Alphabet Changes its Narrative to an AI Disruptor

By Jim Krapfel, CFA, CFP

December 1, 2025

Background

I first purchased Alphabet (ticker GOOG) for my personal account in May 2016 at a split-adjusted price of $35.65. The investment thesis at the time was that Google would continue to dominate search and that the company would benefit from the long-term trend of advertisers shifting their spending to online.

I have consistently purchased Alphabet for client accounts since my firm’s founding in April 2020. As of November 30, it was the 5th largest aggregate stock position across client accounts.

Company Introduction

Alphabet, formerly known as Google, is an advertising behemoth. It is largely known for its search engine, but it additionally generates advertising revenue from its YouTube service and from its Google Network properties.

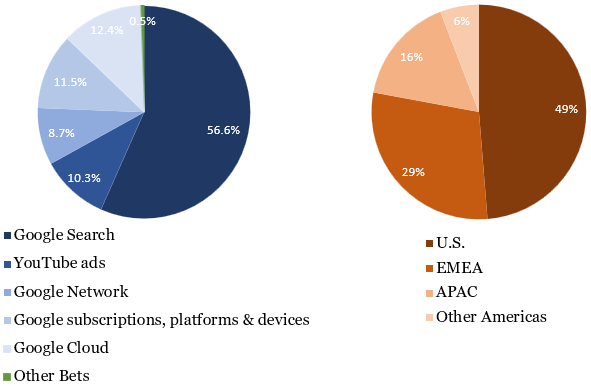

Revenue and operating income are reported in three segments – Google Services, Google Cloud, and Other Bets. Google Services revenue is further broken by type, including Google Search & other; YouTube ads; Google Network; and Google subscriptions, platforms, and devices. A description of each revenue type follows:

Google Search & other: advertising revenue from Google search, Gmail, Google Maps, and Google Play

YouTube ads: advertising revenue from YouTube

Google Network: advertising revenue from Google Network properties participating in AdMob, AdSense and Google Ad Manager. AdMob helps app makers make money by showing ads inside their apps; AdSense helps small and medium-sized websites, bloggers and creators place ads on their content; and Google Ad Manager works with big companies that need advanced tools to sell and manage their ad space.

Google subscriptions, platforms and devices: primarily consists of (1) consumer subscriptions such as YouTube TV, YouTube Music and Premium, NFL Sunday Ticket, and Google One; (2) Google Play sales of apps and in-app purchases; and (3) sales of Pixel devices

Google Cloud: primarily consists of (1) Google Cloud Platform, which generates consumption-based fees and subscriptions for AI infrastructure, Vertex AI platform, Gemini for Google Cloud, cybersecurity, and data and analytics; and (2) Google Workplace, which includes subscriptions for Calendar, Gmail, Docs, Drive, and Meet

Other Bets: includes businesses in various stages of development, ranging from those in the R&D phase to those that in the beginning stages of commercialization. The most notable business here is Waymo, its fully autonomous, paid ride-hailing service that is operating in five U.S. cities as of November 28th.

Figure 1: Revenue Breakdown in 2024

Source: Company filings

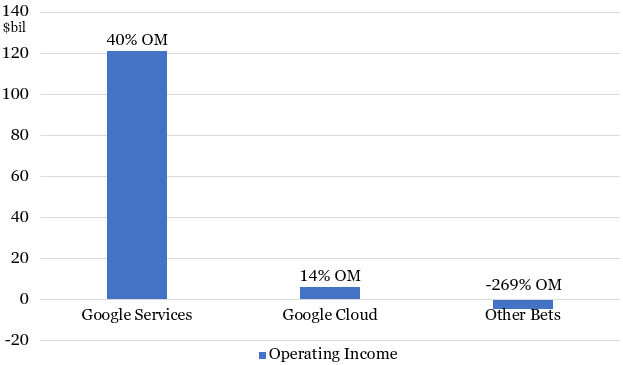

Figure 2: Operating Income and Operating Margins* by Segment in 2024

Source: Company filings

*Before unallocated corporate costs

The company is headquartered in Mountain View, CA and is the third largest company by market capitalization ($3.86 trillion). The company’s history includes the following noteworthy items: its founding in 1998 by Larry Page and Sergey Brin (Stanford PhD students), Google Search launching to the public in 1999, going public with a $23 billion valuation in 2004, acquiring Android in 2005 for ~$50 million, acquiring YouTube in 2006 for $1.65 billion, launching Chrome web browser in 2008, changing its name to Alphabet in 2015, and a 20-for-1 stock split in 2022.

Investment Thesis

Alphabet stands out as one of the strongest long-term compounders in the stock market. This assertion was seriously questioned as recently as several months ago as upstarts’ AI-powered chatbots gained popularity. The fear was that users accustomed to Google searches for their inquiries would leave in droves for the likes of ChatGPT or Perplexity, or at the very least, Google searches, its core profit engine, would be less profitable in “AI Overview” and “AI Mode”. Instead, overall Google search query growth rates have accelerated the past couple quarters, and the company said it is seeing monetization of AI Overviews at about the same rate as a regular search result.

Very recently the AI narrative on Alphabet improved further. The company released its latest chatbot, Gemini 3, on November 18, 2025. Within a few days it gained widespread recognition as the best AI chatbot. Rather than competing against Search, Gemini 3 has been fully integrated into it, enhancing search results with conversational AI responses while preserving the advertising formats that drive revenue. The result is a more powerful search experience that provides faster, deeper answers while still guiding users toward sponsored listings.

Competing AI chatbots may leapfrog each other on performance but with billions of daily searches feeding training data back into the system, Google enjoys an AI feedback loop no competitor can replicate. Google also differentiates itself by successfully manufacturing its own chips, in partnership with chip designer Broadcom (ticker AVGO), at a significantly reduced cost. Perhaps most critically, unlike its primary chatbot peers, Google does not rely on external financing to fund its growth.

YouTube and Google Cloud provide two powerful growth engines that meaningfully supplement growth at Google Search. YouTube continues to benefit from secular shifts in media consumption as viewers migrate from traditional television toward streaming and short-form video. The platform’s unmatched global creator ecosystem keeps user engagement growing, while monetization deepens through multiple channels: advertising, subscription products like YouTube Premium and YouTube TV, and emerging commerce and creator-support tools.

Google Cloud revenues, driven by enterprise technology spending rather than consumer advertising cycles, should continue to grow as businesses modernize their infrastructure and increasingly adopt AI tools. The business has tremendous operating leverage as scale expands, positioning it to contribute both growth and margin improvement to Alphabet’s overall financial profile.

There also exist upside if Waymo can profitably scale its Waymo fully autonomous ride-hailing business over the next 5-10 years. Many analysts attribute around 50% of competitor Tesla (ticker TSLA)’s $1.4 trillion valuation to robotaxis, so major success at Waymo could be a needle mover for Alphabet’s valuation.

Economic Moat

I believe Alphabet possesses a wide economic moat, or sustainable competitive advantage, due to a combination of network effects, switching costs, and intangible assets. This should allow the company to generate strong profitability metrics and returns on invested capital for many years to come.

Alphabet operates at a scale that is extraordinarily difficult for any competitor to match. Google Search accounts for approximately 90% of global search traffic, giving the parent company access to the richest dataset in the world about what people want, need, and intend to do. This data advantage feeds back into better search quality and more accurate ad targeting, creating a powerful network effect: more users attract more advertisers, which funds more innovation, which attracts even more users. Competitors face a catch-22 — without comparable data and traffic, they cannot achieve the same quality, which prevents them from gaining users in the first place.

Another major component of Alphabet’s moat is its ecosystem integration. Products like Android, Chrome, Maps, Gmail, YouTube, and Google Photos are used by billions of people every day. These products reinforce one another and create high switching costs. For example, a user with years of photos stored in Google Photos, documents in Google Drive, a Gmail address, and an Android phone tied to their Google account is unlikely to switch to another ecosystem. This breadth of touchpoints ensures that Alphabet is embedded deeply in the daily routines of its users worldwide. Few companies possess such a broad and sticky set of consumer products.

Alphabet’s technological edge further strengthens its moat. The company has been working on artificial intelligence for over a decade, producing innovations such as Transformers, TPUs (its own custom AI chips), and advanced large language models. Its unique combination of talent, research infrastructure, and proprietary hardware gives it an advantage that new entrants cannot easily replicate. Meanwhile, Alphabet’s global data center footprint, submarine cables, and cloud infrastructure require tens of billions of dollars of spending that only a handful of companies can match. This deep infrastructure allows Alphabet to operate and iterate at a scale competitors struggle to reach.

Finally, Alphabet’s financial strength reinforces all these advantages. Its highly profitable ads business generates enormous cash flow, enabling continuous reinvestment in moonshots like Waymo and next-generation AI systems. These long-term bets could create entirely new revenue streams while strengthening core ones.

Growth, Profitability & Valuation

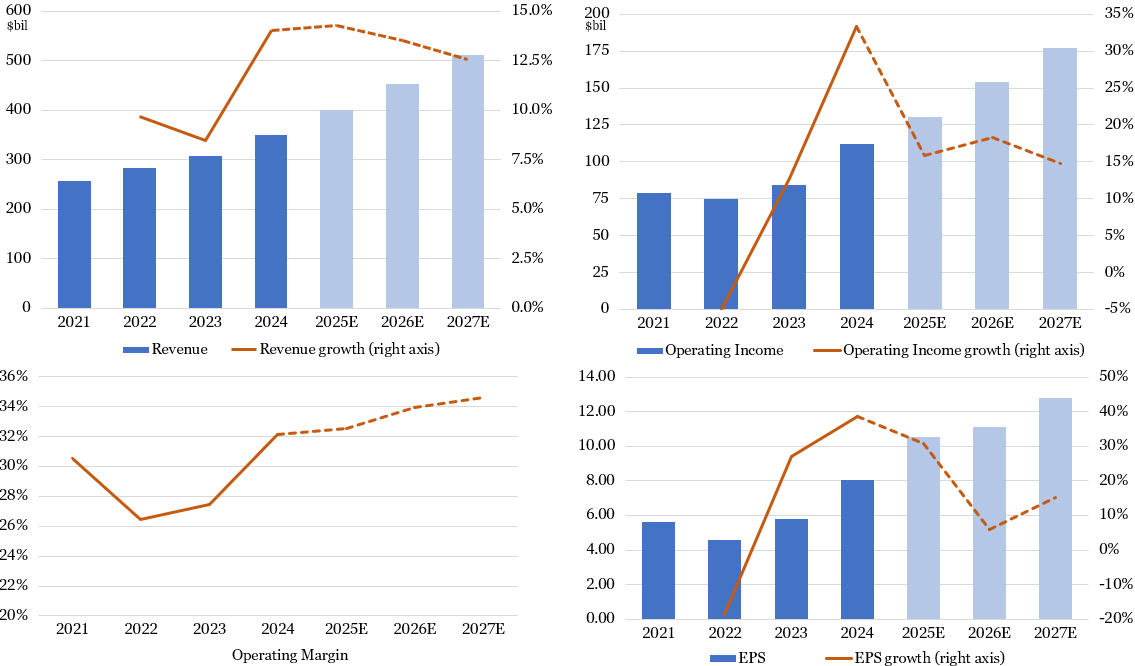

In the near-term, I believe there is a good chance that Alphabet can accelerate its overall organic (excluding foreign currency impacts) revenue growth rate beyond the 15% growth it reported last quarter. Google Search, 57% of its revenue, ought to see improved engagement due to the launch of Gemini 3, and Google Cloud, 12% of revenue, should see continued growth acceleration due to AI infrastructure demand. Over the next several years, I expect the company to sustain mid-teens revenue growth, higher than analyst consensus growth expectations of 13% for 2026 and 2027.

Alphabet also has scope for margin expansion over time. Although rapidly rising capital expenditures, guided to 23% of revenue in 2025 and higher still in 2026, will increase its depreciation expense in the coming periods, it should be able to keep costs in check elsewhere. Also recall that Google Cloud has significant operating leverage (as the business scales, costs grow at a much slower rate than revenue). Mid-teens revenue growth, flat to up profit margins, and 1-2% annual reduction in share count from share repurchases ought to produce a sustainable EPS growth rate in the high-teens to low-20s over the next five years.

Figure 3: Alphabet Has a Strong Growth Profile Despite Enormous Size

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Alphabet’s valuation has risen in tandem with its improved operating metrics and narrative turnaround. Its next 12 months’ (NTM) price to earnings (P/E) multiple has risen from 19x averaged in the first half of 2025 to 30x at present, a premium to the S&P 500’s 22x. I believe the premium is warranted when considering its structural competitive advantages in its businesses that benefit from significant long-term growth drivers, and clean balance sheet (cash well in excess of debt).

Key Risks

No doubt, the biggest idiosyncratic, or company-specific risk, is how Google Search will evolve and perform as AI reshapes consumer behavior. Although many competitive concerns around Search have recently abated, they could quickly resurface if key performance indicators at Search or Gemini weaken. There is a related risk that to maintain its competitive positioning, it is compelled to increase its capital expenditures to the point that its profit margins come under pressure.

Alphabet also faces omnipresent regulatory and legal pressures from governments around the world. Ongoing antitrust actions targeting Google’s dominance in search, digital advertising, and mobile distribution could result in fines, operational restrictions, or remedies that weaken some of the company’s most valuable distribution advantages, such as default search placement agreements or preferential positioning of its own services across platforms.

Alphabet also faces above average cyclical risks. Its revenue remains heavily tied to advertising cycles, making results vulnerable to global economic slowdowns that reduce marketing spend.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.