Microsoft Will Win from AI Advances

By Jim Krapfel, CFA, CFP

June 13, 2023

Background

I started researching Microsoft Corp (ticker MSFT) in earnest for a dividend growth strategy at my predecessor firm in 2017. At the time I became convinced that then and current CEO Satya Nadella had successfully turned the company around to become a consistent double-digit grower with the intention and financial capacity to raise its dividend at attractive rates. After purchasing for client strategies, I initiated a position in my personal account in April 2017 at a share price of $65.68.

Since my launch of Glass Lake in April 2020, I consistently purchased a lot of stock across client accounts. It is the largest aggregate stock position as of June 13, 2023.

Company Description

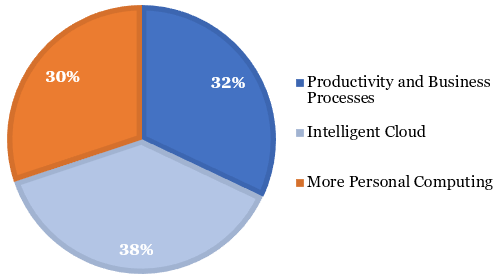

Microsoft provides an array of technology products and services with the following operating segments:

Productivity and Business Processes comprises:

Office Commercial, comprising productivity software suite Office (Word, Excel, Outlook, PowerPoint), Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance and Microsoft Viva

Office Consumer, including Microsoft 365 Consumer subscriptions, Office licensed on-premises, and other Office services

LinkedIn, which connects the world’s professionals and helps companies hire, nurture, and develop talent, market their services, and strengthen customer relationships

Dynamics, which provides cloud-based and on-premises business solutions for financial management, enterprise resource planning (“ERP”), customer relationship management (“CRM”), supply chain management, and other application development platforms

Intelligent Cloud comprises:

Server products and cloud services, including Azure, which is a comprehensive set of cloud services that allow developers, IT professionals, and enterprises to build, deploy, and manage applications on any platform or device. By utilizing Azure’s global network of data centers for computing, networking, storage, mobile and web application services, AI, IoT, cognitive services, and machine learning, customers do not need to manage on-premises hardware and software.

Enterprise Services, which assist customers in developing, deploying, and managing Microsoft server solutions, Microsoft desktop solutions, and Nuance conversational AI and ambient intelligent solutions.

More Personal Computing comprises:

Windows, which is a computer operating system that first launched in 1985

Devices, which include the Surface tablet and PC accessories

Gaming, which includes Xbox hardware and Xbox content and services, including games and in-game content, Xbox Game Pass and other subscriptions, Xbox Cloud Gaming, third-party disc royalties, advertising, and other cloud services

Search and news advertising, which delivers search, native, and display advertising

Figure 1: Sales by Operating Segments in Fiscal 2022

Sources: Company filings, Glass Lake Wealth Management

Microsoft was founded in 1975, went public in 1986, and is headquartered in Redmond, Washington. It carries a dividend yield of 0.8%.

Investment Thesis

We own Microsoft for three primary reasons: (1) superior execution under Nadella that is likely to continue, (2) strong growth outlook for Azure, and (3) artificial intelligence advances have the potential to reaccelerate its growth rate.

Our original thesis of buying Microsoft because of Nadella’s successful turnaround efforts continue to play out. Since taking over for Steve Ballmer in 2015, Nadella has fostered a culture of openness and collaboration both internally and externally. He encouraged Microsoft to adopt a growth mindset, embracing new ideas and learning from failures. He also emphasized the importance of partnerships and cross-platform compatibility, forging collaborations with competitors like Linux and integrating Microsoft services with rival platforms.

Nadella deftly recognized the growing importance of cloud computing and pivoted Microsoft's focus towards cloud-based services such as Azure. Nadella also championed the shift from traditional software licensing to a subscription-based model, leading to the success of Office 365 and other cloud-based offerings. He also spearheaded strategic acquisitions of LinkedIn for $26 billion in 2016 and GitHub for $8 billion in 2018, and unveiled a $10 billion investment in OpenAI, the maker of the viral ChatGPT artificial intelligence chatbot, in January 2023.

Nadella’s eight-year track record has been superb, and I have no reason to doubt he and his executive leadership team will continue to steer Microsoft in the right direction.

The second major reason I like Microsoft is the strong long-term growth outlook for its Azure business. Azure is the second largest cloud service provider, behind Amazon’s (ticker AMZN) AWS and ahead of Google (ticker GOOG) Cloud. Although growth rates have slowed in recent quarters as enterprises curtailed their overall IT budgets, spending continues to shift from on-promises solutions to the cloud to leverage the benefits of scalability, cost savings, agility, advanced analytics, security, and global reach.

I expect Azure, which I believe makes up 20-25% of Microsoft’s total revenue (not actually disclosed), to grow in the 20-40% range over the next five years. The next few quarters could entail Azure growing in the low end of that range due to cyclical pressures, with growth reaccelerating to the high end of range as IT spending recovers.

The third major reason for our big position in Microsoft is the number of ways in which Microsoft ought to benefit from advances in artificial intelligence. First, its stake in OpenAI should allow Microsoft to profit off a coming monetization of ChatGPT. Second, the vast amount of computing power and complexity required to run AI models should catalyze continued robust growth for Azure. Finally, I expect Microsoft to increasingly integrate AI functionality into its suite of products, like Office, Outlook and Teams, making the products even more valuable to customers. AI integration could even supercharge Bing revenues since ChatGPT is integrated into the search engine. Every one percentage point of search advertising market share loss from Google to Microsoft is worth an estimated $2 billion, about 1% of Microsoft’s annual revenue.

Economic Moat

Microsoft’s economic moat, or sustainable competitive advantages, results from its scale-driven cost advantages, customer switching costs, and network effects across many of its businesses. They protect the company’s market position and allow it to sustain long-term growth and high levels of profitability and free cash flow generation.

The company’s cost advantages are most acute in Azure. It takes substantial resources to build the necessary worldwide data center footprint and obtain requisite technical capabilities, while still earning a profit (something Google Cloud continues to struggle with). As the second largest cloud provider, Microsoft has the scale to effectively compete in this attractive marketplace.

Switching costs feature prominently throughout the organization. I believe it would be highly disruptive for a company to pivot to an office suite away from Office, especially since many critical business processes are centered around Microsoft Excel. Windows is another example in which companies would be loathe to make a switch to an operating system that is marginally better, as evidenced by Windows’ dominant share of the PC market over the past three decades. I also see switching costs present in Azure, servers, Dynamics, and LinkedIn given the time and expense involved in moving resources to a competing application.

Finally, network effects take hold in some businesses. The ubiquity of Word, Excel, and PowerPoint across organizations make these software applications a must have for many businesses since their files can only be accessed by subscribing to or licensing the software. LinkedIn also certainly enjoys network effects since the network becomes more valuable the more that professionals and businesses engage on the platform. And GitHub serves as a repository for source code and an online collaboration community for software developers. By fostering this developer community, Microsoft attracts innovation and expands its product offerings, while benefiting from the collective expertise and support of the developer ecosystem.

Microsoft’s financials back up these qualitative claims. Its 42% operating margin last year was among the best in all the S&P 500 and almost one-third of its revenue converted into free cash flows (operating cash flows less capital expenditures).

Growth, Profitability & Valuation

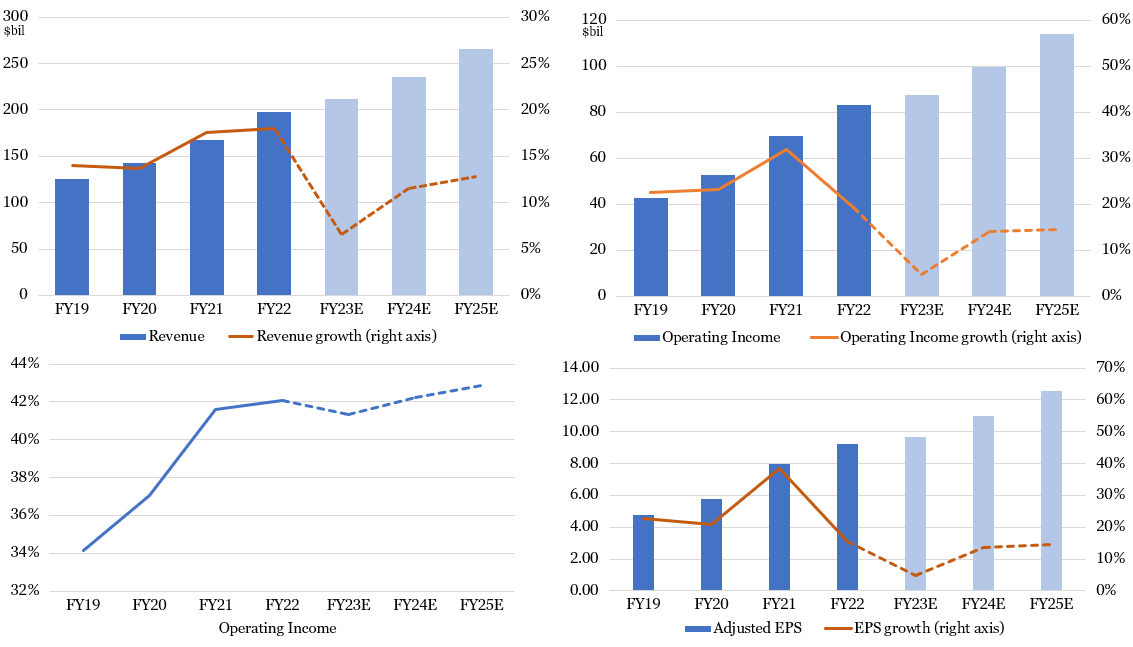

Over the next five years I expect Microsoft to grow revenue in the 10-15% range as it averages 10-15% growth in its Productivity and Business Process segment, 15-25% growth in its Intelligent Cloud segment, and 0-5% growth in More Personal Computing. Boom or bust periods of corporate IT spending are likely to temporarily drive overall growth outside the range. We are likely at the tail end of an industry downturn, with Microsoft guiding to 7% revenue growth in the current quarter.

Other than cyclical fluctuations, I do not expect much change in Microsoft’s margins. I expect negative mix shift effects from lower margin Azure revenues growing fast to be roughly offset by scale-driven margin expansion.

Figure 2: Microsoft’s Growth Should Reaccelerate Next Year

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Microsoft is priced at 31.5x next 12 months’ (NTM) consensus earnings, ahead of the S&P 500 at 19.5x NTM. Its valuation multiple has expanded over the past six months from its cyclical trough in the low 20s due to better than expected first quarter results reported in April and increasing hype around how Microsoft will benefit from artificial intelligence. Although Microsoft has become much more expensive recently, its valuation multiple is only back to what it averaged in 2020 and 2021. I believe its valuation is appropriate because there is a good probability its growth will reaccelerate over the next 12 months, perhaps back to the high end of our forecasted range.

Key Risks

The largest idiosyncratic, or company-specific, risk facing Microsoft is its ability to remain at the forefront of innovation. It operates in a constantly evolving technology landscape, and it risks becoming disintermediated by competitors if it cannot correctly anticipate major technology trends. There are also risks it wastes capital on acquisitions, such as the high-profile flops of aQuantive in 2007 and Nokia in 2013 under prior management, although in recent years anti-trust regulators have heavily scrutinized large technology companies from making any acquisitions (its January 2022-announced acquisition of Activision Blizzard still faces major obstacles to regulatory approval).

Microsoft is exposed to above average cyclicality because IT spending is among the first areas that typically get cut when executives worry about the economy. Indeed, Microsoft’s foreign currency-neutral revenue growth rate slowed from 21% to 7% over the span of three quarters as organizations expressed increased caution late last year.

An additional risk to the stock’s valuation is a rapid increase in U.S. treasury yields because Microsoft is considered a growth stock and it carries above average valuation multiples. Growth stocks are more sensitive to rising yields than value stocks because they have a greater proportion of expected cash flows further in the future, and those cash flows are worth less today when discounted at higher rates.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.