April 2025 Investment Letter

April 2, 2025

In the first quarter the stock market experienced increasing volatility as it grappled with heightened uncertainty surrounding President Trump’s evolving tariff strategy, with potentially large effects on economic growth and inflation. The stock market also contended with worries that the high levels of spending on artificial intelligence (“AI”) will prove unsustainable, ultimately hurting many of the megacap stocks that have performed so well over the past couple of years.

All told, the S&P 500 (SPY) fell 4.3%, dragged by megacaps like Apple (AAPL; down 11%), Nvidia (NVDA; down 19%), Microsoft (MSFT; down 11%), Alphabet (GOOG; down 18%), Amazon (AMZN; down 13%), Tesla (TSLA; down 35%), and Broadcom (AVGO; down 28%). The S&P 500 reached correction territory, defined as a peak-to-trough decline of 10%. The iShares Russell 2000 (IWM), an ETF holding small cap stocks, performed even worse, down 10% for the quarter and off 13% from its January highs.

Outperformance in the first quarter came from defensive areas like consumer staples (XLP up 4%), utilities (IDU up 5%), healthcare (IYH up 5%), U.S. Treasuries (TLT up 5%), and gold (IAU up 19%). Stock markets outside the U.S. outperformed the U.S., reversing a years-long run of U.S. domination.

Figure 1: Safety Wins in First Quarter

Source: Koyfin (inclusive of dividends)

Trump’s Tariffs

Donald Trump campaigned with a tough tariff policy, but tariff announcements over the past two months have been more forceful than almost all market participants expected. The prevailing wisdom going into his second term was that Trump would use tariffs threats to successfully negotiate better trade terms with U.S. trading partners that would ultimately result in manageable, perhaps temporary, implementation of tariffs. However, public statements to date indicate virtues beyond a more level playing field, including encouraging companies to move manufacturing to the U.S., a means to raise revenue for the government, and in the case of Mexico and Canada, reduce fentanyl flows into the U.S.

An optimist could say that the tough rhetoric is all part of a master plan to extract the most favorable deal for the U.S., and that he really does not prefer high tariffs to remain indefinitely. This is certainly a possibility as Trump is an expert negotiator.

However, if he follows through with the more draconian proposed tariffs, like 20% across-the-board tariffs, permanent 25% tariffs on vehicles and auto parts, and 25% on all imports from any country buying Venezuelan oil, and these tariffs prove sticky, then the economy could be in a world of hurt. In this scenario, a recession appears likely and inflation would spike, at least temporarily, a dreaded stagflation environment. We will learn more later today when Trump is scheduled to announce his tariff decision. Then we will have to brace for retaliatory tariff announcements from our trading partners.

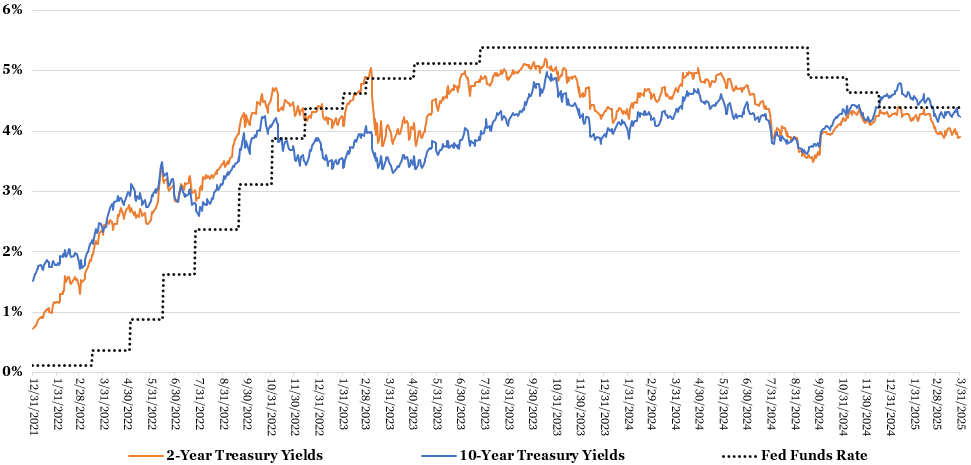

Increasing recession risks does have one positive side effect – lower Treasury yields. Influential 10-year Treasury yields fell by 0.55% from their January 13 peak to the end of the quarter as the lower growth outlook outweighs the direct tariff inflationary impact. If sustained, lower yields could revive housing market transactions, make stocks more competitive to bonds, lower companies’ financing costs, and make stocks’ future earnings worth more today. Of course, investors would also have to project lower earnings in a recession.

Figure 2: 10-Year Treasury Yields Off Cycle Highs

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System. https://fred.stlouisfed.org/series/DGS2 (2-year US Treasury yield). https://fred.stlouisfed.org/series/DGS10 (10-year US Treasury yield). Forbes Advisor. https://www.forbes.com/advisor/investing/fed-funds-rate-history/ (Fed Funds rate)

Market Outlook

The stock market should remain highly sensitive to what happens with tariffs. The deeper and broader the tariffs go, and the longer there is sense of heightened uncertainty as to how the tariff situation will evolve, the more consumers and businesses will pull back on spending. In this recession scenario, the stock market ought to have further downside that could put it into bear market territory, defined as a 20% peak-to-trough decline.

Not all is gloomy though. To the extent tariffs are more forgiving than expected, then the stock market could get a positive jolt. Market sentiment is already very low, so it doesn’t take much positive news to turn things around, at least temporarily. Further, attention will start to shift to the extension of Trump’s tax cuts of 2017, which would otherwise expire at the end of this year. To the extent that tariffs are deeper than expected (therefore driving more tariff revenue), there could be cover for deeper corporate and personal tax cuts that the market likes.

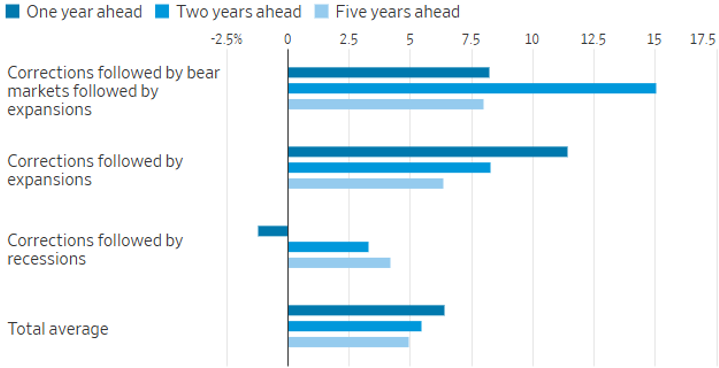

Whatever happens in the near term, there is data to support the notion that stocks will be higher looking out at least a year. The Wall Street Journal analyzed forward one-, two-, and five-year returns following an S&P 500 correction of 10% across three scenarios: (1) correction turned into a bear market but the economy avoided a recession; (2) no bear market was reached and economy remained in expansion; and (3) a recession ensued. Two- and five-year average returns were positive in every scenario and one-year average returns were negative only in the third scenario, and just by 1%.

Figure 3: S&P 500 Average Annualized Compound Growth

Source: Wall Street Journal citing Robert Shiller (stocks), National Bureau of Economic Research (economic output). https://www.wsj.com/finance/stocks/dont-blame-trump-for-all-of-the-stock-markets-problems-c3a6dc6b. Published March 27, 2025.

The level of fiscal, monetary, geopolitical and economic uncertainty is very high right now, so there is a wide range of potential outcomes over the next few months. I lean bearish as I believe the isolationist, anti-free trade stance the Trump administration apparently holds has major negative consequences for consumers and businesses. However, I am not going to try to time the market, which is very difficult to do successfully. Instead, I strive to stay true to a long-term asset allocation that makes sense given one’s return objectives, risk tolerance, and time horizon, and stick to individual company fundamentals.

Client Positioning

I take a long-term view that focuses on compounding returns in a tax-efficient manner. I allocate the bulk of my clients’ equity exposure to “quality growth” companies that possess durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. I generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate my investment thesis and retaining stocks of companies with solid fundamentals. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

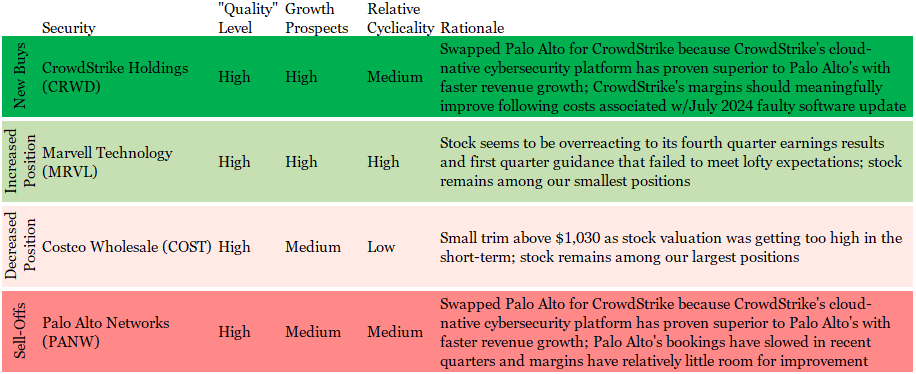

Portfolio activity was moderate in the first quarter. The biggest change was the swapping of Palo Alto Networks (PANW) for direct competitor CrowdStrike (CRWD). I want to own the best-of-breed stock in a particular industry and it has become clear that CrowdStrike has separated itself as the #1 cloud-first cybersecurity platform. I expect to offset most, if not all, of the realized gains from the Palo Alto sales with tax loss harvesting of other positions in the coming months.

Figure 4: Portfolio Changes in Majority of Client Accounts in 1Q 2025

Source: Glass Lake Wealth Management

I continue to have an outsized bet on AI infrastructure companies. Most stocks in the space suffered a material price correction in the first quarter as investors’ AI excitement entering the new year quickly morphed into consternation that customer capital spending levels could peak this year, especially after China’s DeepSeek announcement in late January. I just missed out on my long-held plan to trim Nvidia above $150/share but think the intermediate-term outlook for AI spending remains robust even if the current pace of spending growth cannot sustain. Nvidia currently sports an attractive valuation of 24x expected FY26 (ending January 2026) EPS, down from 34x forward EPS entering the year.

I also continue to like the manufactured home companies, as I profiled in a December 2024 blog. I expect somewhat lower interest rates, a great need for affordable housing, potential orders from federal and local agencies for disaster relief, and relatively strong consumer confidence among its core buyer demographic to outweigh any negative impacts from tariffed inputs like lumber.

As always, you can expect me to abstain from stocks in long-term challenged industries, such as banking, traditional energy, airlines, and autos. I will also continue to avoid the most speculative areas of the market such as unprofitable growth companies, small biotechnology stocks, and pump-and-dump meme stocks.

For clients’ fixed income portfolios, I continue to overweight low duration holdings (duration is a measure of a bond price’s sensitivity to changes in interest rates). I do not believe long-term yields adequately reflect the fiscal situation in the United States. If long-term yields rise, then long-term bond investors’ total returns would suffer because bond prices fall when yields rise.

Overall asset allocation is likely to remain near current levels. However, if the stock market enters bear market territory, I will likely look to increase clients’ exposure to stocks if their willingness and ability to take more risk is there. As legendary investor Warren Buffet famously quipped, “be greedy when others are fearful.”

I wish you a happy, healthy, and wealthy spring season!

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.