July 2024 Investment Letter

July 1, 2024

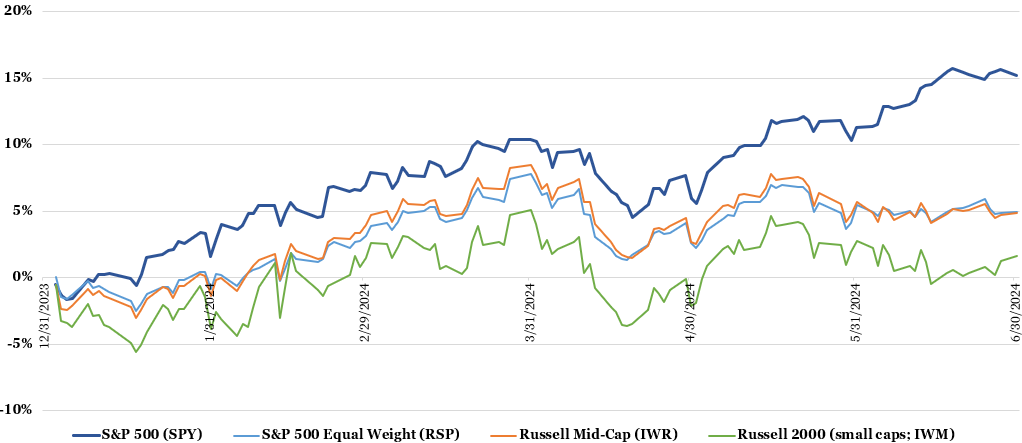

The second quarter continued the trend of the big getting bigger and most everything else being left behind. The S&P 500 (SPY) rose 4.4% in the second quarter and 15.2% year-to-date, due almost entirely to strong performance from the largest companies. The ten largest companies carry a 37% weight in the 500-member index, so their performance can mask everything else.

The so-called ‘Magnificent 7’ technology stocks, such as Nvidia (NVDA; owned, up 150% year-to-date), certainly drove the S&P 500 higher, but so too have non-tech megacap stocks like Eli Lilly (LLY; owned, up 56% year-to-date), Wal-Mart (WMT; up 30%), and Costco (COST; owned, up 29%). By contrast, the Invesco S&P 500 Equally Weighted ETF (RSP) declined 2.6% in the second quarter and increased just 5.0% year-to-date, indicative of flattish performance in large cap stocks that were not among the top two percentile largest.

Other areas of that market also indicate more pedestrian performance than the S&P 500 so far this year. For instance, the iShares Russell Mid-Cap ETF (IWR) declined 3.3% in the second quarter and increased 5.9% year-to-date, while the small cap iShares Russell 2000 (IWM) declined 3.3% and increased 1.6%, respectively. You really had to own a fair share of the very largest companies to generate double-digit returns over the last six months.

Figure 1: Megacaps Continue to Rally; Everything Else is Lagging Behind

Source: Yahoo Finance (inclusive of dividends)

A dominant theme in the stock market continues to be how companies will be affected by advances in artificial intelligence (AI). Many of the largest companies are presumed to be direct AI beneficiaries, whether it is in supplying AI chips to data centers, as is the case for Nvidia, supplying cloud infrastructure needed for AI applications, as is the case for Microsoft (MSFT; owned), Amazon (AMZN, owned), and Alphabet (GOOG, owned), or in giving consumers tools to harness the power from, and protect from potential harms, of AI, as is the case for Apple (AAPL).

Meanwhile, the rest of the stock universe appears to be struggling with an uneven consumer, with continued strength at the high end and weakening at the low end, and persistently high interest rates. Smaller companies tend to have more cyclicality, or sensitivity to changes in the economy, and weaker balance sheets that necessitate access to credit (thus often repaying expiring debt with higher interest debt). By and large, smaller companies have yet to benefit from AI, and in some cases, are pressured by their customers prioritizing AI investments.

As for the overall economy, it continues to be on solid footing. Key economic data such as gross domestic product, retail spending, consumer confidence, and initial unemployment insurance claims indicate a slowing, but still moderately growing economy. Unlike much of 2022 and the first half of 2023, economists are not forecasting a pending recession.

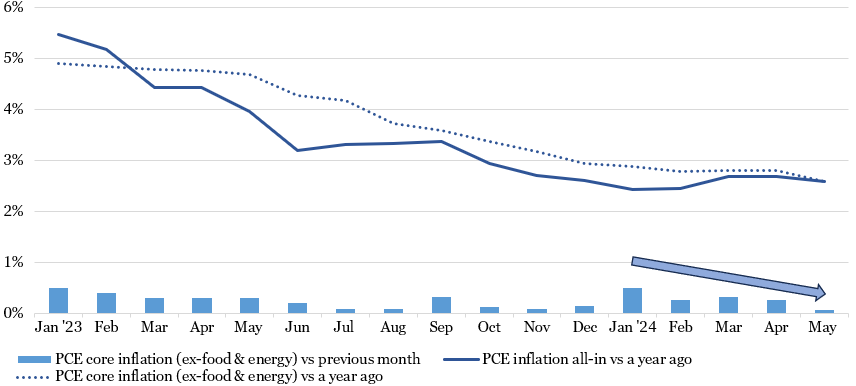

After reaccelerating for a few months early in the year, inflation appears to be back on a downward trajectory. Annual PCE inflation, the Fed’s preferred inflation gauge (as opposed to CPI inflation), was 2.6% in May on a core basis, excluding volatile food and energy prices. The slowing month-over-month inflation readings, as seen below, should allow annual core inflation to approach the Fed’s target level of 2%.

Figure 2: Inflation is Back on a Downward Trajectory

Source: U.S. Bureau of Economic Analysis. https://fred.stlouisfed.org/series/PCEPI (PCE all-in inflation). https://fred.stlouisfed.org/series/PCEPILFE (PCE core inflation). https://apps.bea.gov/iTable/?reqid=19&step=3&isuri=1&1921=survey&1903=84&_gl=1*1bwojbx*_ga*MTc4MDE2NTIyNS4xNzExNjM3MTM4*_ga_J4698JNNFT*MTcxMTk4ODU2NS41LjEuMTcxMTk4OTQ3NC40My4wLjA. (PCI core inflation monthly change)

Slowing inflation, if sustained for another couple months, ought to give the Federal Reserve the green light to finally cut the Fed Funds rate for the first time this economic cycle in September. In the Fed’s June 12 Summary of Economic Projections, the median FOMC participant expected one 25-basis point rate cut in 2024, down from a six-cut expectation entering the year. However, the favorable PCE inflation data reported on June 28 increase the odds for a second cut later in the year, possibly in December.

Market Outlook

The ideal scenario for the stock market is largely playing out. The economy is neither too hot, nor too cold. Inflation is slowing towards desired levels (though cumulative inflation over the past four years is another matter) and investors are anticipating a cycle of Federal Reserve interest rate cuts.

Historical stock market returns are another bullish indicator for second half performance. According to CFRA Research, going back to 1945, when the S&P 500 is up in the first half of the year, the second half of the year is up 76% of the time, rising by an average of 5.3%. When the index is up at least 10% (as is the case this year), the second half of the year is up 84% of the time, rising by an average of 7.9%.

Perhaps the biggest headwinds to forward returns are stock market valuations. Currently, the S&P 500 is valued at 21.9x next 12 months’ forecasted earnings. The average valuation over the past 10 years has been closer to 19x, a time in which bonds yields did not compete as well with stocks. However, the increased composition of faster growing, higher quality technology stocks in today’s market arguably warrants a higher index-level valuation multiple, all else equal.

Figure 3: Stock Market Valuations are High, Especially Considering Higher Bond Yields

Sources: Koyfin (SPY next 12 month P/E), Federal Reserve Bank of St. Louis (10-year U.S. Treasury yields) https://fred.stlouisfed.org/series/DGS10

The stock market is increasingly eyeing U.S. elections on November 5. Congressional races could be just as influential as what happens with the presidential election. If Republicans sweep the presidency, House, and Senate, then markets would likely cheer prospects for less regulation, a softer FTC (i.e. easier to win approval for large acquisitions), and even lower corporate tax rates.

If Democrats sweep, then the knee-jerk reaction would likely entail a market sell-off, mostly because of tax implications. The individual tax cuts that were part of Trump’s 2017 Tax Cuts and Jobs Act would surely be allowed to expire in 2026, prompting investors to cash out winning trades before tax rates increase. Further, there would be a strong likelihood that new legislation is passed that would reverse Trump’s corporate tax rate reductions, hurting companies’ profitability.

If neither party sweeps, then it is mostly status quo for the corporate world, with limited market implications. The probability of Trump winning the presidential election ticked higher following Biden’s poor debate performance last week, but future control over the House and Senate is much too early to posit.

As I have often implored, it is a fool’s errand to try to predict, and act on, the direction of the overall stock market. There are countless interrelated factors that are nearly impossible to predict with enduring accuracy. Instead, I strive to tune out the noise, stay true to an asset allocation that makes sense given one’s return objectives, risk tolerance, and time horizon, and stick to individual company fundamentals.

Client Positioning

I take a long-term view that focuses on compounding returns in a tax-efficient manner. I allocate the bulk of my clients’ equity exposure to “quality growth” companies that possess durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. I generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate my investment thesis and retaining stocks of companies with solid fundamentals. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

There was a moderate amount of portfolio optimization in the second quarter. Two sell-offs of small positions and two partial sells funded two new positions. The general theme of the trades was to reduce exposure to companies with slowing growth outlooks and greater sensitivity to higher interest rates, and increase exposure to companies with improving growth outlooks, especially as it pertains to AI-driven demand for data centers and electrical infrastructure.

Figure 4: Portfolio Changes in Majority of Client Accounts in 2Q 2024

Source: Glass Lake Wealth Management

I do not anticipate making material changes to clients’ stock portfolios over the next three months. However, I will be closely monitoring Nvidia (NVDA), my most recent stock writeup, for a potential trim if the stock price overshoots its fundamental outlook. As mentioned in the writeup, even though I am very bullish on demand for its chips through at least 2025, there is bound to be a cyclical downturn at some point thereafter, and it is prudent to reduce stock exposure well ahead of time.

As always, you can expect me to abstain from stocks in long-term challenged industries such as banking, traditional energy, airlines, and autos. I will also continue to avoid the most speculative areas of the market such as unprofitable growth companies and pump-and-dump meme stocks.

For clients’ fixed income portfolios, I continue to overweight low duration holdings. Duration is a measure of a bond price’s sensitivity to changes in interest rates. Although the Fed is likely to begin a cycle of rate cuts, which predominately impacts only short-term interest rates, longer dated bonds could suffer from higher interest rates (bond prices fall when interest rates rise) if concerns mount about the ballooning federal deficit.

Overall asset allocation is likely to remain near current levels. If bond yields and stock prices each move higher, then I may increase clients’ fixed income allocations. Conversely, if bond yields and stock prices each decline, then I could buy more equities. Note that except for clients with investment horizons under a decade or so, the vast majority of client assets are in stocks because of stocks’ penchant to generate far greater long-term wealth than bonds.

I hope you and your loved ones have a happy, healthy, and wealthy summer.

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.