April 2024 Investment Letter

April 2, 2024

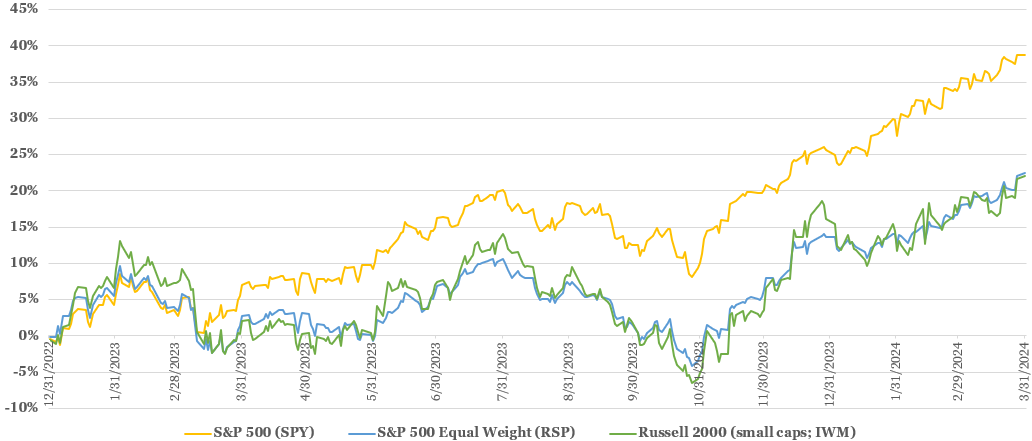

Stock markets maintained their strong momentum into the first quarter of 2024. The S&P 500, a market cap-weighted index of 500 large publicly traded companies in the U.S., jumped 10.4% higher through March, its best first quarter performance since 2019. By way of comparison, the Invesco S&P 500 Equal Weight ETF, an equal-weighted index of the same 500 stocks, increased “only” 7.8%, indicating the largest stocks led the way. Finally, the Russell 2000, a composite of 2,000 small cap stocks, lagged further at up 5.0%.

Figure 1: Stock Markets Extended Their Rally into the First Quarter

Source: Yahoo Finance (inclusive of dividends)

An intensifying market theme is how artificial intelligence (AI) will transform society and companies’ bottom lines. A significant share of the direct AI benefits appears to be accruing to the largest companies that can either derive new revenue streams or serve as arms dealers to the AI industry, such as semiconductors. However, numerous companies ought to achieve AI-driven efficiency gains, driving margins higher and ultimately acting as a disinflationary force to the economy.

The so-called “Magnificent 7” – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), NVIDIA (NVDA), Meta Platforms (META), and Tesla (TSLA) – have increasingly been examined through the AI lens. After moving mostly in tandem last year, the Mag 7 stocks have significantly diverged. NVIDIA, at the forefront of AI with its best-in-class chips, surged 82% in the first quarter, while Apple and Tesla slumped. Apple has not announced anything noteworthy related to AI, while Tesla is enduring industry-specific issues such as softening demand for electric vehicles and intensifying competition overseas such as from China’s BYD.

Figure 2: Magnificent 7 Stocks Significantly Diverged in the First Quarter

Source: Yahoo Finance (inclusive of dividends)

Notes: (1) ”Owned” indicates ownership across majority of client accounts; (2) NVDA was first purchased on January 9, 2024

Besides AI, a resilient economy is helping to support stocks. Key economic data such as gross domestic product, retail spending, consumer confidence, and initial unemployment insurance claims continues to come in largely better than expected. Most economists have abandoned their forecasts of a looming recession. Increased economic optimism portends positively to company earnings, with analysts now expecting overall S&P 500 earnings to rise 9.5% in 2024 after increasing about 4% in 2023.

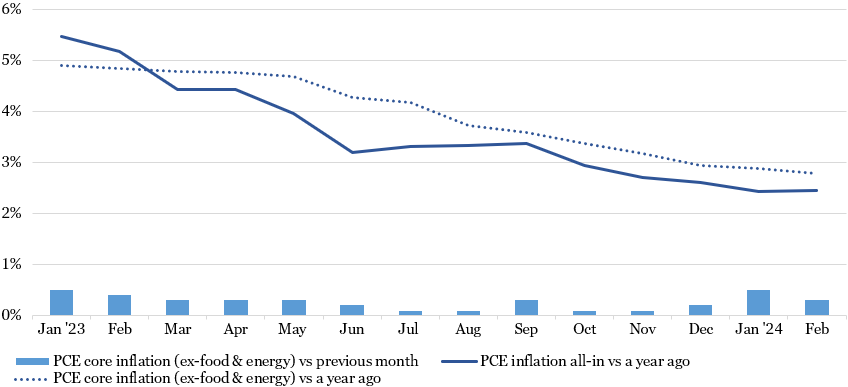

Accompanying the strong economic data has been inflation that has not slowed as quickly as economics and the Federal Reserve expected. Core PCE inflation, the Fed’s preferred inflation gauge (as opposed to CPI inflation), was 2.8% in February, down from 3.2% three months prior and 4.8% a year ago. However, the last three months of inflation readings suggest that the downward progress may have reversed. What is certain is that inflation remains above the Fed’s target level of 2%.

Figure 3: Inflation Has Decelerated, but It May Have Reached an Interim Low

Source: U.S. Bureau of Economic Analysis. https://fred.stlouisfed.org/series/PCEPI (PCE all-in inflation). https://fred.stlouisfed.org/series/PCEPILFE (PCE core inflation). https://apps.bea.gov/iTable/?reqid=19&step=3&isuri=1&1921=survey&1903=84&_gl=1*1bwojbx*_ga*MTc4MDE2NTIyNS4xNzExNjM3MTM4*_ga_J4698JNNFT*MTcxMTk4ODU2NS41LjEuMTcxMTk4OTQ3NC40My4wLjA. (PCI core inflation monthly change)

The strong economic data and still too-high inflation continue to delay the Federal Reserve’s first interest rate cut this economic cycle. The earliest that the Federal Reserve could make its first cut is likely June, and that is roughly a coin flip at present based on bond trading. In the Fed’s March 20 Summary of Economic Projections, the median FOMC participant still expects three 25-basis point rate cuts in 2024, but hawkish commentary from some members suggest there is a growing probability of just two, one, or even no cuts this year. Coming into 2024, investors expected the Fed to cut rates six times in 2024.

Market Outlook

History suggests the path of least resistance for the stock market is a continued upward move. When the S&P 500 adds 8% or more in the first quarter, it finishes the rest of the year higher 94% of the time, with an average gain of 10% over the next three quarters, according to a Wall Street Journal article citing a Dow Jones Market Data analysis of index performance since 1950.

At the same time, there are a multitude of risk factors that could cause the market to reverse lower. Negative potential catalysts include, but certainly not limited to, a tapped-out consumer (possibly driven by depletion of excess savings from pandemic-era stimulus), resurgent inflation (possibly due to continued tight labor conditions or higher oil prices), a worsening geopolitical environment (possibly caused by a Chinese invasion of Taiwan), and a “trough of disillusionment” regarding AI hype.

The upcoming presidential election is a focus for many, but it tends to not be the driving force of the stock market. The fourth year of a presidential cycle does not have substantially different returns than other years, and stock markets are mostly agnostic to the party of the president. More predictive to market performance is the composition of Congress. As the Fidelity-linked article highlights, the S&P 500 tends to do much better when Congress is divided or controlled by Republicans than when it is controlled by Democrats.

As I have often implored, it is a fool’s errand to try to predict, and act on, the direction of the overall stock market. There are countless interrelated factors that are nearly impossible to predict with enduring accuracy. Instead, I strive to tune out the noise, stay true to an asset allocation that makes sense given one’s return objectives, risk tolerance, and time horizon, and stick to individual company fundamentals.

For what little it is worth, I think the economy continues to hum, aided by AI spending and related productivity benefits. My expectation is the Fed cuts interest rates just once or twice this year and refrains from cutting rates more aggressively until recession risks escalate. Finally, I believe the pace of further stock market gains will be difficult to sustain because of somewhat elevated valuations and bond yields that can better compete for investor dollars than years’ past. Still, absent a major negative catalyst, I think stocks could easily tack on another 5-10% by year end.

Client Positioning

I take a long-term view that focuses on compounding returns in a tax-efficient manner. I allocate the bulk of my clients’ equity exposure to “quality growth” companies that possess durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. I generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate my investment thesis and retaining stocks of companies with solid fundamentals. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

The first quarter was highlighted by new purchases of NVIDIA and Deckers Outdoors (DECK), both on January 9. On NVIDIA, I had been waiting for an opportune time to get exposure to the undisputed AI leader, and the early January stock breakout from its six-month trading range provided the impetus to a “now or never” buy proposition. Meanwhile, I made the seemingly correct decision to replace Nike (NKE), sold in December, with Deckers instead of Lululemon (LULU). Deckers surged following its February 1 earnings release while Lululemon tanked following its March 21 earnings release.

Figure 4: Portfolio Changes in Majority of Client Accounts in 1Q 2024

Source: Glass Lake Wealth Management

Looking forward, I am eyeing a couple stocks for new purchase and will strike if the price is right and company fundamentals remain strong. There are also a couple of owned stocks I will be monitoring closely for any fundamental disappointment. As always, you can expect me to abstain from stocks in long-term challenged industries such as banking, traditional energy, airlines, and autos. I will also continue to avoid the most speculative areas of the market such as unprofitable growth companies and pump-and-dump meme stocks.

Overall asset allocation is likely to remain near current levels. If bond yields and stock prices each move higher, then I may increase clients’ fixed income allocations. Conversely, if bond yields and stock prices each decline, then I could buy more equities. Note that except for those with shorter investment horizons, the vast majority of client assets are already in stocks because of their penchant to generate far greater long-term wealth than bonds.

I hope you and your loved ones have a happy, healthy, and wealthy spring season.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.