Nvidia is Driving Generational Innovation

By Jim Krapfel, CFA, CFP

June 3, 2024

Background

I had long admired Nvidia (ticker NVDA) as a pioneer in developing leading graphics processing units (GPUs) that were mainly used for gaming, and later for other uses such as cryptocurrency mining. However, the stock always seemed very expensive relative to projected earnings, especially considering its high business cyclicality. Instead, I opted for longtime holding Monolithic Power (ticker MPWR), and later AMD (ticker AMD), for semiconductor industry exposure.

Nvidia’s leadership in the rapidly developing artificial intelligence (AI) arena took the company to new heights. Its H100 GPU, specifically designed for data centers and AI applications, saw explosive order growth throughout 2023, alongside interest in AI applications such as the popular chatbot ChatGPT, launched in November 2022.

I continued to watch Nvidia’s meteoric rise from January 2023 to July 2023 on the sidelines. Despite the stock basically going nowhere for the rest of the year, the company kept delivering impressive financial results with orders well above levels it could fulfill. During this period, I became more convicted on the durability of its order strength and competitive lead.

Then, in early January, the stock broke out of its 6-month trading range to new highs, and I felt like it was a ‘now or never’ moment to finally buy into the name. So, on January 9, I made the decision to buy Nvidia at a pre-split price of about $540, funding the purchase with trims of MPWR and AMD. Through the stock more than doubling and some additional buying, Nvidia became the 4th largest aggregate stock position as of May 31, 2024.

Company Introduction

Nvidia is a pioneering technology company renowned for its development of high-performance GPUs. Its GPU technology is highly efficient at powering some of the most complex computational tasks, from training AI models to running intricate simulations and processing large-scale data sets.

Nvidia's influence extends into emerging technologies such as autonomous vehicles, where its GPUs enable real-time processing of data from sensors and cameras, facilitating safe and efficient self-driving capabilities. The company also plays a significant role in the development of virtual and augmented reality, enhancing immersive experiences through superior graphical performance.

In addition to hardware, Nvidia offers a comprehensive suite of software solutions, including the CUDA (Compute Unified Device Architecture) platform. CUDA allows developers to leverage the power of GPUs for a wide array of applications, fostering a robust ecosystem that supports research and development in numerous fields.

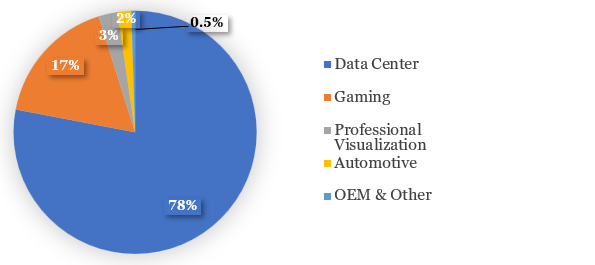

Figure 1: Revenue by End Market in Fiscal Year 2024 (end January 2024)

Source: Company filings

Nvidia was co-founded in 1993 by Jensen Huang, who has served as its CEO since inception. Nvidia went public in 1999 at a split-adjusted price of $0.25/share and has a market capitalization of $2.7 trillion. Nvidia’s 10-for-1 stock split, the sixth split in its history, will take effect on June 10, 2024.

Investment Thesis

We own Nvidia primarily because it is the de facto arms dealer in a generational, society-altering technology. It is fundamentally changing how computing works and what computers can do, in the company’s words “from general purpose CPU (central processing unit) to GPU accelerated computing, from instruction-driven software to intention-understanding models, from retrieving information to performing skills, and at the industrial level, from producing software to generating tokens, manufacturing digital intelligence.”

In some cases, Nvidia’s AI infrastructure products help new or existing companies grow their revenue. Some examples include the growing popularity of large language models such as OpenAI-developed ChatGPT (upon which many chatbots utilize), Google’s (ticker GOOG) Gemini, and Anthropic’s Claude. Big cloud providers like Amazon’s (ticker AMZN) AWS, Microsoft’s (ticker MSFT) Azure, and Google Cloud expect a sales boost with Nvidia estimating that for every $1 spent on Nvidia AI infrastructure, cloud providers have an opportunity to earn $5 in revenue over four years.

In many other cases, Nvidia helps organizations reduce costs and become more efficient. The clearest example in these early days is customer service in which AI-powered chatbots and virtual assistants can handle complex inquiries more quickly and competently than before, thus freeing up human agents for the most complex situations. Other promising areas in various stages of AI development and implementation are writing code, devising pharmaceutical formularies, automating data processing, forecasting demand, and advancing self-driving cars, just to name a few.

The computing power necessary to drive these AI-powered functions is intense. Nvidia expects the world data center infrastructure installed base to double in the next five years and represent an annual market opportunity in the hundreds of billions of dollars (vs its fiscal year 2024 data center revenue of $47.5 billion). Its data center customer base is diversifying away from the large cloud providers, which were a mid-40s percentage of end market revenue versus over 50% in the preceding quarter, to consumer internet companies, Tesla (ticker TSLA), and sovereign countries.

Nvidia continues to out-innovate everyone else. Just when a competitor such as AMD is set to launch a product with similar specs, Nvidia releases its next generation product that is substantially more capable and power-efficient than the prior generation. Nvidia is amidst a product transition from H100 to H200, then will launch B100 on its new Blackwell architecture, with shipments ramping in its third fiscal quarter. The company recently committed to a one-year product cycle from a two-year product cycle, with new product generations planned well in advance. Just yesterday, Nvidia unveiled its chip architecture that will succeed Blackwell, ‘Rubin’, in 2026.

Nvidia also has major growth opportunities outside its chip business. For instance, it recently launched its Spectrum-X Ethernet networking solution that enhances data center performance by providing high-speed, low-latency networking capabilities crucial for AI workloads and large-scale data processing. Nvidia expects this new product line to grow to multi-billion sales within a year. Further, Nvidia’s software platform NIM, unveiled in March, ought to become a substantial business as it helps developers streamline the deployment of custom and pre-trained AI models into productive environments. Software’s 5% contribution to total revenue should increase, which should support margins and lessen business cyclicality over time.

Bigger picture, the rate of technological innovation is accelerating, and this bodes well for Nvidia. New applications are likely to emerge within and beyond the data center that are not easy to fathom at present.

Economic Moat

I believe Nvidia owns a formidable economic moat, or sustainable competitive advantage, due to intangible assets in its GPUs and to a lesser extent, switching costs in its software. This should allow Nvidia to continue to price its products at a premium to the market and allow for returns on its invested capital to greatly exceed its cost of capital.

Under longtime CEO Jensen Huang, Nvidia has expertly designed its hardware. Its leadership dates to the early 2000s when its graphics cards became and still represent the gold standard. Today, its GPUs are also known as the gold standard for AI applications such as inferencing and training for large language models like ChatGPT. According to TechInsights, Nvidia owned a 97% market share in the $39 billion AI accelerator card market in 2023, up from 96% in 2022. It continues to maintain a competitive lead of at least one generation, or approximately one year, over its competition.

Meanwhile, its software complements its powerful hardware by supporting a wide range of applications and fostering a strong developer community. Nvidia’s CUDA platform makes it easier for developers to write programs that can take full advantage of the GPU’s processing power. By fostering a large and active developer community, CUDA has become the standard for GPU computing, locking in developers and researchers who build their applications around Nvidia’s technology.

Growth, Profitability & Valuation

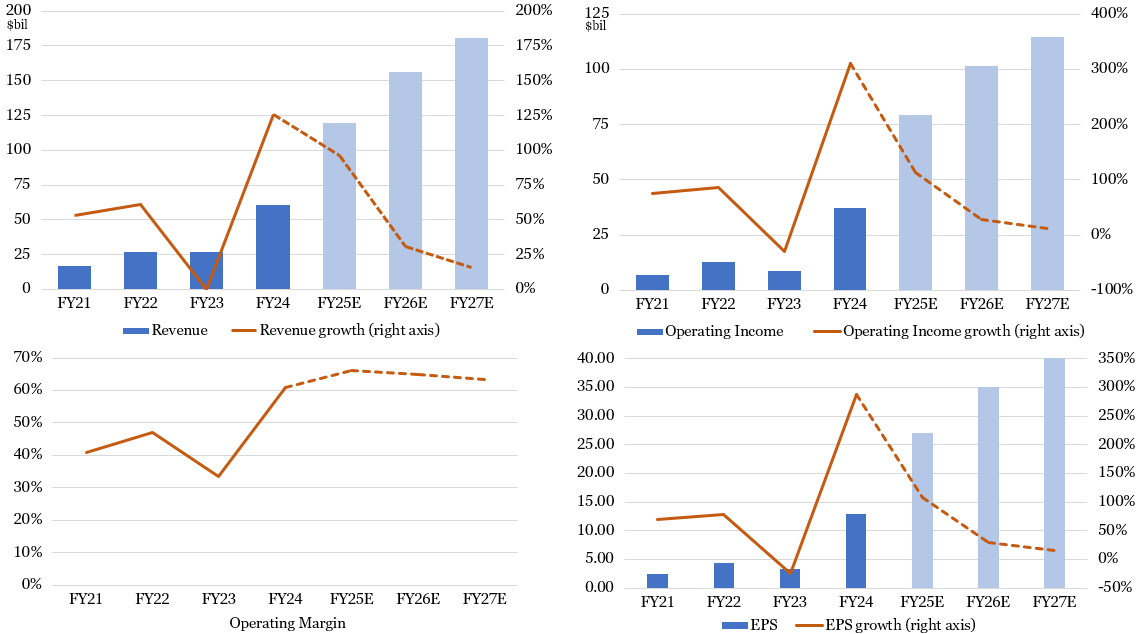

In the short- to intermediate-term, Nvidia’s revenues are only constrained by how quickly it can bring on new capacity. Demand far exceeds supply for its H200 system, and the same will be true for its highly anticipated B100. I expect Nvidia will continue to experience substantial revenue growth through at least its fiscal year 2026 (ending January 2026), and likely into fiscal year 2027 as well. Analysts’ consensus revenue forecasts call for 97% growth in fiscal 2025, 31% growth in fiscal 2026, and 16% growth in fiscal 2027, but I expect analysts’ forecasts to keep ratcheting higher.

For as long as demand far exceeds supply, Nvidia ought to maintain its incredibly high margin profile with gross margins in the mid- to high-70s percentage and operating margins in the mid- to high-60s percentage. When its supply eventually catches up with demand, or if competitors can finally make significant inroads, then its operating margins ought to revert to more normalized levels in the 40%-50% range. Given prospects for flattish margins for the foreseeable future, I expect its EPS growth to approximate its revenue growth.

Figure 4: Nvidia’s Strong Growth Should Sustain for at Least Another 18 Months

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Assessing Nvidia’s current stock valuation level is tricky. On one hand, the stock is expensive because its 12 months’ (NTM) price to earnings (P/E) multiple of 38x greatly exceeds the S&P 500 at 21x NTM. On the other hand, its superb growth profile warrants a higher multiple and many other companies with slower growth than Nvidia trade at much higher multiples.

The key is sustainability of its growth. After the explosive growth phase inevitably ends within the next two or three years, if it can continue to grow by double-digits, then Nvidia’s stock price today will look cheap in hindsight. However, if stock market participants anticipate an approaching peak earnings period (with sales and earnings falling thereafter), then Nvidia’s valuation multiple (and stock price) will surely suffer.

Key Risks

Although Nvidia is competitively advantaged for secular growth in AI, it cannot escape the high degree of cyclicality in the semiconductor industry. In my view, the biggest risk is that hyperscalers such as Amazon, Microsoft, and Google begin to curtail their spending on data centers, and the AI infrastructure products that Nvidia supplies to them. This could be caused by supply sufficiently catching up to their demand, they determine they are not getting enough of a return on their AI investment, or subsequent generations of AI chips do not deliver the same degree of performance improvements.

There also exist intermediate- to longer-term threats that competitors like AMD and Intel (ticker INTC) at least narrow the GPU performance gap to Nvidia and lessen Nvidia’s pricing power. Its largest customers could even become meaningful competitors as they look to lessen their reliance on Nvidia and build chips in-house (although highly unlikely to meet their most demanding needs internally).

My thinking is fluid, but to manage stock downside risk, I anticipate I will begin trimming clients’ positions in Nvidia by year end, well ahead of any major growth slowdown or reversal. In the meantime, I believe Nvidia stock has further room to run.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.