Amazon’s True Earnings Power is Just Beginning to Show

By Jim Krapfel, CFA, CFP

March 1, 2024

Background

I first purchased Amazon (ticker AMZN) for my personal account in January 2020 at a split-adjusted $95.64/share. Of course, I did not foresee the Covid-19 pandemic soon taking hold and how Amazon would be a major beneficiary from the lockdowns (and consumer spending shift to online purchases) that ensued.

Clients of Glass Lake Wealth Management have owned Amazon since their onboarding that dates to April 30, 2020. The first client shares were purchased at a split-adjusted price of $122.31/share.

In December 2023, I increased our position in Amazon by trimming shares of Alphabet (ticker GOOG) in most client accounts because of my belief that Amazon had superior fundamental prospects in 2024 and beyond. Amazon was the 6th largest aggregate stock position as of February 29, 2024.

Company Introduction

Amazon is best known as the largest online retailer in the United States. However, most of its profits come from its cloud infrastructure business called Amazon Web Services (AWS).

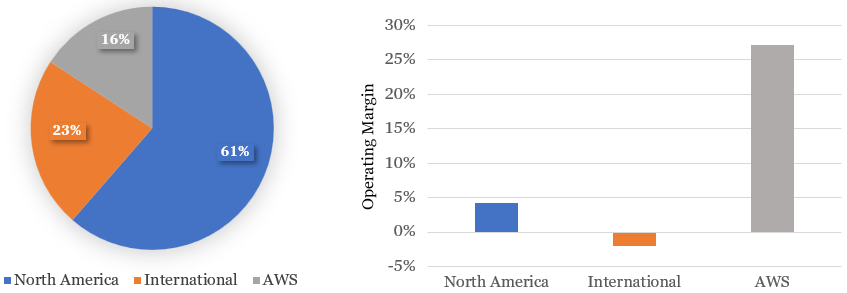

Amazon reports its results through three segments – North America, International, and AWS. The North America and International segments house all its businesses outside of AWS. Segment revenue and profitability metrics are below.

Figure 1: Revenue and Operating Margins by Segment in 2023

Sources: Company filings

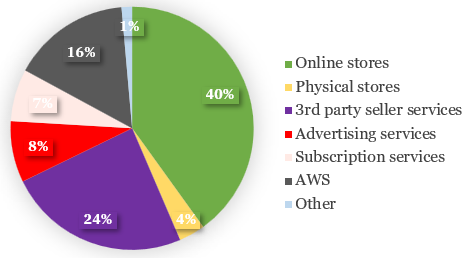

In its annual 10-K filing, Amazon breaks down its revenue further:

Online stores – includes a wide selection of consumable and durable goods like media products available in both a physical and digital format, such as books, videos, games, music and software

Physical stores – mostly comprised of its Whole Foods business, acquired in 2017

Third-party seller services – includes commissions and any related fulfillment and shipping fees when the seller is some entity other than Amazon

Advertising services – includes sponsored ads, display ads, and video ads

Subscription services – includes fees associated with Amazon Prime memberships (currently offered at $14.99/month or $139/year), as well as digital video, audiobook, digital music, e-book, and other non-AWS subscription services

AWS – includes virtualized computing resources provided via the Internet, such as servers and data centers

Other – includes various other offerings, such as licensing and distribution of video content, health care services, shipping services, and its co-branded credit card agreements

Figure 2: Sales by Type in 2023

Sources: Company filings

Amazon was founded in 1994 by Jeff Bezos, went public in 1997 at a split-adjusted price of $0.075/share, and has a market capitalization of $1.8 trillion. Long-time AWS executive Andy Jassey took over the CEO duties from Bezos in 2021. The company was added to the Dow Jones Industrial Average on Monday, February 26th.

Investment Thesis

We own Amazon as a long-term investment for three primary reasons: (1) it has strong, sustainable growth in its high-margin AWS business; (2) a persistent shift of consumer spending to online where Amazon thrives; and (3) its margins appear to be in the early stages of major expansion. Let us dive into each of these points.

(1) Strong, sustainable growth in its AWS business

I believe about half the value of Amazon lies in its AWS cloud infrastructure business. This should continue to be a great business with a clear growth driver in companies continuing to deploy a greater proportion of their information technology workloads with third-party cloud infrastructure providers such as AWS instead of managing themselves on-premises. Firms benefit from outsourcing for a variety of reasons, including cost efficiency, scalability, performance, innovation, global reach, data analytics, compliance, and security.

Market research firm Spherical Insights estimates the global cloud infrastructure services market size will reach $588 billion by 2032, a cumulative annual growth rate of 18% relative to the $114 billion estimated market size in 2022. In the nearer term, industry growth rates ought to accelerate due to companies spending more aggressively on artificial intelligence-driven new applications that drive growth and increase efficiencies. Although AWS’ worldwide market share, 31% as of the fourth quarter of 2023, has slipped some in recent years, it should continue to garner a high share of future spending growth.

(2) Persistent shift of consumer spending to online

The other half of Amazon’s value ought to do well over time, as well. Its online retail business, to which the company is most known for among consumers, has long been a beneficiary of consumers shifting their spending away from stores and towards more convenient online purchases. The Covid-19 pandemic really accelerated that trend in 2020 and the first half of 2021, but as society reopened and people began to go to stores again and prioritize experiences over things, Amazon suffered a Covid hangover from the second half of 2021 until the third quarter of 2023.

Now that the worst of Covid-19 is long in the rear-view mirror and much of the pent-up demand for travel and experiences has been fulfilled, the online retail industry ought to resume a somewhat faster pace of growth. Amazon should secure an outsized proportion of that growth. In fact, in a research note, Morgan Stanley cited that Amazon captures over 50% of the growth in online retail spending growth in the United States and 37% of the growth across bricks & mortar and online.

(3) Margins on the rise

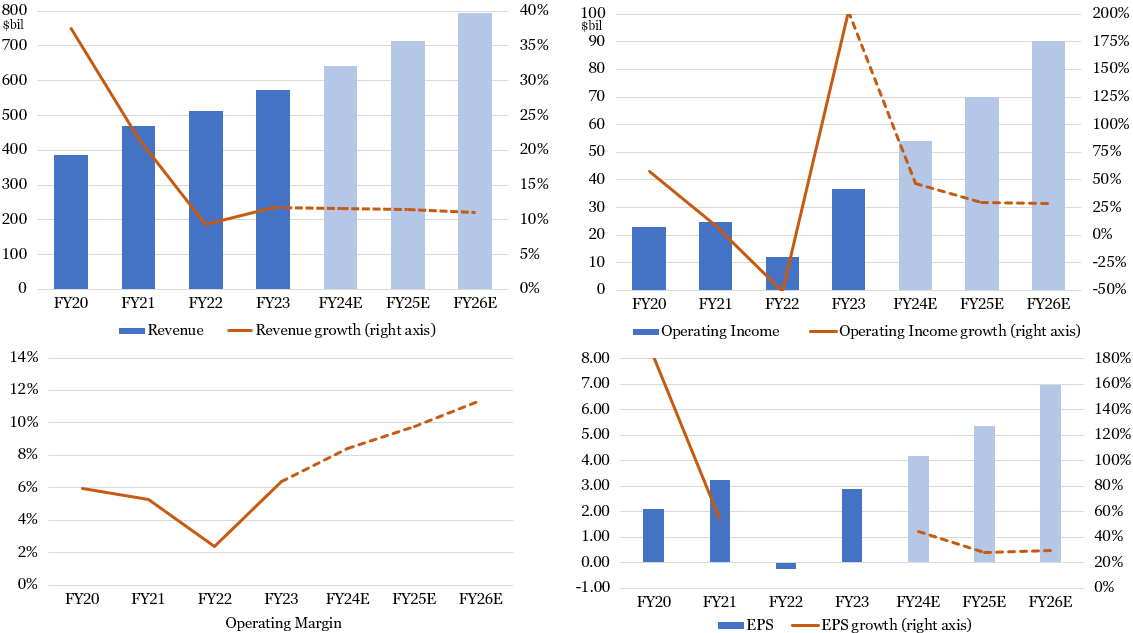

Founder and longtime CEO Jeff Bezos is truly a visionary that built Amazon into the online retail and cloud infrastructure behemoth it is today. However, he was not known for his spending discipline. Upon relinquishing his CEO duties to Andy Jassy in July 2021, he had already committed the company to spend vast sums to further build out its fulfillment network under the false premise that its pandemic-driven supercharged growth would not seriously falter. Instead, the Covid-19 growth hangover ensued, leading to a substantial decline in margins and earnings from the second half of 2021 through 2022. In 2022, the company even produced a slight loss and generated negative $12 billion in free cash flow (operating cash flow less capital expenditures).

Upon taking over, Jassy quickly recognized the level of overinvestment in the organization and took a keener approach to profitability. It took some time for the spending commitments (i.e. new warehouses finishing construction) to run their course, but he allowed the company to grow into its excess capacity. In 2023, operating margins improved by 4 percentage points to 6.4%, earnings spiked, and it generated $37 billion of positive free cash flow. I expect continued spending discipline will be a major contributing factor to Amazon’s margins reaching new heights in 2024 and beyond.

Another boost to margins should come from strong growth from its very high margin advertising revenue. Over many years, Amazon has been growing its advertising revenue by over 20% annually via initiatives such as placing more sponsored ads into product search results. Advertising revenue should get a further boost as Amazon launched ads on Prime Video on January 29. Users must pay extra to not see ads. Growth in advertising revenue is a major driver for higher margins because those revenue streams carry around 68% operating margins (versus 6.4% for all of Amazon), Morgan Stanley estimates.

Economic Moat

I believe Amazon owns a formidable economic moat, or sustainable competitive advantage, due to cost advantages in AWS and retail businesses, switching costs in AWS, and network effects in retail. This should allow Amazon to price its offerings such that returns on its invested capital easily exceed its cost of capital, thus creating shareholder value.

Scale matters tremendously in cloud infrastructure and AWS has that. As seen below, AWS enjoys the largest worldwide market share in cloud at 31%. Its size allows it to spend vast sums to meet demand. In 2023, Amazon spent $48 billion on capital expenditures, the majority of which was to support AWS business growth. Few companies have the financial resources to keep up with Amazon’s investment pace.

Figure 3: Market Share in Global Cloud Infrastructure in Fourth Quarter of 2023

Source: Statistica. “Amazon Maintains Cloud Lead as Microsoft Edges Closer.” 2/5/24. https://www.statista.com/chart/18819/worldwide-market-share-of-leading-cloud-infrastructure-service-providers/

Once a customer of AWS, pretty much always a customer. AWS benefits from significant customer switching costs because of the time and expense of integrating applications with core software elements. The operational risks of changing mission-critical technology are too high to justify switching cloud infrastructure providers to save a small amount of money.

In retail, it enjoys cost advantages in a couple forms. In my opinion, the most significant cost advantage results from its vast logistics network that consists of warehouses, trucks, planes, and delivery vehicles. Amazon saves money and better controls the fast movement of goods versus utilizing UPS or FedEx. Amazon’s size also gives it bargaining power over its suppliers, leading to lower procured prices over smaller retailers.

Its retail business possesses strong network effects too. Amazon Prime memberships help attract and retain customers who wish to spend more with Amazon to take advantage of one-click online shopping with fast delivery and easy returns. Its large pool of buyers attracts more third-party sellers, the source of over half of all goods sold on Amazon, which helps keep prices competitive and increase selection. More sellers attract more buyers, which attracts more sellers.

Growth, Profitability & Valuation

Amazon’s non-AWS businesses, as represented by its North America and International segments, should sustain revenue growth in the 8-12% range over the next five years given the ongoing shift to online spending, Amazon’s capture rate of that growth, and an advertising business (10% of these segments’ revenue) that has a long runway of strong growth. Meanwhile, I expect AWS growth to accelerate to at least the mid-teens over the next couple of years (from its 12% trough growth rate) driven by demand from artificial intelligence, before ultimately leveling off to the 10-12% range. It total, Amazon ought to grow revenue by at least 10% for years to come.

The coast is clear for Amazon to realize profit margins much higher than it has ever achieved. I expect AWS’ operating margins to remain in the high-20s to low-30s range, but the big swing factor will be how high its non-AWS business margins can expand. I am excited to see if its North America segment can ultimately produce double-digit operating margins versus the 4.2% operating margins it had in 2023.

Figure 4: Amazon’s Profits Should Soar to New Heights

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Amazon has always appeared to be an expensive stock because the true earnings power of the company had been masked by its economic moat-building investments in cloud and fulfillment. Now that margins finally appear to be on a sustainable path of expansion, analysts’ EPS estimates have risen accordingly. So, despite the stock’s 116% appreciation off its December 2022 lows, its next 12 months’ (NTM) price to earnings (P/E) multiple has contracted to 41x from 60x. As earnings continue to rise, I expect the stock to follow suit while maintaining an earnings multiple well ahead of the S&P 500 at 21x NTM.

Key Risks

The largest idiosyncratic, or company-specific, risk facing Amazon is that its competitive advantages in AWS erode over time. Microsoft’s Azure and Google Cloud have already been growing their cloud infrastructure businesses at faster rates than AWS. If these and other cloud providers’ solutions prove better equipped in this new era of artificial intelligence-driven demand, then AWS’ market share declines could accelerate.

Amazon also faces a high degree of sensitivity to retail spending and business confidence. If consumers retrench their spending or businesses slash their IT budgets, then growth rates and margins for its retail and AWS businesses should suffer.

Finally, there is omnipresent regulatory risk. Besides periodic fines, regulators could force certain changes to Amazon’s business model that could hurt profitability.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.