Umbrella Insurance Can Protect You from Financial Ruin

By Jim Krapfel, CFA, CFP

August 1, 2024

Most people see the merits of, or are required to obtain, auto, homeowners, renters, and health insurance. Some people understand and see value in term life insurance as well. Fewer still comprehend, or even consider, umbrella insurance. In fact, only about 10% of homeowners carry umbrella insurance, which covers individuals’ personal liability to others in a variety of common legal claims.

The case for umbrella insurance protection is rising given years of high inflation for repairs and medical bills, skyrocketing jury awards, and rampant groundless lawsuits. Although most lawsuits target well-insured businesses with deep pockets, claims against individuals are increasingly common. Thus, a careful analysis of your need for umbrella insurance is imperative so you can avoid a potentially catastrophic financial outcome.

In this financial planning blog, I get into what umbrella insurance typically covers, what activities increase the odds of a lawsuit, how one’s asset composition might dictate the need for and level of coverage, and how much it typically costs. For those who can benefit from the additional protections that umbrella insurance provides, it is well worth the rather modest premiums.

What is umbrella insurance?

Umbrella insurance, also known as personal liability umbrella insurance, offers protection above and beyond the limits in your homeowners, renters, auto, and/or boat insurance policies. Umbrella insurance provides coverage after you exhaust the limits of your other policies, which are typically limited to $500,000 for homeowners and auto insurance policies. Most umbrella insurers require applicants to have a minimum of $250,000 of liability insurance on an auto insurance policy and $300,000 of liability on a homeowners insurance policy.

Umbrella insurance covers circumstances found in your other insurance policies, such as others’ bodily injury and funeral costs, others’ property damage, and a tenant’s injuries or property damage. Unlike your other policies, umbrella policies may also cover damages for slander (false spoken statement), libel (false written statement), and international incidents. Like your other policies, umbrella policies provide your legal defense (the insurer will pay for attorneys to represent you in a lawsuit) in addition to paying settlements.

Umbrella insurance does NOT cover your own injuries, own property damage, liabilities associated with your business, breach of contract, intentionally injuring someone, or committing a crime.

Who needs umbrella insurance?

I believe there are two key thresholds that apply to most people. First, those with at least $1 million of “unprotected” assets should seek coverage (more on what assets are considered unprotected in a bit). Second, those with $500,000 or less of unprotected assets can probably forgo umbrella insurance, provided their other policies’ limits exceed their unprotected assets. Those in the middle should evaluate their risk factors of getting sued, such as:

Own your home(s) rather than rent

Often have people over at your house, such as hosting parties, having your kids’ friends over, or paying a nanny, au pair, or housecleaner

Own pools, boats, trampolines, guns, or certain dog breeds

Participate in sports in which you could injure others, such as hunting, skiing, or surfing

Are a landlord (although a best practice for landlords is to hold rental properties in an LLC that would purchase its own homeowners coverage, providing an extra layer of protection over one’s personal assets)

Are a public figure, such as having a seat on the board of a nonprofit, or coaching kids’ sports

Have an inexperienced driver in your household

Regularly post reviews of products and businesses

If you frequently travel internationally and are worried about potential liability while abroad, then umbrella insurance can make a lot of sense for that reason too, especially since you are unlikely to be covered by your other policies.

What assets are considered “unprotected”?

Unprotected assets are those potentially collectible by judgement creditors. Some asset types are fully protected by federal law, some are only protected by certain states, and some are mostly unprotected. Next, I walk through major asset classes, ranked from most protected to least protected.

First, you can be rest assured that ERISA-backed retirement plans such as 401(k), 403(b), pension, deferred compensation, and profit-sharing plans are fully protected from civil lawsuits. Life insurance cash values and death benefits, and annuities, are fully protected as well.

It is possible that future income could be considered an asset subject to garnishment, although in practice this is rare. In the unlikely event a judgement includes garnishment, federal law limits the garnishment amount to the lesser of 25% of disposable earnings or the amount by which weekly earnings exceed 30x the federal minimum wage. All but 13 states set stricter limits on wage garnishment, and North Carolina, Pennsylvania, South Carolina, and Texas make it very difficult for creditors to go after income.

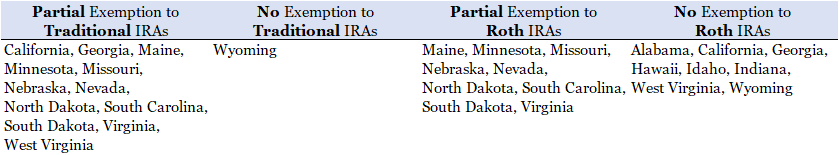

Individual retirement accounts (IRAs) are not protected at the federal level, but many states give full exemption, or protection, from civil lawsuits. Below are the states that offer only partial protection and/or do not protect Roth IRAs. States not listed give full protection. Importantly, protection depends on where you get sued, not the state where you live.

Figure 1: States That Do Not Fully Exempt, or Protect, IRAs

Source: IRAFinancial. “IRA Asset & Creditor Protection by State, Including Lawsuits.” March 5, 2024. https://www.irafinancialgroup.com/learn-more/self-directed-ira/ira-asset-and-creditor-protection/

Note: States listed as partial either have dollar limits or exempt only to the extent necessary to provide for the support of the judgment debtor and/or for the support of spouse and dependents of the judgment debtor. The table does not necessarily reflect Inherited IRAs.

Home equity, the difference between what your primary home is worth and your outstanding mortgage balance, are protected to varying extents by each state. Below are the seven states (plus Washington, D.C.) that give unlimited “homestead exemptions”, or asset protection from creditors, as well as the nine states that offer a meaningful amount of protection. The states not listed offer relatively little to no protection from creditors. Here too, protection depends on where you get sued, not the state where you live.

Figure 2: States That Give Meaningful Exemption to Home Equity

Source: Asset Protection Planners. “Homestead Exemptions by State and Territory.” https://www.assetprotectionplanners.com/planning/homestead-exemptions-by-state/

Assets that are largely considered unprotected from judgment creditors include non-retirement investment accounts, cash, checking and savings accounts, money market accounts, certificates of deposits, jewelry, cryptocurrencies, collectibles, vacation homes, and vehicles.

How much umbrella coverage do you need?

The amount of needed coverage depends on your asset mix, an assessment of which states you are most likely to get sued, and risk tolerance. If your real estate holdings and travel is largely restricted to one state, you might simply look to that states’ asset protections. For example, if your risk factors are heavily weighted to my home state of North Carolina, you might feel comfortable excluding your IRA assets from your unprotected asset calculation.

For enhanced peace of mind, you should protect yourself from getting sued in less friendly states for defendants. For example, being at fault for a major auto wreck in Georgia could put the vast majority of your net worth at risk since the state’s only partially exempts traditional IRAs, gives no exemption to Roth IRAs, and provides only $43,000 of homestead exemption for married people ($21,500 for singles). Under this safer approach, you should include all IRAs and home equity in your unprotected asset calculation.

Once you have determined your unprotected asset amount, subtract your liabilities like auto loans, student loans, and credit card debt. Then subtract your coverage limits on your homeowners and auto policies. Since umbrella insurance is typically offered in $1 million increments, up to $10 million, round up to the next $1 million to receive full protection.

How much does umbrella insurance cost?

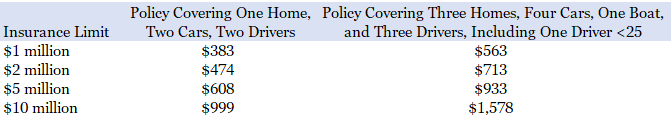

The great thing about umbrella insurance is that it is typically affordable relative to the coverage amount provided. It is so cheap because the policy kicks in after your applicable auto or homeowners policy limits have been exhausted. Of course, your umbrella insurance policy cost will reflect your risk profile.

Figure 3: Average Annual Costs of Umbrella Insurance

Source: Forbes.com, citing ACE Private Risk Services. “How An Umbrella Insurance Policy Works and What It Covers.” https://www.forbes.com/advisor/car-insurance/umbrella-insurance/

A good place to start pricing out your coverage is through your auto or homeowners insurance provider, which is likely to offer a bundling discount. You can also seek quotes from other umbrella insurance providers like Allstate, American Family, Auto-Owners, Chubb, Country Financial, Erie Insurance, Farmers, Nationwide, Progressive, Shelter, State Farm, Travelers, USAA, and Westfield.

Bottom Line

Having umbrella insurance can be a financial life saver, and it should not cost a fortune. To determine if you need coverage, and how much, evaluate your risk factors, asset mix, and asset seizure protections afforded by the states where you own property and spend most of your time. Remember that even if you live in a state with strong asset protections, you could get sued in a state with weaker protections. Be sure that your umbrella coverage, combined with your auto and homeowners policies, give you sufficient, but not unnecessary, protection.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, tax, legal, insurance or accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.