Planning Possibilities Stemming from the One Big Beautiful Bill Act

By Jim Krapfel, CFA, CFP

November 3, 2025

In my August financial planning blog, I identified key winners and losers from the July 4th passage of the “One Big Beautiful Bill Act” (OBBBA). I explained how the OBBBA retains tax favorability for middle- to upper-income and wealthy households, with added sweeteners for mortgage owners in high tax areas, seniors, tip collectors, overtime workers, young families, and educators. I also pointed out that this arguably comes at the expense of future generations, with a broad swath of student loan borrowers, ACA healthcare plan customers, Medicaid recipients, and frequent gamblers about to feel the pain.

In this blog, I identify how the bill’s provisions might impact financial decision making. Areas that I explore include: (1) how to fully benefit from tax eliminators, deductions and credits; (2) how certain big purchases could become more advantageous; (3) implications for contributing to minor investment accounts; (4) charitable giving optimization; and (5) what existing student loan borrowers ought to do.

Tax Minimization

As detailed in my August blog, the OBBBA contains a host of tax provisions. The most meaningful element is making permanent the 2017 individual tax cuts that were set to expire in 2026. It also quadruples the state and local tax (SALT) deduction (through 2029), eliminates taxes on tips and overtime (through 2028), adds deductions for seniors and auto loan owners (through 2028), and expands the child tax credit (permanent), all subject to income limits.

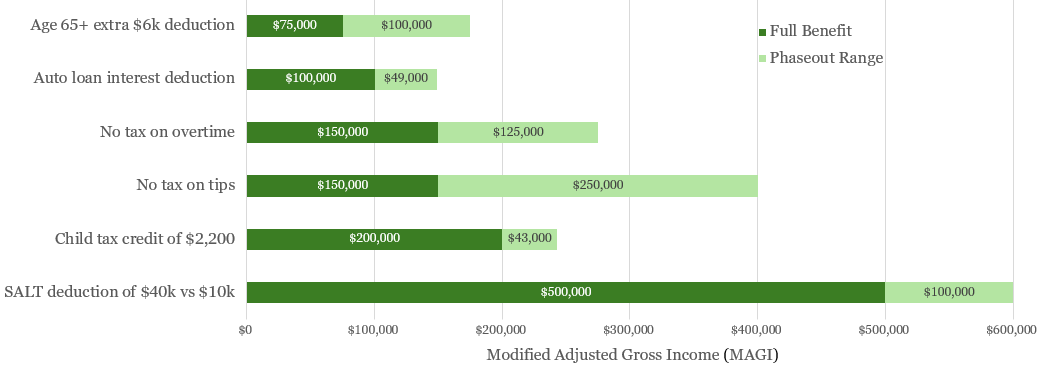

Figure 1: Tax Benefit Phaseouts for Single Filers

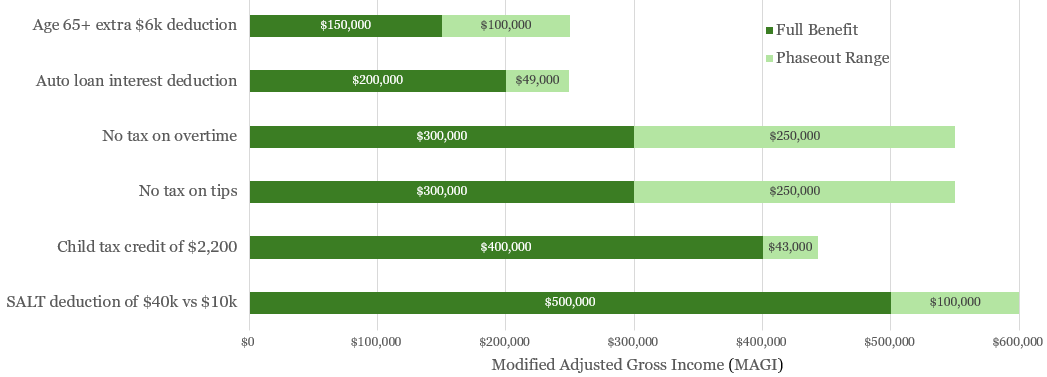

Figure 2: Tax Benefit Phaseouts for Married Filing Jointly (MFJ) Filers

Source: Glass Lake Wealth Management analysis

Notes: (1) for purposes of calculating taxable income subject to these tax benefits, MAGI is the same as adjusted gross income (AGI; line 11 of Form 1040) for the vast majority of tax filers; (2) applicable tax benefit is ratably reduced to $0 within its phaseout range

The law could give credence to either deferring or accelerating taxable income, depending on one’s situation. A reason to defer income would be to take advantage of all the new tax eliminators, deductions, and credits that do not apply (or only partially apply) if you earn too much. A reason to accelerate income would be to take advantage of these historically low tax rates that although made “permanent”, could be reset higher by a future administration and Congress.

Some ways to defer, or reduce, taxable income include:

Prioritize pre-tax retirement account contributions over Roth contributions, and maximize the contribution

Contribute the maximum allowed to HSA accounts (my blog on HSA benefits here)

“Tax-loss harvest” losing investments to offset capital gains and report a capital loss of up to $3,000 (with unused losses carried forward to future tax years), and wait to buy back losing investments until at least 30 days have passed (to avoid a wash sale, which defers loss recognition)

Avoid asset sales that would generate a capital gain, especially those held under 1 year

Business owners can either defer revenue by waiting to collect money from customers until the new year or accelerate expenses by paying vendors faster, prepaying expenses, or pulling forward a large purchase (especially with the permanent reinstatement of 100% bonus depreciation)

Some ways to accelerate taxable income or otherwise optimize long-term taxability include:

Prioritize Roth retirement contributions over pre-tax, traditional contributions (my blog on Roth benefits here)

Convert a portion of pre-tax retirement money to a Roth (my blog on Roth conversions here)

Take capital gains when you would like to reduce a position, preferably at the lower tax rates applicable to long-term capital gains, or positions held at least one year

Take larger than required distributions from your pre-tax retirement account provided you are at least 59 ½ (so no penalty applies)

Big Purchase Decision Making

The OBBBA makes it somewhat more advantageous to buy a home or finance a car purchase.

One of the virtues of owning a home is that it carries meaningful tax benefits. A homeowner can deduct real estate taxes and mortgage interest (on the first $750,000 of mortgage debt). However, the old $10,000 deduction limit on SALT -- which cover state and local income taxes and real estate and personal property (such as vehicles) taxes -- meant that only about 10% of filers in recent years had enough itemized deductions to overtake their standard deduction, which is $15,750 for individuals and $31,500 for MFJ filers in 2025. (Itemized deductions also consist of charitable contributions and medical expenses that exceed 7.5% of AGI.)

The new $40,000 deduction limit on SALT will allow more tax filers to benefit from itemizing. Homeowners who either live in a high-income tax city and state and a high property tax municipality will benefit the most from the change. Further, since average mortgage rates are over 6% currently, home buyers who finance much of their purchase will enjoy substantial tax savings.

For example, take a married couple with $300,000 of taxable income, living in a city with 5% combined state and local income taxes, 1.2% effective home property tax, buying a $1,000,000 home with 20% down and a 30-year fixed mortgage at 6%. They would have $71,540 of itemized deductions from SALT and mortgage interest in the first year of home ownership, which is worth an extra $40,040 deduction (and $9,610 of tax savings) versus taking their standard deduction. Under previous SALT limits, itemized deductions would be limited to $54,540. The expanded SALT limits are worth an additional $4,080 (($71,540 – $54,540) * 24% marginal tax rate) in tax savings here.

There are two key disclaimers. First, the SALT limit is scheduled to revert to $10,000 in 2030, so the duration of tax savings will be limited unless extended by future legislation. Second, taxes should not be the driving force behind such a big purchase decision. As I blogged a couple years ago, it is often advisable to rent rather than buy unless you expect to stay put for at least seven years given the ongoing housing affordability challenges. Taking this tax change into account, perhaps the break-even rule of thumb can be adjusted to six years.

The tax law’s impact on the car purchase decision is less pronounced, but worth mentioning. Someone financing a $50,000 vehicle purchase over five years at 6% would be paying about $1,600 of annual interest, on average, over the life of the loan. With the allowed deduction on auto loan interest, someone in the 22% marginal tax bracket would effectively be saving about $350 per year on taxes. The key limitations to the auto loan tax benefit are the relatively low income phaseout ranges (see Figures 1 and 2), its applicability only through 2028, and the requirements for the vehicle to be new and assembled in the United States.

Contributing to Minor Investment Accounts

The two big changes to minors’ investments accounts pertain to making 529 plans more robust and introduction of Trump accounts. The overall takeaways are that 529 plan contributions can be biased upwards but Trump account contributions can generally be avoided.

The OBBBA makes 529 plans more advantageous in several ways. First, it expanded the number of K-12 expense categories eligible for tax-free withdrawal. Previously, only K-12 tuition was eligible, but now books, curriculum materials, testing fees, and tutoring costs are included. Second, it doubled the allowed K-12 annual expenses to $20,000. Third, it introduced an unlimited number of payments towards qualified postsecondary credentials, including tuition, materials, exam fees, and ongoing continuing education costs for licensing, certification and credentialing programs (like the CFA, CFP, CPA).

The introduction of Trump accounts is also worth discussing. The key benefit of these accounts is that the government will make a one-time $1,000 contribution to each American citizen baby born from 2025-2028. Details and timing of the government contribution are still being ironed out, but parents will probably have to check a box on a tax form testifying that they are new parents.

What is clear is that Trump accounts are rarely worth loved ones’ contributions. The primary drawbacks of the accounts concern the taxability of the accounts and withdrawal limitations. The accounts take on many aspects of traditional IRAs, such as tax-free growth, early withdrawal penalty before age 59 ½, required minimum distribution rules (reportedly likely to be the case once fully defined), and distributions taxed as ordinary income. However, contributions are non-deductible.

Better alternatives to Trump account contributions include some combination of 529 plan investments, Roth IRA contributions, and taxable UTMA/UGMA custodial accounts. The primary benefits of 529 plans are the tax-free growth and tax-free distribution for eligible education payments (see my blog on why 529 plans are best in class). The primary benefits of Roth IRAs are the multi-decade tax-free growth and tax-free distribution, provided the child is eligible to contribute by having earned income (is working). The primary benefit of custodial accounts is that the child gains control of the account at age of majority (18 in most states), though undesirable kiddie taxes apply when unearned income crosses $2,700.

Charitable Giving

The charitable giving changes that become effective in 2026 alter the strategy somewhat. I’ll run through a couple of scenarios to see what can be done to maximize the tax savings.

Scenario #1: a tax itemizer would like to donate cash or property to charity

An effective strategy could be to accelerate some planned 2026 and beyond giving into 2025 because starting in 2026, charitable giving has a new 0.5% floor on AGI. This means that for someone with an AGI of $300,000, the first $1,500 of any giving would not count as a deduction starting next year. Since this person already plans to itemize in 2025, all charitable giving will be deductible this year. If someone resides in the 37% marginal tax bracket (taxable income >$626,350 for single filers and >$751,600 for MFJ filers in 2025), then there is further reason to accelerate giving because the value of itemized deductions will be capped at 35% starting in 2026.

Scenario #2: a non-itemizer would like to donate cash to charity

An effective strategy could be to wait until 2026 to make the donation because starting in 2026, single filers can deduct up to $1,000 and MFJ filers can deduct up to $2,000 of cash donations (must be cash) to qualifying charities even if they do not itemize. A non-itemizer would receive no tax deduction if he or she donates in 2025.

Student Loans

For existing student loan borrowers, the new provisions ought to spur a prioritization of paying down loans for a couple reasons. First, those on the popular Saving on a Valuable Education Plan (SAVE) had interest resume accruing in August. Required payments have not resumed but interest capitalizes if no payment is made, meaning unpaid interest is added to the loan’s principal balance.

Second, it will be much more difficult to qualify for loan forgiveness. By July 2028, borrowers under SAVE, Pay As You Earn (PAYE) and Income-Contingent Repayment (ICR) plans must switch to either the existing Income-Based Repayment (IBR) plan or the Repayment Assistance Plan (RAP) that launches in July 2026. IBR and RAP require much greater monthly payments than the sunsetting plans, so loan balances are unlikely to persist long enough to qualify for forgiveness unless the borrower is already within a few years of qualifying for forgiveness.

If a SAVE borrower is close to having the requisite number of monthly student loan payments to qualify for forgiveness, then it is imperative to immediately switch to the IBR plan, which retains forgiveness timelines of 25 years for pre-2014 loans and 20 years for post-2014 loans. Any future payments while on SAVE do not qualify towards forgiveness timelines.

For those unlikely to qualify for forgiveness, they should prioritize paying down student loan balances over other contributions options, such as to a retirement plan that is not employer matched (do prioritize employer-matched dollars) or to a brokerage account, especially if the student loans carry an interest rate of at least 6%.

Bottom Line

The recent passage of the OBBBA creates a host of planning opportunities, and I have covered just a few here. Many opportunities arise from the tax changes. You should see if you are likely able to fully benefit from the new tax eliminators, deductions and credits, and if not, if there are ways to reduce your taxable income enough to do so. Alternatively, you might be best advantaged in this low tax regime by favoring all Roth contributions, for example.

Those who are on the fence about a house or car purchase, have kids or grandchildren, are charitably inclined, or possess student debt might also consider planning adjustments. Consult with your accountant and/or financial advisor to see what actions you should pursue given your unique situation.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, tax, legal, insurance nor accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.