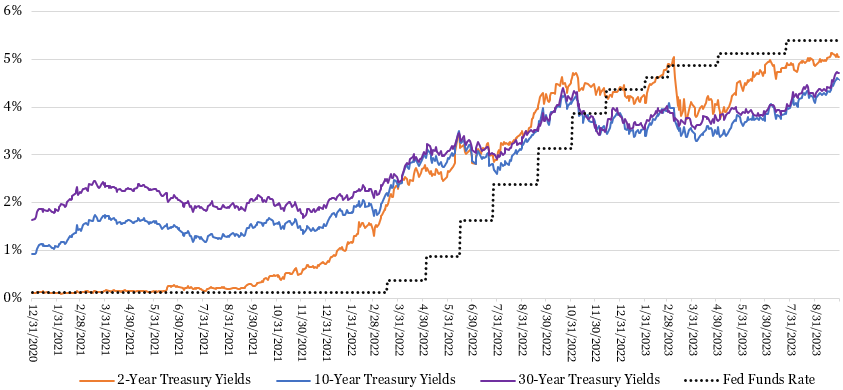

The source of the newfound market angst can easily be traced to rising U.S. Treasury yields. Yields recently reached new cycle highs across the interest rate curve. The 2-year and 10-year Treasury yields are now at their highest levels since 2006 and 2007, respectively. Yields jumped higher again on the first trading day of October, pressuring stocks some more.

Figure 2: Treasury Yields Are at New Cycle Highs

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System (Treasury yields). https://fred.stlouisfed.org/series/DGS2. https://fred.stlouisfed.org/series/DGS10. https://fred.stlouisfed.org/series/DGS30.Forbes Advisor (Fed Funds rate) https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Yields are rising not because of higher inflation expectations (notwithstanding the 29% increase in oil prices over the last three months), but rather a growing realization that the Federal Reserve will keep rates higher for longer given a still-tight labor market and resilient economy. On September 20, Federal Reserve Board members projected the Fed funds rate to end 2024 and 2025 at 5.1% and 3.9%, respectively, up from their 4.6% and 3.4% projections in June and 3.9% and 2.9% projections a year prior. Increasing concerns about U.S. debt levels and a large supply of new debt issuances have weighed on Treasury yields as well.

Rising Treasury yields can pressure stock prices because they provide stiffer competition for investors’ funds. More specifically, as Treasury yields rise, investors might switch their asset allocation from riskier stocks to safer bonds with acceptable interest rates.

Rising Treasury yields are particularly troublesome for three subsets of companies:

1) those with high debt loads – earnings negatively impacted by higher interest expense, whether that is immediate in the case of floating rate debt, or with a lag on fixed rate debt that eventually must be refinanced (or paid down with available cash) when it comes due;

2) those with high dividend yields – these companies had served as proxies for bonds when interest rates were lower because of their perceived safety and steady dividends… now that 5%-plus yields can easily be had from less risky bonds, 3-4% dividend yields no longer appear as attractive; and

3) those deemed more speculative – their highly uncertain and further afield cash flows are worth less today when discounted back to the present at higher interest rates

As discussed shortly, we are limiting our exposure to these three subsets of companies.

Market Outlook

We are not overly optimistic about overall stock market returns over the next 6-12 months. As mentioned earlier, stocks are facing stiffer competition for capital from bonds. There are also known headwinds from dwindling excess consumer savings that were built up because of pandemic-era government stimulus, resumption of student loan repayments, higher oil prices that eat into household budgets, and the lagged effect of higher interest rates on the economy.

Not all is gloomy though. If the unemployment rate does not spike higher and people generally feel confident they will not be laid off, then consumer spending should hold up. There are also a lot of infrastructure and climate project spending in the pipeline, funded by the Infrastructure Bill of 2021 and the Inflation Reduction Act of 2022. The fourth quarter also tends to be a seasonally strong period for stocks.

Although we see some reasons to be cautious, it rarely pays to become overly concerned about macroeconomic risk factors. As the adage goes, “stock markets climb a wall of worry,” meaning as concerns about known risk factors abate -- which are largely already reflected in stock valuations -- then stock prices typically rally. Further, the best advice is to be appropriately invested all the time. Trying to time the market is usually a fool’s errand.

Client Positioning

We take a long-term view that focuses on compounding returns in a tax-efficient manner. We allocate the bulk of our clients’ equity exposure to “quality growth” companies that possess durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. We generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate our investment thesis and retaining stocks of companies with solid fundamentals. We believe this investment philosophy affords our clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

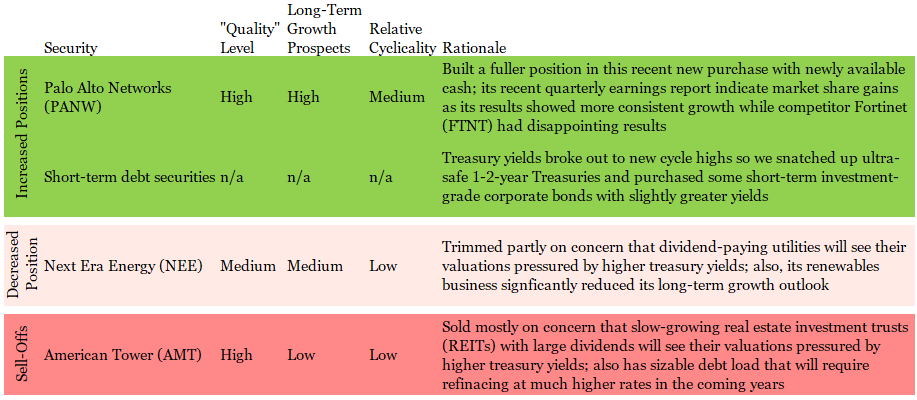

Our investment philosophy is well suited in this environment of increased consternation around higher interest rates. Companies that can continue to grow their earnings through a period of rapidly rising interest rates and a potential slowing of the economy ought to perform better than companies that (1) shoulder a hefty debt load, (2) are being sold in favor of bonds, or (3) face materially higher costs of needed capital. In the third quarter we took steps to reduce or eliminate positions in companies that fall into the first two buckets.

In its place we mostly purchased 1–2-year U.S. Treasuries and short-term corporate bonds that pay 5-6% yields. Recall that bond prices have an inverse relationship with interest rates, so as interest rates rise, bond prices go down. The longer the debt maturity, the more risk an investor faces from higher rates. We are keeping most of our clients’ bond portfolios in securities with a “duration” (a measure of interest risk) of under three years so there is less bond price risk and we can reinvest maturing bonds at higher interest rates if rates stay high.

Figure 3: Portfolio Changes in Majority of Client Accounts in 3Q 2023

Sources: Glass Lake Wealth Management

Looking ahead, we are likely to continue shifting some client assets to bonds and away from stocks if Treasury yields continue to climb higher and/or stocks rally in the fourth quarter. Still, we are likely to hold the overwhelming majority of client assets in stocks when their investment horizon is at least a decade. Special attention will be made to avoid companies with a lot of debt in this new environment of higher interest rates.

You can expect us to continue to abstain from stocks in the banking, traditional energy, and other long-term challenged industries. We will also continue to avoid the most speculative areas of the market such as unprofitable growth companies, SPACs, cryptocurrency plays and meme stocks. As always, we will keep an open mind and be on the hunt for the next great long-term investment.

We hope you and your loved ones stay happy, healthy, and wealthy this fall.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.