July 2023 Investment Letter

July 5, 2023

Stock market returns in the first half of 2023 illustrate why it makes sense to tune out the noise and stay invested for the long run. Entering the year most investors and economists were calling for a continuation of the narrative that pushed stocks lower in 2022, namely expectations of impending recession, high inflation and rising interest rates, and a stock market valuation that did not reflect the difficult economic circumstances. There was also growing consternation about a potential U.S. default ahead of reaching its debt ceiling in June. Instead, consumer spending, the labor market, and company earnings have held up very well, and Congress voted to suspend the debt ceiling until January 2025.

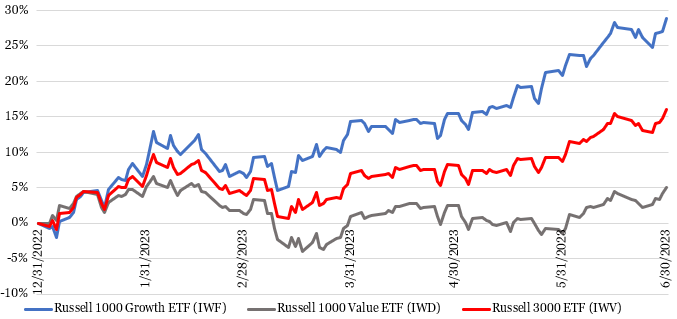

All told, the iShares Russell 3000 ETF (ticker IWV), our preferred measure of overall market performance, rose 16% in the first half, including 8% in the second quarter. Divergences that formed within the market in the first quarter widened significantly in the second. For instance, large cap growth stocks soared 29% in the first six months, outpacing large cap value stocks’ 5% advance. Furthermore, the approximately 100 stocks in the S&P 500 that do not pay a dividend together gained 18% while those that do pay a dividend mustered only a 4% gain. That was the widest first-half performance spread since 2009.

Figure 1: Growth Stocks Crushed Value Stocks in the First Half of the Year

Source: Yahoo Finance (inclusive of dividends)

Much of the bifurcation can be explained by the growing excitement surrounding artificial intelligence (AI). The impressive advancements already seen in chatbots, such as the recently launched ChatGPT, have market participants buzzing how future advancements will reshape the economy, producing big winners and losers in the process. The market is effectively saying that the bulk of AI-driven value will accrue to the largest technology companies. Indeed, each of the largest six companies by market capitalization – Apple (ticker AAPL), Microsoft (ticker MSFT), Alphabet (ticker GOOG), Amazon (ticker AMZN), Nvidia (ticker NVDA), and Tesla (ticker TSLA) – were up at least 36% in the first half. Two of those and the eighth largest company – Meta Platforms (ticker META) – were up triple digits.

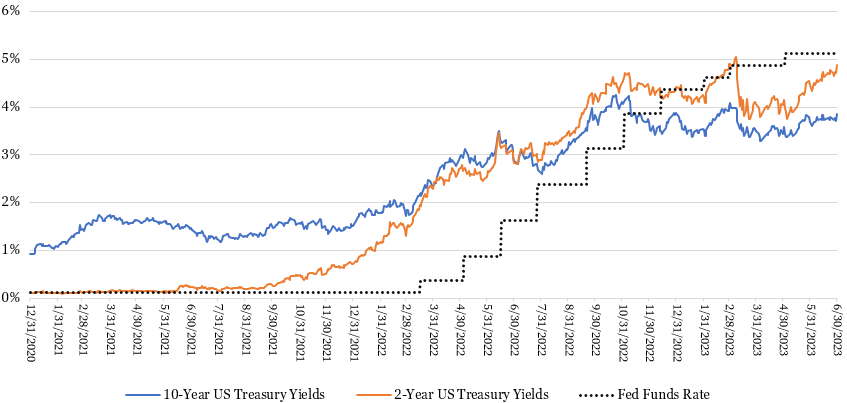

The makings for a new bull market occurred despite resurgent Treasury yields in May and June. The banking scare, which rattled equity and bond markets in March, is fading away. This, along with economic releases that showcased resilient consumer spending, rebounding consumer sentiment, and positively inflecting existing home prices, are making the Federal Reserve less worried its historically rapid rate hikes will seriously damage the economy. Market participants no longer expect the Fed to reverse course and start cutting rates later this year. Instead, members of the Federal Reserve’s Federal Open Market Committee (FOMC) project a median of two more 25 basis point hikes by year end.

Figure 2: Treasury Yields Bounced Back Following Banking Scare

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System (treasury yields). https://fred.stlouisfed.org/series/DGS2. https://fred.stlouisfed.org/series/DGS10. Forbes Advisor (fed funds rate) https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Market Outlook

The fear of missing out by the many who were defensively positioned going into the year appears to be the primary force driving stock markets higher in the near term. Looking out a bit further, the markets ought to take their cue from inflation data, the Fed, interest rates, the economic outlook, and ultimately, company earnings.

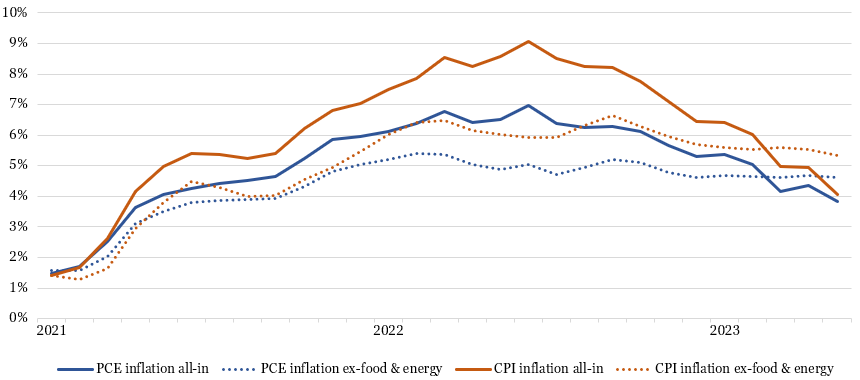

Inflation has figured prominently since it became clear the inflation spike in 2021 was not entirely due to transitory Covid-related effects. Headline inflation has continued to rapidly cool, but not by so much when stripping out volatile food and energy prices. So-called core inflation remains around 5%, much above the Federal Reserve’s longstanding target of 2%. To get inflation to that level we now believe it will either take a few more Fed rate hikes and/or an elusive economic recession.

Figure 3: Core Inflation Remains Too High

Sources: U.S. Bureau of Labor Statistics (PCE) https://fred.stlouisfed.org/series/PCEPI, Fred St. Louis Fed citing U.S. Bureau of Economic Analysis (CPI) https://data.bls.gov/cpi/data.htm

Although the economy has proven to be far more resilient to rising rates than anyone expected, we are not confident that will always be the case. Eventually, rates will rise enough to break something in the economy that cracks the labor markets (the unemployment rate remained at a historically low rate of 3.7% in May) and consumer spending. Clearly the March bank run that produced three of the four largest bank failures of all-time was not enough to derail the overall economy. It is impossible to know what and when that will be. Until then, it appears the path of least resistance for the stock market is up.

Besides an eventual recession, whether that is six months or six years from now, the other identifiable market risk stems from higher interest rates. If the Fed must go higher for longer, then stocks valuations ought to get hit as investors shift more capital to safer, attractive-yielding bonds.

We are also concerned about ramifications from any Chinese attempted takeover of Taiwan. Besides potential U.S. military involvement, global supply chains could be seriously impacted, possibly creating another inflation spike, and U.S. multinationals that sell into China could suffer. The hit to the stock market would likely be significant.

Client Positioning

We take a long-term view that focuses on compounding returns in a tax-efficient manner. We allocate the bulk of our clients’ equity exposure to “quality growth” companies that have durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. We generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate our investment thesis and retaining stocks of companies with solid fundamentals. We believe this investment philosophy affords our clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

Our investment philosophy was in favor in the first half of the year as valuation multiples expanded across many of our growth stocks. Further, excitement around AI raised growth prospects, and resultant stock prices, for some of our holdings. Although we are bullish on how AI advancements can reaccelerate growth and provide greater efficiencies in the years ahead for many, we are also wary that some froth is building and that the earnings impact will be negligible for most in the near term. As such, we are not looking to increase our exposure to the AI theme at this time.

We also benefitted from our stance against owning banks and traditional energy companies that seriously lagged. Our longstanding view is that banks have little competitive differentiation, are subject to onerous but necessary regulations that limit returns, and are vulnerable to exogenous shocks that can shake investor confidence. Our longstanding view on traditional energy companies is that their industry’s intense cyclicality is difficult to manage through, they have not shown adequate capital discipline over a full economic cycle, and they face long-term disintermediation risk from cleaner energy sources.

The second quarter was a light one for portfolio moves. The one meaningful trade was a swapping of PayPal Holdings (ticker PYPL) for Palo Also Networks (ticker PANW). Long overdue in hindsight, we believe Palo Alto fits much better into our investment philosophy of owning the best positioned companies for the long run, as summarized below.

Figure 4: Portfolio Changes in Majority of Client Accounts in 2Q 2023

Source: Glass Lake Wealth Management

Looking ahead, we are likely to resume shifting some client assets to bonds and away from stocks if Treasury yields continue to climb higher and/or stocks continue to surge. Bond yields are becoming increasingly competitive with potential equity returns, especially since one can safely secure a nearly 5% return for two years and not be subject to state and local income tax rates, as is the case with U.S. Treasuries.

You can expect us to continue to abstain from stocks in the banking, traditional energy, and other long-term challenged industries. We will also continue to avoid the most speculative areas of the market such as unprofitable growth companies, SPACs, cryptocurrency plays and meme stocks. As always, we will keep an open mind and be on the hunt for the next great long-term investment.

We hope you and your loved ones stay happy, healthy, and wealthy this summer.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.